-

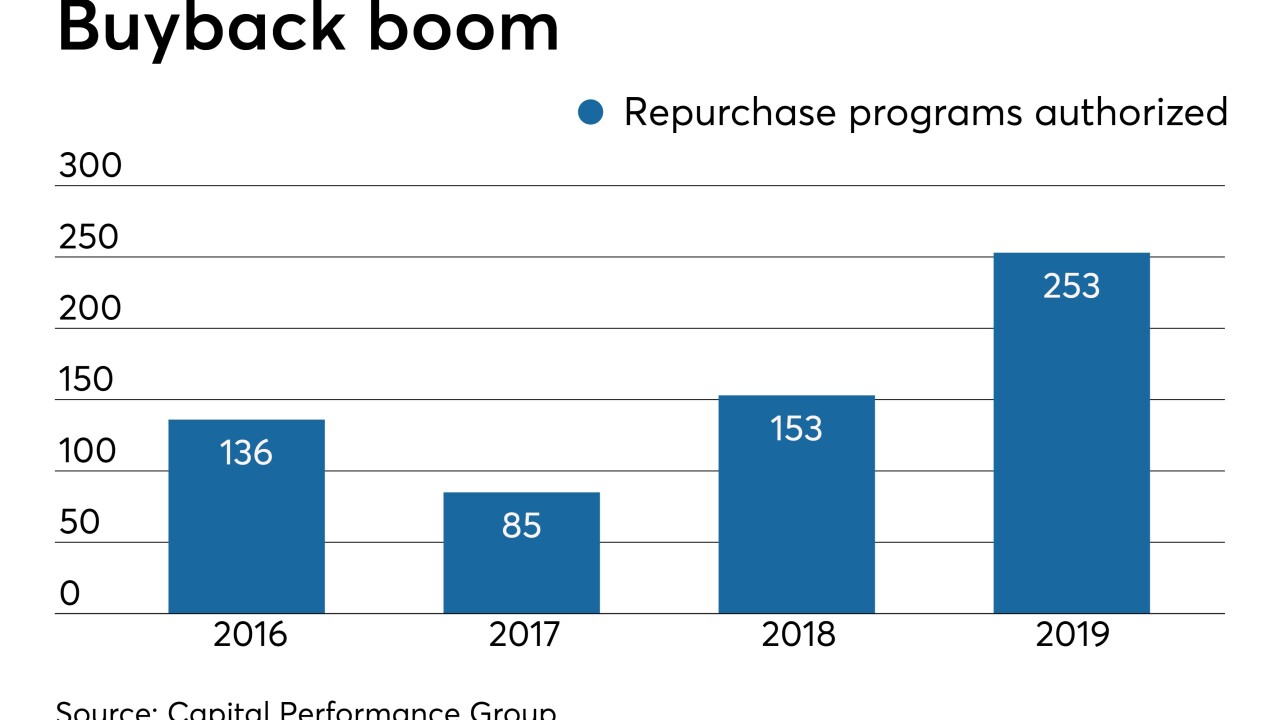

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

The California company will pay $1 billion for Opus, a once highflying bank that struggled with credit issues in recent years.

February 3 -

Kenneth Lehman, a former banking attorney who acquires large stakes in small banks, will buy BankFlorida, which lost $555,000 through the first nine months of 2019.

January 30 -

The new regulation aims to standardize the process for determining if those owning less than a quarter of a bank must comply with holding company requirements.

January 30 -

In another rollback of the bank trading ban, the federal agencies unveiled a plan to allow financial institutions to invest in multiple companies through certain fund structures.

January 30 -

CenterState and South State are the latest regionals to announce a deal driven heavily by the need to compete with larger banks that can afford to spend more on cutting-edge technologies.

January 27 -

The company will acquire the parent company of First National Bank of Manchester and Bank of Waynesboro for $85 million.

January 23 -

Two major banking organizations objected to a proposal by the agency that would expand the pool of investors in subordinated debt issued by credit unions. They fear it could provide credit unions more financing to buy banks.

January 23 -

The company will pay $64 million to significantly increase its scale in the Tampa Bay area.

January 23