-

The central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

April 27 -

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

Some say the agencies are exacting too high a price to buy loans from the cash-strapped lenders; some small banks hustled in dealing with the Paycheck Protection Program, others are accused of a hustle.

April 23 -

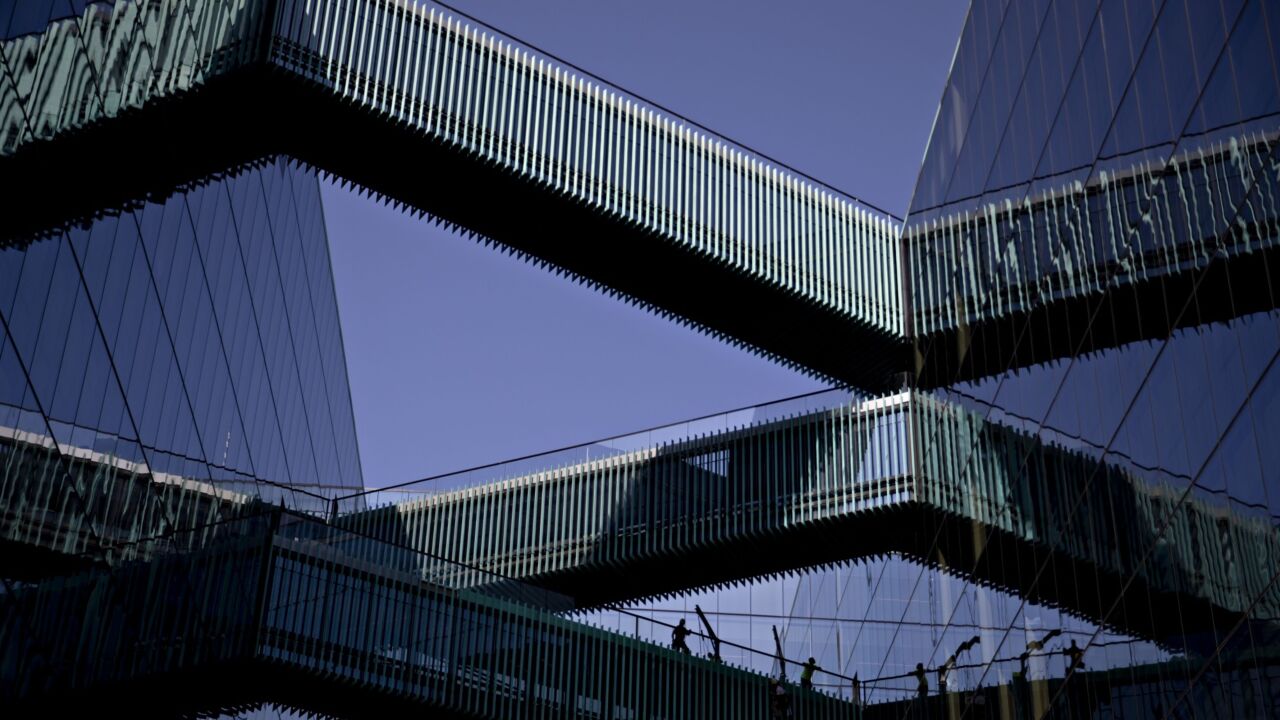

Large institutions say their strong capital positions allow them to reward investors, and the Fed agrees. But critics say this is the time to be preparing for a sharp downturn and continue helping those hurt by the coronavirus pandemic.

April 17 -

Some states aren't waiting on the Federal Reserve to help with the historic hits to their budgets. Instead, they're working with a lender that they have a much longer history with: Bank of America.

April 16 -

Bank’s earnings fall 69% in the first quarter; this week’s earnings reports could determine whether banks will need to suspend dividends.

April 14 -

The agency's top supervisory official said the Comprehensive Capital Analysis and Review will proceed on schedule, and signaled that the Fed will look at how institutions are responding to fallout from the coronavirus.

April 13 -

Midsize businesses and state and local governments are among the beneficiaries of the central bank's latest $2 trillion effort to mitigate the economic damage caused by the coronavirus pandemic.

April 9 -

The Fed's actions are designed to ensure the flow of credit to midsize businesses and state and local governments hit hard by the economic impact of the coronavirus pandemic.

April 9 -

The regulator must speed up its capital reform efforts while taking immediate steps to reduce the examination burden.

April 7 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions

![“I don’t think … [halting dividends] is appropriate this time,” said Fed Chair Jerome Powell. But his predecessor, Janet Yellen, said holding on to income gives banks a “buffer” to further ”support the credit needs of the economy.”](https://arizent.brightspotcdn.com/dims4/default/792845e/2147483647/strip/true/crop/3998x2249+0+209/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F40%2Fb4%2F76873fe44e4599186506d287c6be%2Fpowell-jerome-yellen-bl-041720.jpg)