Just in time for a big election year, credit unions continued to thrive according to NCUA's data on federally insured CUs for the fourth quarter of 2015.

The numbers, showing total shares surpassed the $1-trillion mark even as loans of every stripe continued to boom along with healthy membership growth, gives the industry the opportunity to show politicians that CUs are different.

"Election season is a good time to point out that financial wellness is more than a campaign pledge," said Alix Patterson, a partner at CU consultancy Callahan & Associates. "As financial cooperatives, credit unions have the ability and opportunity to build on the movement's historic growth by helping members achieve fiscal fitness, one family at a time."

Overall, share and deposit accounts at federally insured credit unions rose by $65.2 billion, or 6.9%, from the end of the fourth quarter of 2014.

Total assets climbed to $1.2 trillion at the end of fourth quarter 2015, a jump of $82.2 billion, or 7.3%, from year-end 2014. As overall deposits rose, growth in share drafts surged by 14.5% for the year.

Total loans reached $787 billion in fourth quarter 2015, a 2.3% climb from the prior quarter and 10.5% jump from a year earlier.

Moreover, loans grew in every major category: new auto loans rose to $100.1 billion, up 3.4% for the quarter and 16.0% for the year; used auto loans soared to $161.9 billion, up 2.1% for the quarter and 12.7% for the year; while total first mortgage loans outstanding reached a figure of $322.3 billion, up 2.1% for the quarter and 10.3% for the year.

Also, other mortgage loan volume stood at $74.4 billion, up 1.4% for the quarter and up 3.6% for the year. Net member business loan balances rose to $58.1 billion, up 3.6% for the quarter and up 12.2% for the year. Non-federally guaranteed student loans stood at $3.5 billion, up 2.1% for the quarter and up 11.3% for the year.

At the end of the fourth quarter 2015, the loans-to-shares ratio at federal credit unions amounted to 77.5%, unchanged from the previous quarter, but up 2.5% from the end of the fourth quarter of 2014.

No Long-Term Parking

Credit unions also cut back on their exposure to long-term investments, not surprising given the new climate of potentially higher interest rates at the Federal Reserve.

Total investments stood at $272.8 billion at the end of fourth quarter 2015, a decrease of $3 billion, or 1.1%, from 2014.

The system's net long-term assets ratio stood at 32.7% in the fourth quarter, compared to 33.6% a year ago. Credit unions with less than $10 million in assets had the lowest net long-term asset ratio of any peer group at 10.5%. In comparison, credit unions with more than $500 million in assets had a ratio roughly three times higher, at 34%.

More and more credit unions are now better capitalized as well. Indeed, the percentage of CUs that were well capitalized climbed over the past four quarters—with 97.9% reporting a net worth ratio at or above 7%. A year ago, 97.6% of credit unions were well capitalized. As of Dec. 31, 2015, only 0.6% of federally insured credit unions were considered under capitalized.

Net income reported by federally insured credit unions amounted to $8.7 billion in 2015, a slight increase of 0.3% from 2014. The credit union system's aggregate net worth ratio was 10.92% at the end of fourth quarter 2015, down 4 basis points from a year earlier.

Members Only

Membership in federally insured credit unions rose to 102.7 million at the end of 2015, a surge of 3.5 million from the end of fourth quarter 2014.

But, due to mergers and consolidation, the total number of federally insured credit unions dropped to 6,021 at the end of the fourth quarter, 252 less than at the end of 2014, a fall of 4%. "Consolidation within the credit union system has remained steady for more than two decades across a variety of economic cycles," NCUA commented.

With respect to returns, federally insured credit unions' year-to-date return on average assets ratio stood at 75 basis points at the end of 2015, just five basis points below the level in the fourth quarter of 2014. On the whole, 79% of federally insured credit unions reported "positive returns" on average assets for 2015, compared to 78% in 2014.

Size Matters

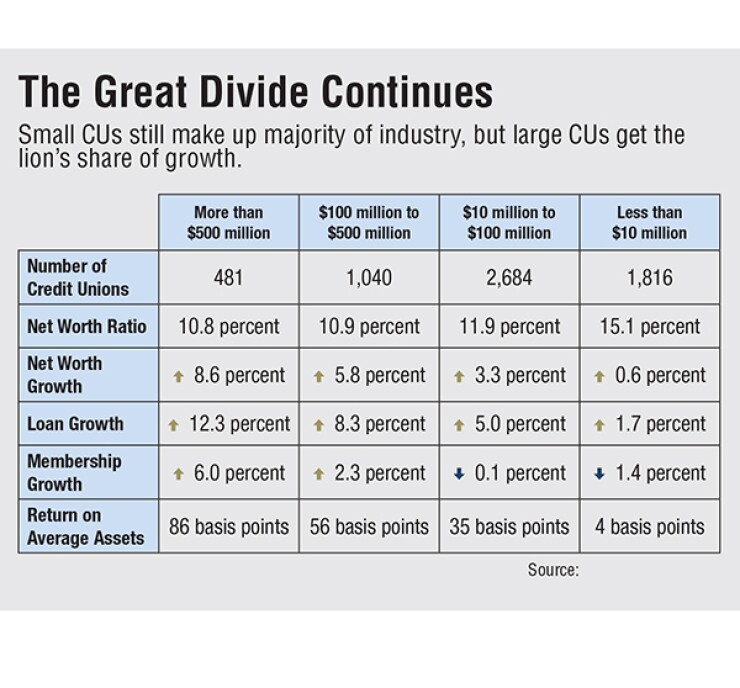

But the "great divide" between large and small CUs continues. NCUA said CUs with more than $500 million in assets continued to lead growth in most performance measures in the fourth quarter of 2015. With $867.5 billion in combined assets, these 481 credit unions held 72% of total system assets.

On the other end of the size spectrum, credit unions with less than $10 million in assets recorded "positive" loan and net worth growth. Interestingly, these credit unions also reported a higher net worth ratio than their larger peers, but membership in these small institutions continued to decline.

The delinquency rate edged up slightly in fourth quarter 2015 to 81 basis points from 78 basis points the previous quarter, but remained below the 85 basis-point level reported in the fourth quarter of 2014.

The year-to-date net charge-off ratio was 48 basis points for 2015, down from 50 basis points in 2014.

The percentage of year-to-date loan charge-offs due to bankruptcy in the fourth quarter was 17.2, which is 2.3 percentage points below the end of Q4 2014.

Curt Long, chief economist and director of research at NAFCU, also said the NCUA report shows the strength of U.S. credit unions as a whole, but he is concerned by "stresses to the bottom line" at the smaller CUs.

"These smaller institutions are operating under thinner and thinner margins," he told Credit Union Journal. "When you add the burdensome regulatory climate coming out of Washington, I think we will see further consolidation, which will result in smaller credit unions continuing to either disappear or merge into bigger institutions."

Focus on Financial Wellness

Callahan & Associates' Patterson said these record-breaking numbers should be used to send a powerful message to legislators.

"These numbers help prove that there's a trust there, the belief that credit unions are there to do the right thing," she told Credit Union Journal. "Our industry does more than offer better loan and savings rates than banks. In today's interest rate environment, there's not much difference there. That's not our only differentiator." She explained that the credit union difference continues to be "in how we deliver those services. The flexibility, the innovation, the personal service delivered in the branch or online, the community service, the financial education. American consumers recognize that difference and they're responding to it."

Dennis Dollar, an Alabama-based consultant and former NCUA chairman, said the numbers were strong, but cautioned the biggest challenge is to "maintain the growth momentum" into the next few years, particularly in the face of the increased regulation.

He specifically cited possible Consumer Financial Protection Bureau (CFPB) action looming on overdraft programs—which may impact non-interest income.

Dollar emphasized that "draconian actions" on overdraft programs by CFPB could "fundamentally change" the non-interest income stream for all financial institutions and "likely bring about the end of free checking as we know it today. "

"This could return us to the dark ages of NSF [Non-Sufficient Funds] fees, bounced checks and merchant fees that double the costs for consumers – not to mention stripping [financial institutions] of a source of revenue that has made free checking a staple of the marketplace," he elaborated. "Ironically, the folks that will be hit the hardest by this will be persons of modest means who have a checking account, little in a savings account and no CD or IRAs. The CFPB could end up driving many of the very lower-income consumers it most seeks to protect away from lower-fee credit unions."

Thus, CFPB overdrafts, Dollar asserted, is the single biggest variable on the regulatory horizon that "could slow the momentum of the very strong 2015 numbers going on into 2016 and beyond."