Aaron Passman is editor of Credit Union Journal, the nation’s leading credit union news resource. He was appointed editor in 2018 after two years as an assistant editor at CUJ and nearly five years as a reporter there. He has worked as a staff writer or freelancer for a variety of publications across the country and is a graduate of the University of Kansas.

-

The legislation, which takes effect in July, follows a 2019 law that modernized the state's credit union statutes.

April 23 -

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The agency will hold an exercise this summer related to emerging fraud risks and one board member suggested Congress should once again consider allowing the NCUA to oversee third-party vendors — a measure that would cost the regulator roughly $2 million a year.

April 22 -

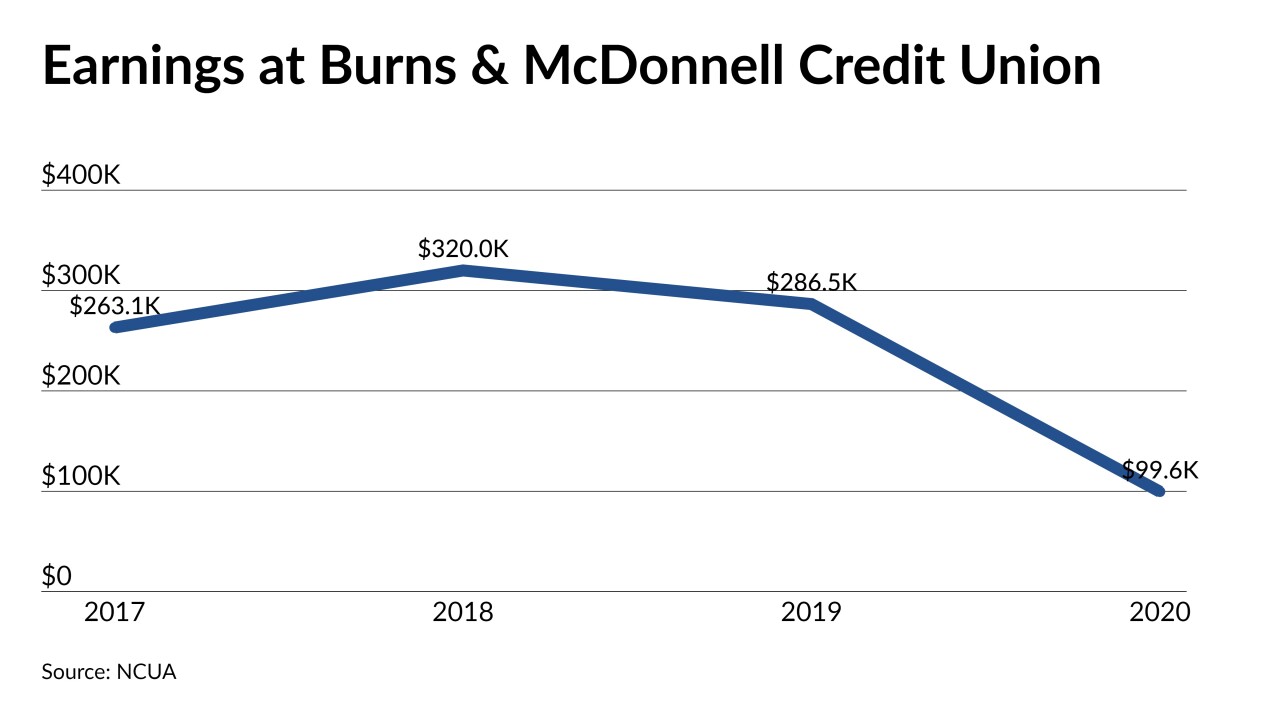

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

Rhonda Diefenderfer, who has led the Billings, Mont., credit unon for 20 years, will retire in May and be succeeded by the credit unions busines vice president of business lending.

April 20 -

Key legislation to protect banks and credit unions serving the legal marijuana industry looks set to move forward in the House this week.

April 19 -

Calvin Philips led the credit union – which today operates as Neighborhood CU – from 1958 until he retired in 1988, and remained active on its board long after his retirement.

April 19 -

Credit unions are warning members that fraudsters are trying to prey on them by asking for data in exchange for appointments that turn out to be bogus.

April 18 -

The retirement of the chief executive at Cincinnatio Ohio Police FCU has resulted in a new hire there and at nearby TruPartner Credit Union.

April 15 -

Janet Sanders has retired after 13 years at the helm of the $142 million-asset credit union. She is succeeded by the credit union's longtime executive vice president, Shelley Sanders. The two are not related.

April 15 -

The South Carolina credit union has pivoted to an open-concept model that allows for social distancing, along with a walk-up window to serve members outside the branch if lobby access is restricted for any reason.

April 13 -

The Michigan-based institution has positioned itself for additional growth by making it easier to qualify for membership.

April 13 -

The Louisiana credit union holds just $3.5 million of assets and could not find a successor for its retiring chief executive.

April 12 -

The New York institution is believed to be the first credit union to open its doors to the general public as part of the mass vaccination effort.

April 8 -

Regulators have approved the credit union's request to add 477 underserved census tracts to its field of membership, allowing it to reach roughly 2.5 million consumers.

April 8 -

Michigan State University Federal Credit Union has doubled in size since 2015, thanks in part to expanding its branch network and field of membership.

April 8 -

State-level groups are pushing measures intended to improve the operating environment for the industry, such as increasing flexibility with field of membership, and providing parity with banks and federally chartered institutions.

April 8 -

David Bunch joined the Maryland credit union as a member in 1979 and has worked there since 1987. He was appointed to lead the organization in 1996.

April 5 -

The credit union service organization's newest chief executive took the helm April 1 and a new name for the company will debut in June.

April 5 -

The Texas fintech embraces a progressive culture and has taken steps during the pandemic to maintain a spirited vibe even as employees work remotely.

April 4