Read on for highlights from that coverage.

Reg watch

For more,

All eyes on 2020 (or even 2021)

For more,

More extreme weather coming, and what it means for CUs

For more,

Buying banks

For more,

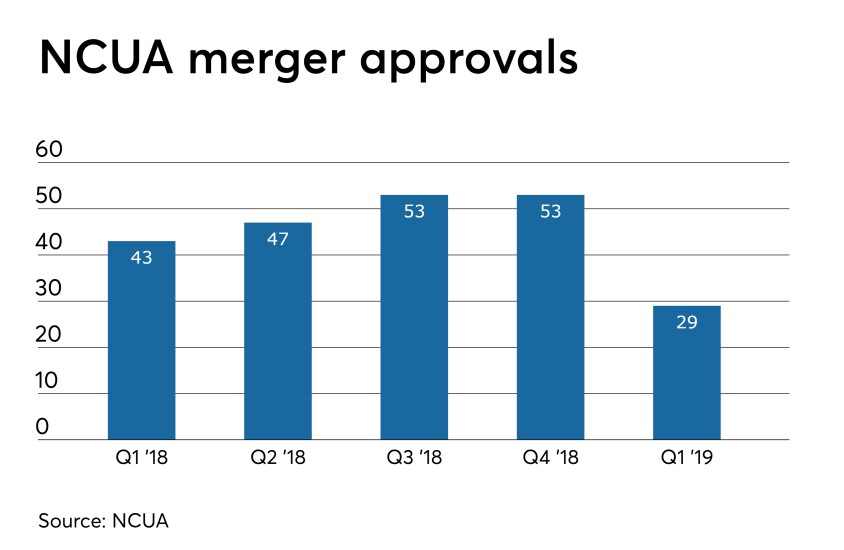

Mergers slowing?

For more,

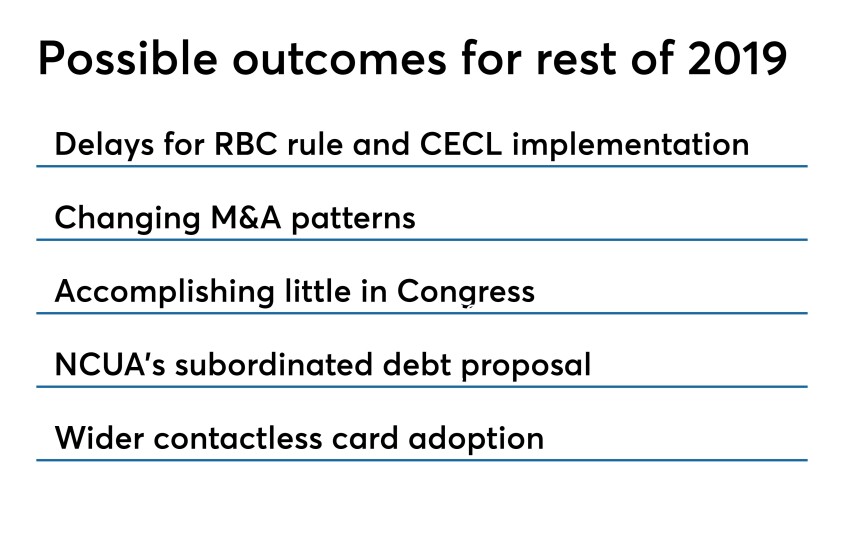

Reg changes coming?

On top of that, the Financial Standards Accounting Board has also pledged to

Can CUs capitalize on ongoing bank mergers?

But do credit unions in a particular market benefit from bank consolidation there? Quite simply, it depends who you ask.

For more,

Is a fight brewing over nonmember deposits?

NCUA approved a proposed rule during its May board meeting that would allow federal credit unions to

But the proposal is far from a done deal, and banking trade groups have plenty to say about it.

For more,

Contactless and rewards

For more,