Change is constant, rarely easy and important for continuous improvement. During change, such as the evolving capital regulations for natural person credit unions, we need to listen to diverse opinions.

The terms “alternative,” “secondary” and “supplemental” capital have been used synonymously to describe capital from debt or borrowings. In NCUA’s Alternative Capital Board Briefing and ANPR, these terms were uniquely defined.

Alternative capital is an umbrella term referring to any debt or borrowing instrument that any federally insured credit union can use to count toward either net worth or risk-based capital ratio. Secondary capital refers to such an instrument that already exists but only for low-income credit unions. Supplemental capital would be available to all federally insured credit unions but could only count toward risk-based capital.

Note that any low income-designated credit union (LICU) — about 40 percent of all credit unions — can issue secondary capital today. The ANPR sought feedback on the current regulation and considers authorizing CUs to issue supplemental capital instruments that would only count toward risk-based net worth requirements.

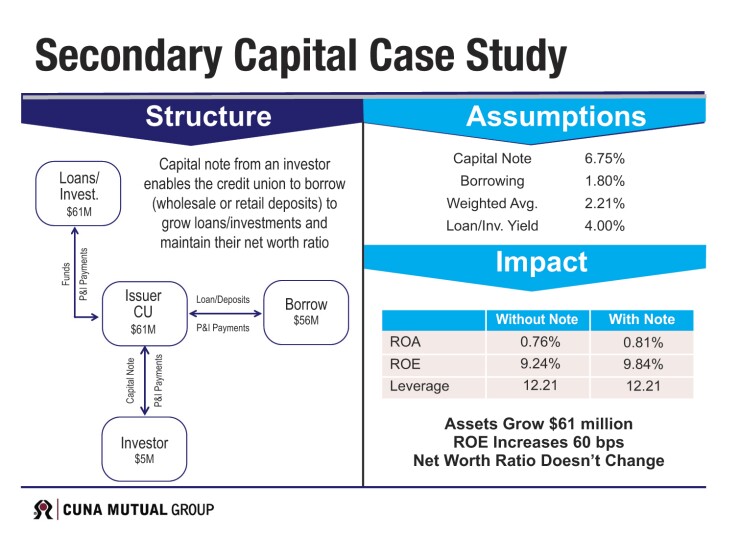

Model various alternative capital scenarios for your credit union. Our internal analysis shows most LICUs, under reasonable assumptions, would find secondary capital accretive to their financials. Here’s a simple secondary capital example for a $1 billion credit union leveraging $5 million in capital. The credit union could grow its assets by more than $61 million, increasing ROE by 60 basis points while maintaining its net worth ratio. However, supplemental capital would have a different impact.

For issuing supplemental capital, consider potential effects on net worth and RBC ratios. Under proposed guidelines, supplemental capital would not count toward the net worth ratio and would actually worsen the ratio for any credit union that does not qualify as a LICU. Consider a $500 million credit union with a 10 percent net worth ratio that issues $10 million of alternative capital. If issued as secondary capital, its net worth ratio would rise to 11.76 percent, but if issued as supplemental capital, its net worth ratio would fall to 9.80 percent.

In both cases, the credit union added a layer of capital to protect members and the National Credit Union Share Insurance Fund from losses. In the latter case, its net worth ratio would not reflect its improved capital position. Consequently, we believe only well-capitalized credit unions are likely to pursue supplemental capital, even though it would protect members from losses and increase the credit union’s loss-absorbing capacity.

Given asymmetric benefits supplemental capital would provide, we encourage NCUA to consider offering allowable incentives to credit unions that secure supplemental capital (e.g. allow credit unions to take supplemental capital into account when considering its ability to engage in certain investment activities, evaluating a credit union’s overall financial health, etc.).

Balancing issuer and investor needs

While issuance of secondary capital has been limited, we sense a growing interest and awareness of alternative capital benefits, driven by the growing number of LICUs and upcoming RBC requirements for complex credit unions. Developing a strong market will require balancing issuer and investor needs, such as:

- Allowing secondary and supplemental capital to be pledged by the account investor as security for a loan or other obligation.

- Granting investors and credit unions the discretion to determine whether to redeem a secondary capital account in the event of a merger.

- Prepayment and call provisions are important levers for issuers and investors and should be allowed but not required.

Assuming a pragmatic balance of needs, limited regulation and low issuance costs, we see a number of potential purchasers of alternative capital, including insurance companies, pension funds, asset managers and other institutional investors.

We also need to educate potential investors on the value, safety and soundness of credit unions. For example, available FDIC (failed bank list) and NCUA (NCUSIF reports showing failed credit unions) data from 2008 to Q1 2017 shows three times more bank failures than credit union failures. Investors want stability and a high degree of confidence they’ll get paid back. The credit union market is relatively predictable, stable, and in our view, offers a strong risk-adjusted return for potential institutional investors.

Modernizing capital regulations to provide credit unions robust and diverse ways to manage their capital has started. Additional work lies ahead, so be ready to share your perspectives when NCUA issues its notice for proposed rulemaking.