-

The National Credit Union Administration quietly announced Thursday a meeting to discuss a reproposed executive compensation rule one of the last and most important unfinished regulations in Dodd-Frank.

April 15 -

Democratic presidential hopefuls Bernie Sanders and Hillary Clinton both emphasized during a late Thursday debate that they are prepared to break up megabanks that pose a systemic risk to the U.S. economy, but also showed there are differences in how they approach "too big to fail."

April 14 -

Federal Deposit Insurance Corp. officials fielded tough questions Thursday about how they have wielded the resolution planning powers given to them by the Dodd-Frank Act.

April 14 -

The bank's top executives expressed confidence Thursday in their ability to address regulators' concerns about flaws in its resolution plan.

April 14 -

WASHINGTON The House passed a bill 247-171 on Thursday that would raise the threshold for a Federal Reserve Board exemption that helps banks raise Tier 1 capital.

April 14 -

The bad grades and detailed laundry list of fixes that institutions must make in the next five months or face possibly severe consequences may actually prove helpful in the long run, both to the debate over "too big to fail" and the banks themselves. Here's why.

April 13 -

House Republicans moved two bills through committee on Wednesday that would each roll back key provisions of the Dodd-Frank Act.

April 13 -

The Office of Financial Research, an agency tasked with examining emerging threats to the financial system, said in a paper released Wednesday that U.S. global systemically important banks remain among the riskiest in the world, though risks from Chinese banks are growing the fastest.

April 13 -

U.S. regulators have asked their internal watchdogs to examine how assessments of banks' plans for winding down during a potential bankruptcy ended up in a news article.

April 13 -

In declaring that five U.S. banks' resolution plans were "noncredible," regulators provided new details on exactly what each institution did wrong, as well as what Citi and others did right. Here's what they said.

April 13 -

The decision blocking the Financial Stability Oversight Council's designation of MetLife was presaged in factual and legal arguments made by trade associations and others for more than five years.

April 13

-

Regulators struck down the living wills of five of the eight megabanks under evaluation, including JPMorgan Chase, Bank of America and Wells Fargo, requiring them to submit fixes to their resolution plans by Oct. 1 or face more stringent regulatory requirements.

April 13 -

WASHINGTON The House passed a bill Tuesday that would create a new bankruptcy system for large financial institutions.

April 12 -

The Federal Reserve Board and Federal Deposit Insurance Corp. are set to give at least four megabanks a "harsh verdict" on their living wills, including JPMorgan Chase, according to an article by The Wall Street Journal, which cited "people familiar with the matter."

April 12 -

WASHINGTON The Federal Reserve Board and the Federal Deposit Insurance Corp. should rethink the review process for big banks' resolution plans, the Government Accountability Office said in a report released Tuesday.

April 12 -

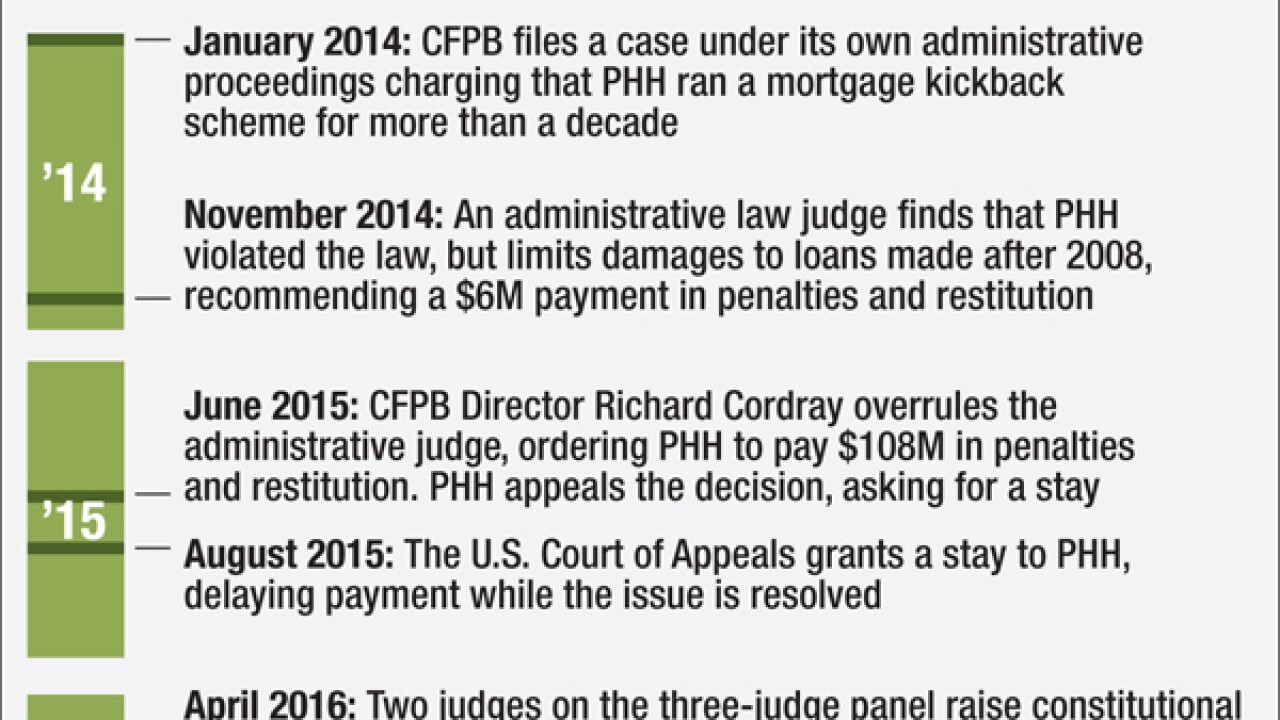

The Consumer Financial Protection Bureau faced hostile questions from two judges during oral arguments before a federal appeals court Tuesday as it sought to argue the constitutionality of its single-director structure in a lawsuit brought by the nonbank mortgage lender PHH Corp.

April 12 -

The impending Consumer Financial Protection Bureau proposal will limit access to payday lending but it will not enable small-dollar lending alternatives for consumers.

April 12 Financial Services Innovation Coalition

Financial Services Innovation Coalition -

Regulators have yet to provide feedback on last year's living-will resolution plans, but for foreign banks with significant operations in the U.S., those assessments are too late. Such institutions are required to put in place an entirely different business model by July of this year.

April 11 -

The U.S. Court of Appeals for the D.C. Circuit will hear oral arguments Tuesday about the Consumer Financial Protection Bureau's structure, in a case that has national implications. Even though a ruling isn't expected until the end of the year, legal experts say there are four major legal issues involved.

April 10 -

In a panel featuring the four living chairs of the Federal Reserve Board, Janet Yellen said that she does not share Minneapolis Fed President Neel Kashkari's view that the biggest banks need to be broken up but respects his opinion and the role of regional banks in the Fed system.

April 7