Credit unions have received a green light to serve a new market: hemp farmers.

The National Credit Union Administration said in August that federally insured credit unions could serve legally operating hemp businesses. The updated guidance came after a written request from Senate Majority Leader Mitch McConnell, R-Ky., who outlined the banking challenges that Kentucky hemp farmers face.

But there still remains some uncertainty around a number of issues, such as the due diligence required to serve this new segment.

“I think it gives credit unions that are interested in serving hemp businesses a little bit more clarity on how to go about it,” said Ryan Donovan, who serves as chief advocacy officer at the Credit Union National Association. “You have a situation where hemp was made legal through the farm bill last year, and it’s new territory for financial institutions — so I think credit unions are naturally conservative organizations and want to make sure that what they're doing is OK.”

Hemp was previously classified as a Schedule 1 drug alongside other substances such as heroin and ecstasy. But the 2018 farm bill declassified it as a controlled substance and legalized its production in December.

Now demand has skyrocketed for hemp. Total American hemp acreage soared by 204%, to 78,176 acres, in 2018 from 2017.

Previously credit unions were permitted to serve hemp businesses, but those who chose to do so didn’t have much direction. This new guidance from the NCUA clarifies how credit unions can increase banking access to hemp. The range of financial services that credit unions are permitted to provide legally operating hemp businesses include standard offerings, such as business accounts and loans.

“I think [credit unions] need assurance that hemp is not marijuana,” said Debbie Painter, president of the Kentucky Credit Union League. “There continues to be a ‘moral’ issue with the connotation that serving the hemp industry is supporting and promoting the use of marijuana which remains illegal in the state of Kentucky.”

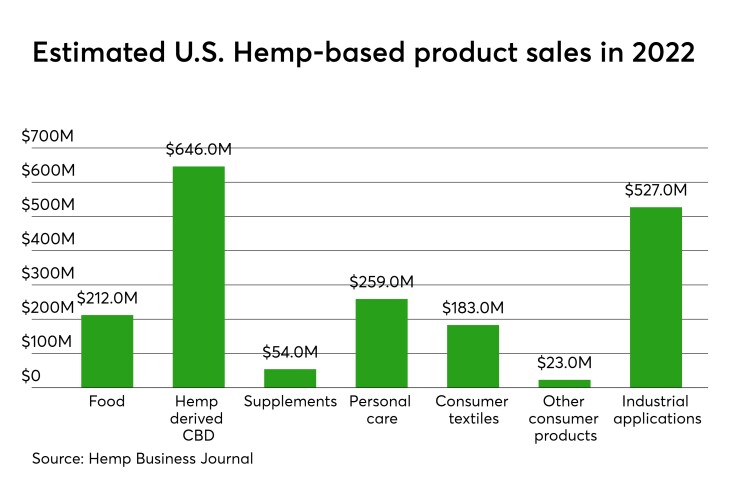

Hemp contains low concentrations of tetrahydrocannabinol (THC) and higher concentrations of cannabidiol (CBD), which lowers and, at times, completely eliminates cannabis' psychoactive effects. Hemp is used in a variety of items, including skin care products and shampoos, and are sold at mainstream retailers, such as Amazon.

But credit unions still need to be careful about serving hemp businesses, warned Lucy Ito, president and CEO of the National Association of State Credit Union Supervisors. Even though hemp is legal at the federal level, the product straddles a fine line legally. When hemp passes above the 0.3% THC threshold, it legally becomes marijuana — a substance that remains illegal at the federal level.

“Given the versatility of hemp business products and legality of it at the federal level, more people are pursuing hemp because it is perceived as less risky but people don’t understand the volatility of hemp,” Ito said. “They need to be aware that what they might think is hemp may be proven to be marijuana.”

Currently there are no Kentucky credit unions that serve the hemp industry, Painter said. But institutions in other states may serve the industry. For example, Timothy Moore, general counsel at Allegacy Federal Credit Union in Winston-Salem, N.C., discussed at a conference in June how

Credit unions that are most likely to serve the hemp industry should already have ag lending programs in place since they will need that type of expertise in place, Donovan said. He noted that CUs won’t need to adjust much operationally, except in adding to their due diligence.

However, the due diligence credit unions should complete remains murky since many states have yet to decide how to regulate hemp. Credit unions vetting a potential hemp business should make sure that the business holds the proper licenses. It’s important to determine if a business focuses on marijuana, on hemp or both, said Deirdra O’Gorman, CEO of DX Consulting and Empyreal Logistics.

A federal standard would alleviate a lot of the confusion that financial institutions and even law enforcement face. This could cover areas such as what happens when crops test over the mandated THC limit, whether crop insurance will be available and rules for interstate commerce and transportation, O’Gorman said.

But setting a federal standard is highly contested, and there is no timeline for when any meaningful legislation could be passed.

“I’ve seen a lot of financial institutions that were banking hemp decide to close out their hemp accounts,” O’Gorman said. “A lot of CUs are generally so out of their depth that they want more clarity. Many of these businesses are multi-state businesses and go across state lines, and the complexity is too great at this time.”