-

Total loans rose 3% at the Minneapolis bank, but its net interest margin climbed 10 basis points. It also booked a one-time accounting gain of $910 million related to tax reform.

January 17 -

Though business owners are more optimistic about the direction of the economy since the tax law was passed, it's doubtful their borrowing will increase meaningfully until they see more signs of more robust growth, bankers say.

January 16 -

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

Apart from a one-time adjustment for deferred taxes, the Dallas company reported strong gains in net interest income and meaningful improvement in all of its key performance ratios.

January 16 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

Executives of large banks told investors and analysts what they wanted to hear Friday when they said they plan to increase returns to shareholders.

January 12 -

The Kennesaw, Ga.-based company, which targets borrowers with blemished credit records, has acquired LoanHero, which specializes in loans at the cash register.

January 11 -

Banks that have flocked to the business because of higher yields and loan diversity stand to benefit if clients use tax savings to upgrade equipment.

January 10 -

The CDFI formerly known as Progreso Financiero targets consumers with little or no credit history.

January 10 -

The payments company will pay $321 million for Crestmark Bank, a commercial lender that focuses on asset-based lending, equipment finance and government-guaranteed loans.

January 9 -

The late-payment rate on loans frequently used to consolidate credit card debt hit its highest level in more than four years.

January 9 -

The company tapped a new president for the business, which it will also rebrand, after hiring a team from Scottrade Bank in Missouri.

January 9 -

The Carson City-based credit union now has three wholly owned subsidiaries.

January 9 -

United will pay $130 million for NLFC Holdings, the parent company of Navitas Credit.

January 9 -

The Minneapolis bank is the first bank to join Community Reinvestment Fund's online service that matches small-business borrowers who don’t qualify for bank loans with community development financial institutions.

January 8 -

A number of banks, especially those with extra real estate on their hands, are trying to capitalize on the co-working craze to appeal to fledgling companies that could become success stories — and their customers.

January 8 -

How new developments on many fronts are going to affect the banking business in the coming year and beyond — and what bankers can do to prepare.

January 7 -

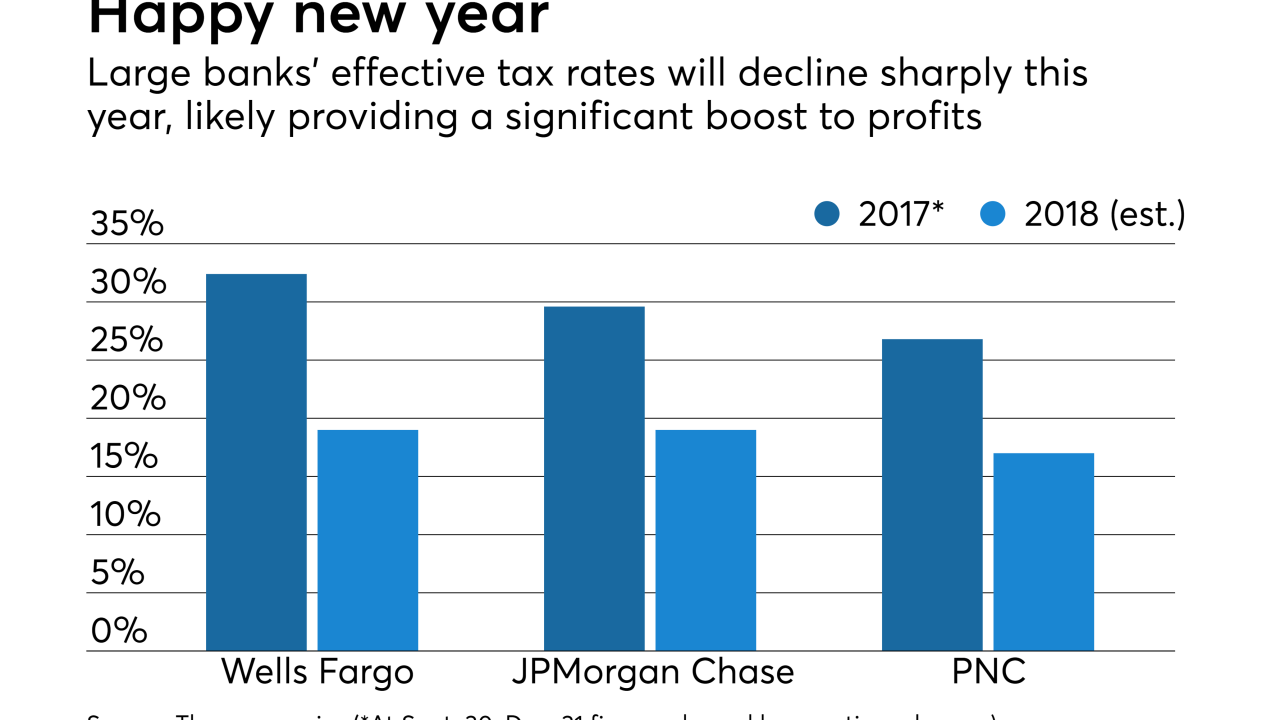

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

Intrust Bank has agreed to purchase $20 million worth of Funding Circle's small-business loans in what could just be the beginning of a long-term relationship.

January 4 -

Changing political and economic forces are raising new questions about deployment of tax savings and the cost of deposits, while old concerns about cost-cutting, credit quality and risk-taking persist or return.

January 3