Everyone is a consumer. We all have predilections about the items we purchase and the brands we prefer. Many of these preferences are formed by marketing, influenced by the experiences of our social network, as well as our own first-hand knowledge. You know this scenario – you have a great experience at a local eatery. You promise to return and even post a glowing review on social media. Or the reverse happens – you have a terrible experience, vow to never return, caution your friends not to frequent the place and maybe even post a negative review on social media. But how does brand sentiment impact the auto lending industry?

One obvious example is the Hyundai Assurance program that was launched during the heart of the Great Recession. Based on EFG Companies’ WALKAWAY vehicle return protection program, Hyundai dealers and their lenders offered a first-of-its-kind deal with Hyundai Assurance. Consumers could return the vehicle and be relieved of their lease or loan obligations if unforeseen life events such as unemployment, disability, or illness occurred. As a result of this program, Hyundai saw sales of their vehicles grow 8 percent while the rest of the industry declined by 21 percent. Although nearly 10 years old, some brand experts indicate that the Hyundai Assurance program has continued to deliver positive brand revenue to Hyundai. And, you can be sure that lenders who financed Hyundai cars during the Great Recession saw a positive boost as well.

Does brand matter now?

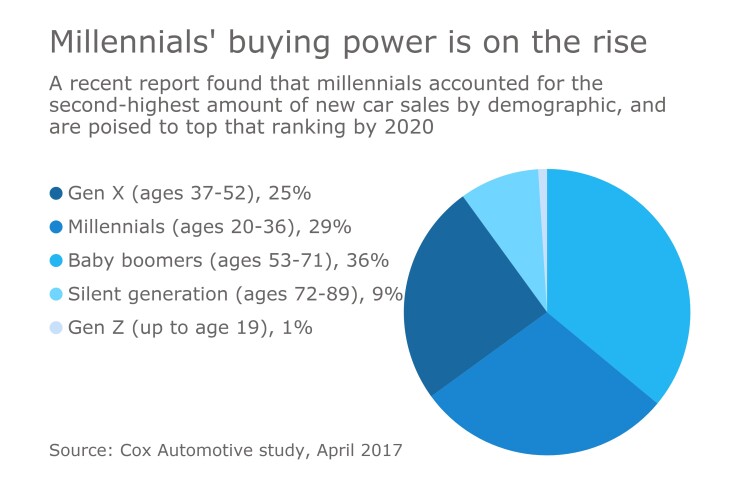

There is a myriad of research available surrounding the car-buying preferences of consumers age 40 and younger. For example, recent research fielded by Cox Automotive and Deloitte tracked the purchasing habits of millennials and Generation X compared to Baby Boomers. Among the highlights of that research:

- In 2016, millennials accounted for 29 percent of new vehicle sales.

- Generation X accounted for 25 percent of new vehicle sales in 2016.

- Baby boomers accounted for 36 percent of new vehicle sales in 2016.

- By 2019, millennials will account for 40 percent of new vehicle sales.

- Millennials made up 36 percent of the lending market in 2016.

- Almost 40 percent of millennials who submitted credit applications through Dealertrack’s network were subprime.

- Almost 60 percent of millennials set a budget before looking at vehicles, compared to 46 percent of Generation X, and 40 percent of baby boomers.

- More than 83 percent of millennials said an affordable monthly payment is very important when selecting a lender.

But, what brands will they purchase? With low gas prices, crossover utility vehicles and pick-up truck sales continue to lead all other vehicle types across the board. Improvements in fuel efficiency have prompted the first-time car buyer to go big. Age-wise, these buyers are at the height of their expanding family years, and they often plan to keep the vehicle past the pay-off point. Instead of having a starter car, these 20-to-30+-year-olds are buying their first vehicle to grow with them.

According to a study fielded by Forbes and Elite Daily, millennials do develop strong brand loyalty when presented with quality products and actively engaged brands.

- Sixty-two percent of Millennials surveyed said that they are more likely to become loyal customers to brands that engage with them online.

- Eighty-seven percent of millennials used between two and three tech devices at least once on a daily basis.

EFG Companies recently conducted consumer research, sampling over 1,000 car owners to determine their future purchase plans and brand preferences.

- At least half of the respondents currently drive an American-brand vehicle.

- More than 60 percent plan to purchase their next vehicle in the same general price point/quality level.

- Sixty-four percent of respondents indicated they will purchase a vehicle sometime within the next four years.

- More than half of respondents will finance that vehicle through a loan.

- The majority of respondents are looking for brands that offer trucks and SUVs, as well as good technology options.

A second study fielded by EFG Companies asked consumers their perceptions about the job market, their own ability to remain or gain employment, and areas of financial concern. While the majority were confident they would be able to regain comparable employment if they were to lose their jobs, over 80 percent were concerned about the country’s economy. When asked about a program such as WALKAWAY, 55 percent said such a program would have a modest to significant impact on where to finance their next vehicle, and 77 percent of respondents said they would be somewhat to very likely to finance a vehicle with a lender offering such a program.

Brand Impacts on Financing

So, what impact do these data sets have on financing in the automotive retail space? While auto sales have dipped slightly in the past few months, a strong market remains, as evidenced by these consumers who say they plan to purchase a vehicle in the future. And if the consumer is a first-time buyer, chances are they will be financially prepared for the purchase. These consumers will be looking for value as well as financial products that will keep that vehicle running for quite a while. As a credit union lender, are you prepared to work with this type of customer, as well as the dealer who will sell them their first car? Will your “brand” generate a rave review – or a cautionary tale told to friends?

For those consumers who plan to return to the car market, are you in tune with current consumer sentiment and prepared to offer products that address their concerns? While the research shows this set of consumers is fairly comfortable with their financial and employment outlook, the overall economy weighs heavily on their minds. Although the Great Recession is clearly in the rearview mirror, these returning, established consumers may choose a lender that offers a bit more security.

Remember – we are all consumers and we all have choices when it comes to making purchases. How does your “brand” stack up?