First Citizens BancShares landed as the top-performing large bank for the second year in a row, still riding the windfall from its acquisition of the failed Silicon Valley Bank in 2023.

The list, which is based on year-end data for 2024, is compiled by the consulting firm Capital Performance Group. Rankings are based on banks' three-year average returns on average equity.

As high interest rates, election uncertainty and geopolitical tension have strained banks' operations since 2022, their returns on average equity have declined. In 2024, the top 10 performers logged a median return on average equity of 14.31% in 2024, down from 15.88% the previous year.

Still, the top 10 performers easily outpaced the 9.95% median for all banks across the asset tier.

The top banks were also able to grow noninterest income faster than their peers, which helped them boost profits at a time when high interest rates were compressing margins.

On top of fee businesses, loan growth at the top performers outpaced peers. They reported median growth of 4.10%, compared with 2.10% for all banks in the size group. Core deposits for the top 10 banks grew by 2.14%, compared with median growth of 1.88% across the asset tier.

Raleigh, North Carolina-based First Citizens

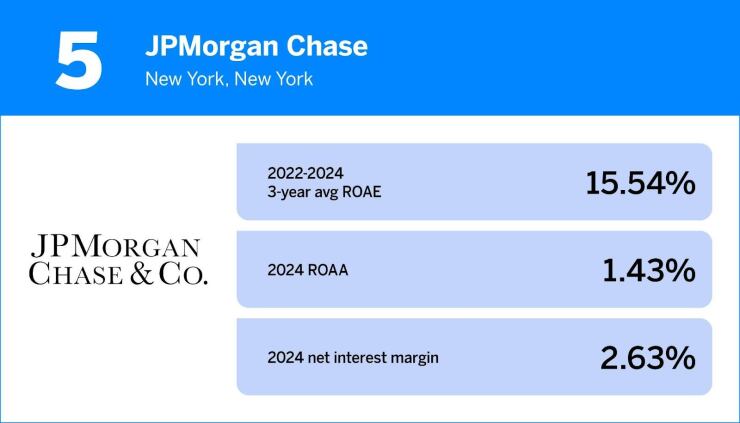

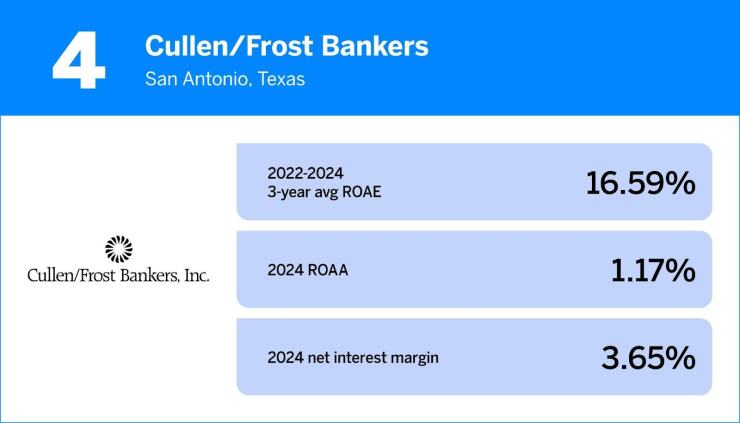

Below are performance metrics from 2024 for the 10 highest-performing banks with more than $50 billion of assets. Click on the table at the bottom of the page for the full ranking of banks in the asset class.