How can credit unions help consumers keep more of their hard-earned money if they don’t even know we exist?

How do we help them reach their financial goals faster if they’re confused about what we do? And how do we empower people to take control of their financial future if they’re mystified about the important role of credit unions in American life or whether they can join?

Those of us in the credit union movement know our products and services remain unsurpassed in financial services. But in the end, if the general public isn’t broadly aware of us, we risk turning over more of the market to the banks or to other fintech for-profits that don’t hold the best interests of consumers as their top priority.

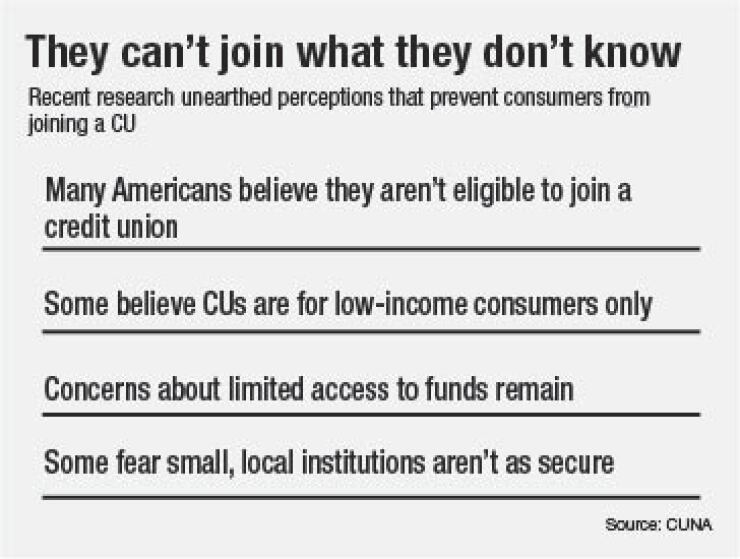

The reality is that far too many consumers simply don’t know about CUs. Research recently conducted by CUNA indicates that even if consumers have a basic understanding of CUs, they don’t know they can join, or whether their finances would be as accessible, convenient or secure.

These misconceptions are keeping people away from credit union membership.

Last summer, the CUNA Board appointed the Creating Awareness Advisory Group to address this awareness gap. Our mission is to identify exactly what is holding back top-of-mind awareness of CUs, and to determine what steps we need to take as an industry to overcome these obstacles.

To the advisory group—folks from large credit unions and small, league leadership and credit union service organizations—the only logical first step was to conduct new, national research that would clearly reveal the current perception of credit unions among the general public. At the same time, we wanted the research to unearth the latest trends in consumer preferences so credit unions could create a compelling brand platform to benefit the full industry.

The result of this research would provide us a roadmap that showed the areas we needed to attack in terms of overall awareness or underlying misconceptions, and how to do so in a way that would resonate with consumers.

Earlier this year, we finished our first round of consumer research. While we will present the results of this data fully at a breakout session during the CUNA Governmental Affairs Conference, I’d like to touch on a few points here.

The first and most obvious conclusion was that knowledge around credit unions was sorely lacking across all demographics. At a high level, consumers did not know they had the ability to join a credit union, or that credit unions can offer a modern menu of financial products and services, or that becoming a member—a word that also was often misunderstood—was just as easy as becoming a bank customer.

On a subtler, but critically important level, the research also found credit unions don’t evoke feelings of financial aspiration or success, as larger retail banks might.

This reputation, it appears, has also created a mistaken belief that credit unions are strictly for the needy, or, in other words, “not for me.” Consumers also voiced anxieties over the safety of their money at a credit union. Most could identify the FDIC, but almost no one had heard of the NCUA--which is particularly troubling in a time when consumers are worried about cybercrime and identity theft.

We’ll dig deeper into this data during the GAC breakout session, but I think the research provides an excellent foundation for the next step in this process: To educate consumers about credit unions by creating a brand platform that clearly defines our industry in the financial services category in a way that resonates with consumers.

The idea is not to create a retail marketing campaign for every credit union and League, which have their own brands in addition to a strong understanding about their markets and communities. Instead, we aim to develop a long-term communication initiative to differentiate our industry from other financial services providers.

An analogy is the National Football League. The NFL clearly defines what professional football is in America today. And from that definition, franchises build their own identities that speak to their specific markets.

That’s the mission of our Advisory Group: To create a research-tested platform that will deliver the clearest and most compelling definition of a credit union at the highest level that may be used by credit unions and Leagues nationwide.

While we are still in the first steps of our journey, we’ll share more of our progress along the way. Ultimately, it will be up to all of us to make this initiative work so credit unions are well-known, widely understood and held in high regard by consumers who know that we make their world better.

Freeborn is President and Chief Executive of Xceed Federal Credit Union and serves as chair of CUNA’s Creating Awareness Advisory Group.