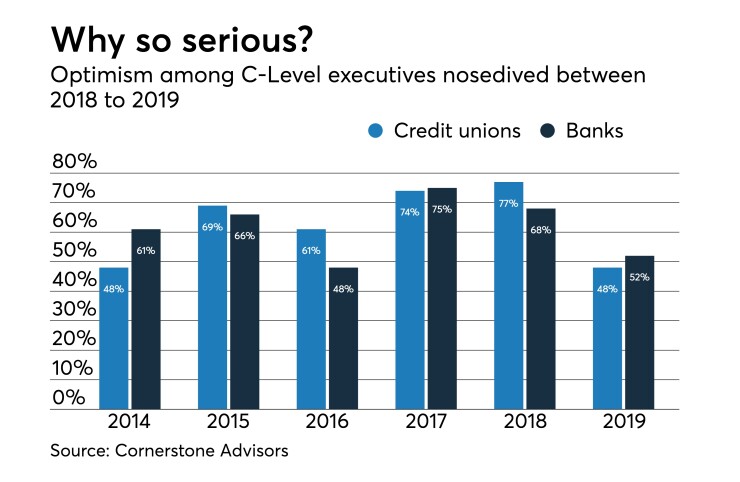

Executives at banks and credit unions are increasingly pessimistic about the year ahead, according to a recent study from Scottsdale, Ariz.-based Cornerstone Advisors.

According to the consultancy’s “What’s Going on in Banking 2019” report, optimism among credit union leaders has taken a nose dive, with a nearly 30 percentage-point drop in optimism among CU leaders, from 77 percent last year to 48 percent this year. On the other hand, this year’s report marks a stark change from recent years: whereas in the past credit union executives have had a more positive outlook, this year things have flipped, with bankers more optimistic than in the recent past. Banker optimism rose by 16 percentage points, from 52 percent last year to 68 percent for 2019.

"That's a big surprise,” said Ron Shevlin, director of research at Cornerstone, which surveyed 305 senior executives from community banks and credit unions to gauge industry priorities and outlook for the year ahead.

Shrinking margins, rising interest rates, reduced loan demand and the inability to retain deposits are some of the indicators cited by credit union executives for their pessimistic outlook, according to the report.

Growing consumer deposits remains a top priority for credit union executives for 2019, compared to the previous focus on boosting consumer loans – the top priority for bank executives in 2019.

That’s borne out by Alliant Credit Union. CEO David Mooney said hanging on to deposits remains a must for the Chicago-based credit union, and he expressed skepticism at the rush of institutions attempting to grow their deposit base by offering certificate promotions.

“I’m not sure that just posting promotional CD rates is going to do it this time because you have very attractive liquid saving rates in the market at 2 percent and higher, whereas the typical credit union or bank is still offering 0.15 percent on savings accounts,” he explained. “I think more of those funds are going to be in play as higher balance savers seek better returns on their funds.”

In terms of day-to-day operations, Mooney admitted his credit union would “be more cautious with large commitments” such as expensive investments in 2019, but noted that this was a planned move for the CU since it already “conducted a period of substantial investments in technology and talent.”

The credit union is still exercising caution in terms of asset concentrations.

“We’re avoiding asset concentrations particularly on the lending side because that can kill,” Mooney said.

Who’s your partner?

Technology is also a major focal point of the report. For one thing, the report urges credit unions to take more initiative with AI. Cornerstone described artificial intelligence as “coffee-table technology,” given that many credit unions are more likely to talk about it than actually implement it.

But the consultancy also emphasized the need for CUs and other community-based lenders to examine the viability of fintech partnerships. Cornerstone’s report found that 60 percent of credit union executives and half of bank chiefs believe fintech investments will be “very or somewhat important to them” in 2019.

Will Callender, a partner at AT Kearney, noted that while some institutions may view those firms as potential competition, developing the next generation of automated banking technologies is generally “not something that an individual bank at a mid-sized level or community level can develop on their own, so they need to be able to partner.”

Many FIs already have the pieces in place for those partnerships thanks to integrated core systems typical at most mid-sized institutions, he said. And those who don’t have those capabilities within their core may need to turn to fintech if they’re hoping to innovate.

But partnering does pose some challenges. For one, credit union executives will have to have a solid understanding of the fintech market in order to ensure a compatible partner is found – a task many small and mid-size institutions aren’t up for without outside assistance.

The other challenge, Callender explained, is how to partner.

“In some cases, banks need to go bilaterally to other fintechs and work out partnerships, which can be challenging given compliance challenges and the need to move quickly so that the process doesn’t become unnecessarily delayed,” he said.