-

The Federal Reserve deserves praise for a proposal that would strengthen financial stability by eliminating the rights of counterparties to tear up derivatives contracts in a failure.

May 9 The Clearing House Association

The Clearing House Association -

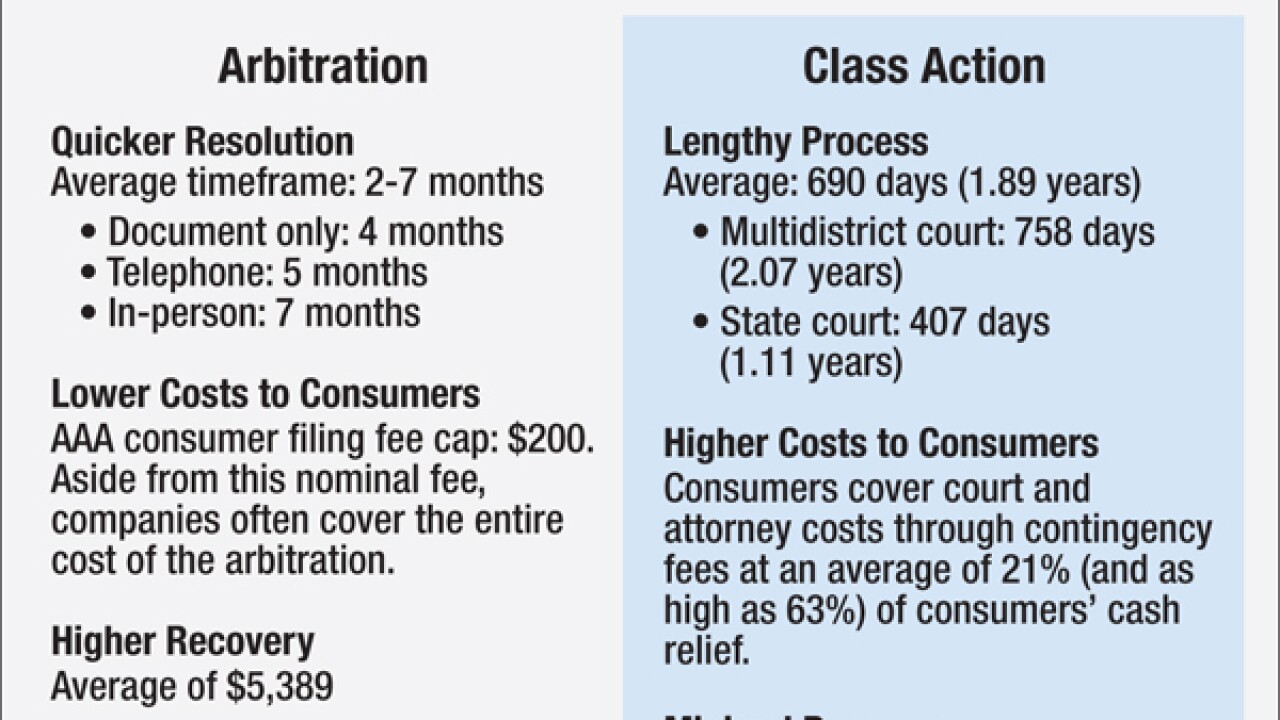

The finance industry pushed back against a proposal by the Consumer Financial Protection Bureau Thursday that would ban arbitration clauses in consumer contracts.

May 5 -

Presumptive GOP presidential candidate Donald Trump's pledge to replace Fed Chair Janet Yellen with a Republican is a break from recent presidential tradition and might further politicize the central bank, observers said.

May 5 -

The Consumer Financial Protection Bureau is set on Thursday to issue a proposal that would ban the use of arbitration clauses that prevent consumers from bringing class action lawsuits. The proposal on arbitration is a major setback for the financial services industry, which will face potentially higher expenses to defend lawsuits.

May 5 -

With agencies created by the Dodd-Frank Act embroiled in court battles and continued questions dealing with "too big to fail," can anyone honestly say the reform law is working?

May 4 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Just six months out from the general election, presumptive Republican presidential nominee Donald Trumps positions on banking issues remain a complete mystery aside from a general pledge to roll back the Dodd-Frank Act.

May 4 -

The Consumer Financial Protection Bureau is expected to issue a proposal Thursday that would limit the use of arbitration clauses on millions of financial contracts from cellphones to credit cards to checking accounts. Here are key areas to look at when the plan is released.

May 3 -

Regulators cited a slew of technical concerns in their response to megabanks' living wills, but the technological, logistical and legal flaws they found appeared to center around a single issue: liquidity.

May 2 -

In a speech Sunday, Federal Reserve Bank of New York President William Dudley gave credence to concerns that post-crisis regulatory reforms may have dried up liquidity in the Treasury and corporate bond markets, but said more examination is needed to guide effective policy.

May 2 -

Even if the Financial Stability Oversight Council fixes flaws in its process for designating "systemically important" companies, that doesnt solve everything the council needs to achieve its mission.

May 2 Bipartisan Policy Center's Financial Regulatory Reform Initiative

Bipartisan Policy Center's Financial Regulatory Reform Initiative