A new study reemphasizes the growth opportunity credit unions have when it comes to wealth management services.

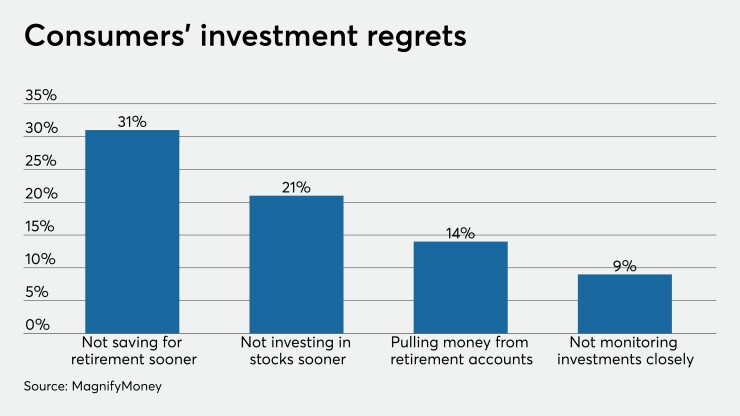

Magnify Money released a report last week noting that nearly 75% of Americans across a variety of demographics regret not investing sooner, including 31% who wished they had started saving for retirement earlier in life.

Among other results:

- 21% of respondents said they regretted not investing in stocks sooner

- 14% said they regretted pulling money from their retirement accounts

- 9% lamented not monitoring their investment portfolios more closely

And it’s not just older Americans. A