We Are People Helping People

Debbie Pidek, EVP- communications/CCO, Gulf Coast Community FCU, Gulfport, Miss.

How Federal Decisions Impact States

Lucy Ito, President and CEO of NASCUS

The Role of the Three Estates

Nate Webb, President, Oklahoma CU Association

Stay Focused on Consumers

Chris McDonald, president and CEO of Northwest FCU, Herndon, Va.

Increased Regulations Threaten Viability of Movement

Jeff Huffman, president, Texas CU Association

Why Credit Unions Do What We Do

Brad Houle, president, C.A.H.P. CU, Sacramento, Calif.

CUs Ready and Willing to Help

Jim Phelps, SVP-advocacy, Cornerstone CU League

Preserve CU Tax Exemption

Sue Longson, advocacy specialist, Boulder Dam CU, Boulder City Nev.

A Little Give and Take

As credit union leaders, we are also consumer advocates. Please help us find the right balance in consumer regulations. CUs, as not-for-profit cooperatives should be completely exempt from CFPB regulations. Regulatory overreach is hurting consumers by restricting access to affordable credit.

What I would ask them:

Would you support credit unions' efforts to modernize the Federal Credit Union Act so more people can have easy access to affordable financial services, even if bankers objectas they always do?

Dave Adams, CEO, Michigan CU League

How Will You Preserve Our Greatness?

Mark Hawkins, president and CEO of Altura CU, Riverside, Calif.

CFPB Requires Supervision

Reta Kahley, president, Arkansas CU Association

Three Questions, Three Statements

My statement: I am for increasing the NCUA board seats from three to five in order to provide additional diversity and dialogue in arriving at decisions impacting CUs.

Question 2: Do you support lifting the business lending cap?

My statement: I support raising the business lending cap. As John Kennedy once said, a rising tide will lift all boats. If we allow CUs more flexibility by raising the MBL cap, it will allow us to serve more members and as these members' businesses continue to grow, they will need expanded services offered by the major banksa win-win for everyone.

Question 3: Do you see any concern with the growing number of "conduits" to qualify individuals for credit union membership?

My statement: There appears to be an abuse of "conduits" in our marketplace, in terms of field of membership. Earlier this year it was reported there were more than 400 CUs doing business in Phoenix, and since there are only about 40-plus CUs in Arizona, over 360 credit unions are from out of state?

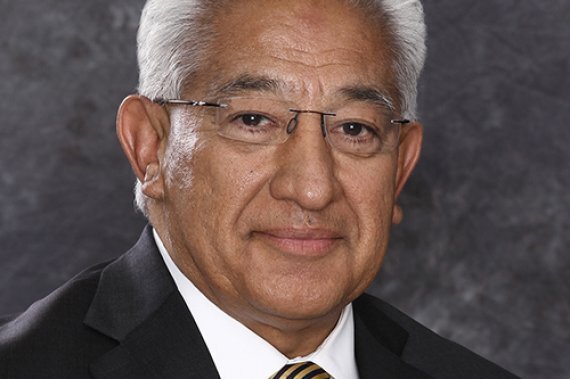

Robert D. "Bob" Ramirez, president and CEO, Vantage West CU, Tucson, Ariz.