Each week, Credit Union Journal runs several announcements of new credit union hirings, from front-line staff all the way to the corner office. Less common, of course, are terminations. And while CU CEOs aren't fired often, it does happen—and it can be a high-profile affair when it occurs.

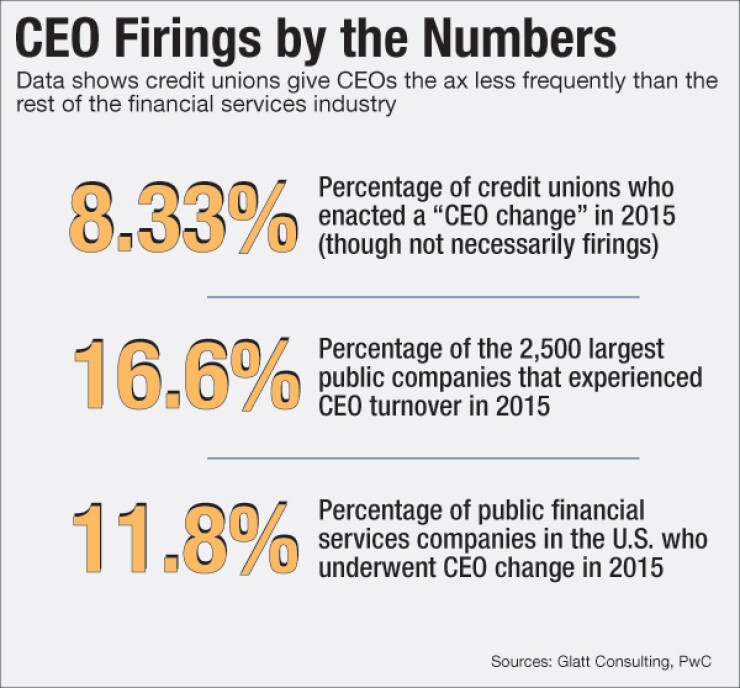

According to data from Glatt Consulting, a credit union consulting firm based in Wilmington, N.C., last year 512 of 6,147 (8.33%) credit unions enacted a "CEO change" (although not all — or even most — of these CEOs were terminated, as this figure includes changes related to retirements). For purpose of comparison, data from PwC shows that in 2015, of the 2,500 largest public companies in the world, 16.6% underwent a CEO turnover. With respect to public financial services companies in the U.S., 11.8% had a change in CEOs.

Indeed, credit unions sometimes have no choice but to fire their CEOs, especially when they commit fraud, embezzlement or other criminal acts that can embarrass the institution and endanger its financial solvency.

While embezzlements and other crimes make for good newspaper copy, most CEO firings are usually on the mundane side. According to Jo Ellen Whitney, senior shareholder and chair of the Des Moines-based Employment and Labor Relations Department at Davis Brown Law Firm, "terminations tend to be more frequently related to financial performance and customer service."

In general, she added, CEOs at any financial institution are let go "when their goals and performance don't meet the expectations" of the board and the institutions' customers or members.

Specifically, Whitney said that some of the reasons behind a chief executive's firing might include a change in management philosophy; a CEO who does not manage staff well; a failure to focus on customer service; a failure to meet financial goals for the organization; or simply not being present to run the organization due to other commitments.

Tom Glatt, founder of Glatt Consulting, noted that credit union executives at the top level typically lose their jobs over "poor organizational performance" and having a "poor relationship" with the board.

"I have seen a CEO's anger issues cause a termination, and also have seen staff rise up [to cause] the board to terminate the CEO — though this may be more indicative of board/CEO relationship weaknesses," he added.

A Question of Performance

As noted, CEOs can be held responsible for a credit unions' failure to perform or to reach certain pre-determined targets.

But Whitney cautioned that the concept of "performance" covers a broad territory. She said that metrics established by a credit union's board would vary by the organization, but could include such items as accounts opened, accounts closed, loan ratios, loan defaults, employee issues or turnover, complaints from the membership and similar matters.

The key negative metrics boards look at to determine if a CEO should be shown the door, Glatt offered, comprise such things as declining net worth, repeated net losses, and escalating delinquency/charge-offs. "Surprisingly, [the] lack of growth isn't one often used to define poor performance," he added.

Usually, a credit union's board of directors is mandated to fire a CEO, but the actual logistics are dependent upon the bylaws, operating agreements or other governing documents of the institution.

"In a general firing, [there] would be a small committee — of one or two — of the board members delegated to have the actual conversation [on the potential firing], but the board as a whole would make the decision," explained Whitney.

Glatt commented that usually a board will seek a "majority" for a decision on terminating a CEO, and often delegate the messaging to the chairman.

Keeping Firings Quiet

Many organizations are reluctant to publicize the fact that they have terminated their most important employee. Typically, the credit union will note that their former CEO "resigned" and that he was "succeeded" by someone new — that is, using vague, euphemistic language in order to protect the fired employee's dignity, while also preventing the likelihood of any lawsuits in the future.

Unless the terminated employee has committed some kind of criminal act that can't be hidden or overlooked, most institutions avoid specifically stating that he or she was fired.

"Very few companies simply say they fired a CEO," Whitney said. "This is not unique to credit unions or the financial industry. Sometimes it is just a change in management philosophy or direction — so that statement would be accurate. Sometimes there are other performance issues, but to explain those issues fully would not always be easy, would serve no useful business purpose and could lead to claims such as defamation."

Keeping good relationships between credit unions themselves is also important — especially if a CEO jumps from one institution to another.

Indeed, Glatt indicated that when a credit union fires a CEO, they usually say something along the lines of "mutual agreement to part."

"Credit unions are so connected to one another that I think most don't want to burn bridges publicly even if there was ample, justifiable reason for a termination," he said.