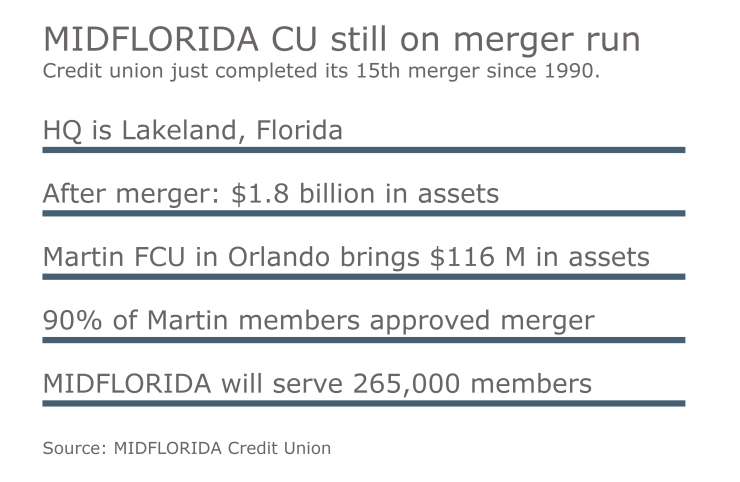

Martin Federal Credit Union, Orlando, Fla., merged with Lakeland-based MIDFLORIDA Credit Union effective March 1, the two CUs announced Wednesday.

A vote by the members of $116 million Martin FCU resulted in 90% of ballots cast in favor of the merger. Voting results were final on Feb. 17, the credit union said.

The merge of assets took place on March 1, but the merge of account records, which will allow Martin members access to MIDFLORIDA’s products and services, will not take place until later this year.

Following the merge of account records, MIDFLORIDA members will be able to use the new MIDFLORIDA-Martin branded locations acquired from the merger, and former Martin members will have access to MIDFLORIDA’s network of branches, the CUs said. Once combined, MIDFLORIDA will employ a staff of 790 with 44 branch locations serving all or parts of 25 Central Florida counties.

“We are very happy with the results of the membership vote,” Kevin Jones, president and CEO of $2.6 billion MIDFLORIDA Credit Union, said in a statement. “It solidifies our confidence in this merger as a mutually beneficial move, offering significant value to the blended membership as a whole.”

This represents the 15th merger for MIDFLORIDA since 1990 and brings the locally owned financial institution to assets of $2.8 billion and more than 265,000 members throughout Central Florida, from coast to coast.

“This merger not only will provide Martin members with access to high-tech services and an assortment of new products,” explained Jones, “but also offers our existing members additional branch options while expanding our footprint further into the Orlando market. Our vision is to represent what our name already signifies – a credit union servicing all of Central Florida, while maintaining the same community credit union feel. This merger is one step closer to achieving that goal.”