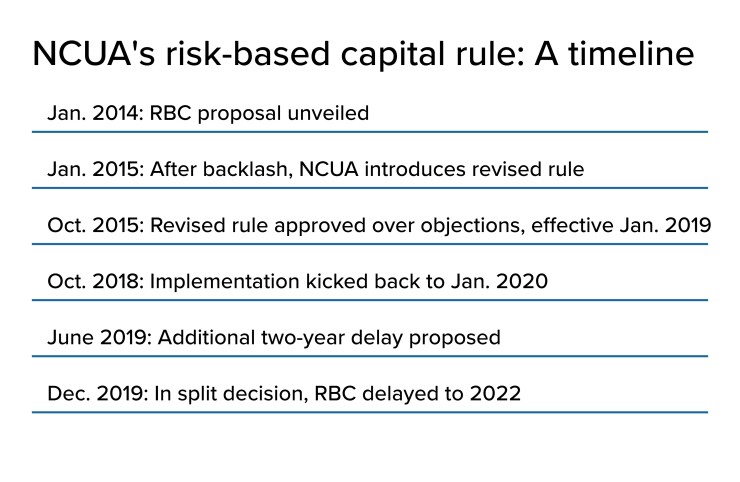

In a pair of split decisions, the National Credit Union Administration board on Thursday passed a budget for 2020 and 2021, and delayed implementation of its controversial risk-based capital rule until 2022.

The risk-based capital delay was done in part to allow the board more time to formulate proposals on broader capital issues, which are likely to set off a firestorm of criticism from bank groups.

Both issues were approved by a 2-1 margin. Board member Todd Harper dissented on both votes, taken during the panel’s regularly scheduled monthly meeting in Alexandria, Va. “Today’s meeting is really one in which we will delay and do little,” he said.

Harper’s vote against the risk-based capital delay came as no surprise. He had telegraphed his opposition to the plan when it was

Harper criticized the NCUA for a

Harper said Thursday that he thought he had hammered out a compromise to hire two examiners, only to see the deal collapse at the eleventh hour. “I am deeply disappointed that after negotiating for almost two weeks and seemingly reaching an agreement … that agreement is not reflected in the budget before us today.”

An NCUA spokesman declined to comment on what caused the compromise to founder. As reported, the agency received a

“If you don’t measure it, you can’t manage to it,” Harper added Thursday. “We aren’t giving large, complex credit unions a tool they need to manage consumer compliance performance.”

For his part, Chairman Rodney Hood said the NCUA already funds a robust consumer compliance program. “I am not convinced the credit union system needs a dedicated consumer compliance program,” Hood said.

Board member J. Mark McWatters, indicated he was inclined to support of Harper’s consumer compliance proposal, but a vote sinking the budget was out of the question, he added.

“As a CPA for over 40 years I appreciate that the board’s failure to approve an updated budget for 2020 would create an administrative nightmare,” McWatters said. “Let the record reflect, however, that I strongly support the allocation of additional resources so as to permit the NCUA to continue to regulate consumer protection in a sensible, proactive manner.”

The approved budget provides the NCUA with a total of $347.4 million for 2020 and $360.1 million in 2021.

McWatters sounded more certain about his vote backing risk-based capital delay. That rule, which was approved in 2015 and initially scheduled to take effect in January 2019, would require credit unions with riskier, complex business models to hold additional capital.

The NCUA later voted to delay the rule until January 2020. Thursday’s vote moves the start date back even further.

McWatters voted against risk-based capital when it was first approved, arguing the board lacked statutory authority to enact a risk-based net worth requirements for credit unions deemed well-capitalized and a second standard for those classed as adequately capitalized.

“That’s what I believe as a lawyer, as a member of the bar in New York and Texas," McWatters said. “I’m not going to vote to have a rule go into effect that in my opinion as a lawyer for over three decades violates the law.”

Capital proposals coming soon

Additionally, McWatters, Hood and other NCUA officials indicated the agency plans to introduce a series of new capital proposals that could render the long-debated risk-based capital rule moot — including one that would allow credit unions to count subordinated debt as capital for risk-based net worth purposes. Banks have consistently fought credit union efforts to broaden their access to capital.

“The subordinated debt rule has been drafted. It’s my understanding it will be brought before the board in January,” McWatters said. “It’s good rule. It’s a complex rule. We’ll need a lot of feedback.”

Beyond that, Julie Cayse, the NCUA’s director of risk management, said the agency plans to unveil a proposal that would provide all but the largest credit unions credit unions the option of complying with a simplified risk-based standard, similar to the

“We’re looking at holistic approaches such as subordinated debt and a credit union leverage ratio just to name a few of the types of things under consideration,” Hood said.

Harper, however, called out the NCUA for tolerating “an uneven regulatory field.”

“After the Great Recession, the [Federal Deposit Insurance Corp.] and other banking regulators moved promptly to update and implement their risk-based capital standards, yet the NCUA wants to delay implementation for a second time,” he said. “Why should it take complex, federally insured credit unions with $500 million or more in assets seven or eight years longer to implement their comparable risk-based capital rule?”

The industry’s current strong financial profile gives the NCUA time to consider additional capital options, according to Larry Fazio, director of the agency’s office of examination and insurance.

“The NCUA can afford to take additional time to make these improvements,” Fazio said. “The level of net worth in the credit union system is high at 11.4%...The [National Credit Union Share Insurance Fund] is healthy, the level of problem credit unions is very low and the economy is strong.”

In other actions, the board approved a 2020 normal operating level for the share insurance fund at 1.38%, in line with the current level.