CFPB News & Analysis

CFPB News & Analysis

-

Dave Uejio, acting director of the Consumer Financial Protection Bureau, promised to protect veterans from predatory loans and to crack down on companies that improperly garnish stimulus checks or mistreat struggling borrowers.

January 28 -

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

The agency has amassed more in fines than it has returned to wronged customers. With Democrats now in power, some hope the bureau will allocate the unused money more aggressively.

January 25 -

The new administration is wasting no time assembling a team of regulatory appointees and urging agencies to pause pending rules.

January 21 -

Dave Uejio, who served as chief of staff to ex-Director Richard Cordray, was named by the Biden administration to lead the Consumer Financial Protection Bureau until the Senate confirms Rohit Chopra for the permanent job.

January 21 -

After a pivotal Supreme Court ruling last year, the Trump administration’s handpicked leader of the Consumer Financial Protection Bureau was widely expected to leave voluntarily or be fired by the new president.

January 20 -

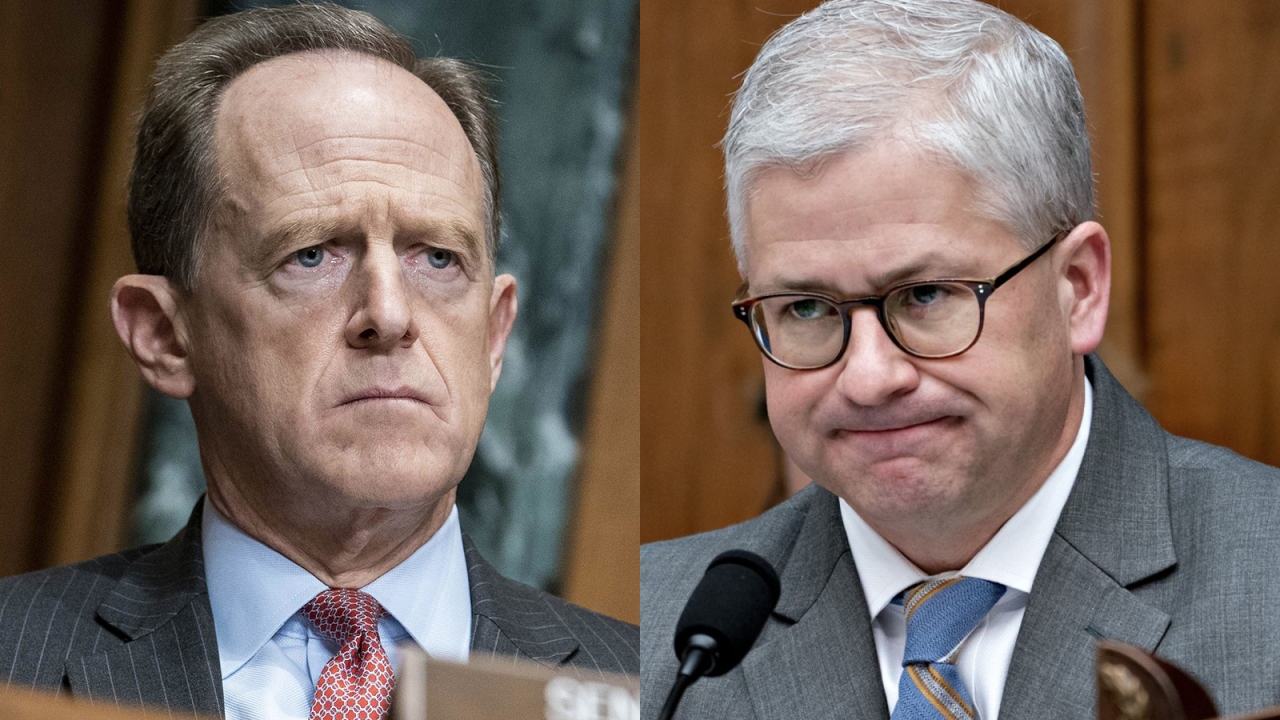

The nominees, strongly backed by progressive Democrats to lead two key Wall Street watchdogs, signal that the Biden administration is planning tough oversight after four years of light-touch policies under appointees of President Trump.

January 18 -

The National Credit Union Administration and the Consumer Financial Protection Bureau will hold strategy sessions and share information tied to consumer protections at institutions with more than $10 billion of assets.

January 14 -

The Office of the Comptroller of the Currency appears intent on being the federal chartering agency for tech firms with banking ambitions. But some experts say the Consumer Financial Protection Bureau is better suited for the job.

January 12 -

New guidance from the Consumer Financial Protection Bureau shows how companies that offer workers early access to their wages can avoid being regulated as lenders. But the incoming Biden administration could add new complications.

January 7 -

In memos to their staffs, acting Comptroller of the Currency Brian Brooks and Consumer Financial Protection Bureau Director Kathy Kraninger denounced the violence perpetrated by President Trump's supporters and said both agencies remain in operation.

January 7 -

Acting Comptroller of the Currency Brian Brooks pushed back on a recommendation from a task force — appointed by Consumer Financial Protection Bureau — suggesting that Congress should give the CFPB the authority to charter and regulate fintechs.

January 6 -

A panel appointed by the Consumer Financial Protection Bureau said Congress should consider authorizing the bureau — and not the Office of the Comptroller of the Currency — to issue federal charters to fintech companies.

January 5 -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

The agency said Omni Financial in Las Vegas illegally required service members to designate a portion of their paychecks to repay loans, depriving of them of other payment options.

December 30 -

The Consumer Financial Protection Bureau is giving the credit card issuer and the fintech firm some regulatory latitude to develop specific new products.

December 30 -

The Consumer Financial Protection Bureau is headed for more disruption in the new year with a Democratic administration likely to reverse several GOP-backed policies. More aggressive relief for mortgage borrowers, a rollback of Trump-era rulemakings and yet another realignment of CFPB offices will all be on the table.

December 29 -

Underpinning the technology with mathematically sound models can make a better case to consumers and regulators for why a loan applicant was denied.

December 23 -

The consumer bureau said the bank’s migration to a new servicing platform led to unauthorized payment withdrawals, misrepresentations about what borrowers owed and violations of a prior 2015 enforcement action.

December 22 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18