Michigan credit unions continue to make strong gains, according to new data from the Michigan Credit Union League, with membership rising 3.5 percent in 2017 to a total of 5.2 million members – more than half the state’s population.

Along with high consumer confidence and unemployment reaching nearly a 17-year low, MCUL also cited tax reform and a buoyant stock market for the strong performance of local credit unions.

CUs across the state saw strong membership growth, but population centers in the western part of the state tended to experience the most significant increases in membership, including Grand Rapids (4.7 percent) and Traverse City (5.9 percent). Membership was flat in Lansing, while Detroit and Marquette, in the Upper Peninsula along Lake Superior, saw membership numbers shrink.

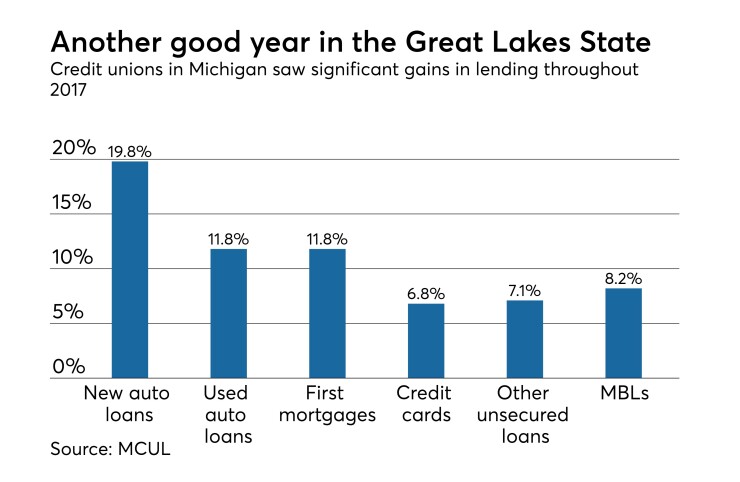

Loan portfolios at CUs in the Great Lakes State grew by 2.6 percent in the fourth quarter, a 10.4 percent annualized pace. New auto loans led the way with a three-month, 5.5 percent gain.

MCUL further said that thanks to holiday spending, credit union loan growth came in at or “near post-recession highs,” with credit card loan growth rising 5.1 percent for the fourth quarter, eclipsing the 4.8 percent gain reported in the final quarter of 2016.

Overall, 2017 loan growth came in at 11.6 percent, the highest such rate of growth since 1994.

“2017 was a great year for Michigan credit unions,” MCUL President and Chief Operating Officer Ken Ross said in a statement. “With strong membership growth and double digit increases in loan sales, it’s clear that more consumers every day are choosing the credit union difference.”

The state’s credit unions also posted strong growth figures in the