-

Federal Reserve Board Chair Janet Yellen faced tough questions Wednesday by House Financial Services Committee lawmakers over the central bank's regulatory treatment of big banks.

February 10 -

While the courts generally accord deference to regulators, Judge Rosemary M. Collyer of the D.C. District Court appeared highly skeptical of the Financial Stability Oversight Council's case during the first round of oral arguments on Wednesday.

February 10 -

Should companies that manage collateralized loan obligations but don't originate the loans be subject to Dodd-Frank's risk-retention rules for securitizations?

February 10 -

Sen. Bernie Sanders' victory in New Hampshire will undoubtedly boost his campaign, but his plan to cap interest rates for credit card and other consumer loans at 15% won't help anyone in the short term and could potentially wreak havoc on low-income people in the long term. Here's how.

February 9IntraFi Network -

Overhauling the S&L crisis-era method for intervening in struggling banks, which did not live up to expectations during the 2008 meltdown, should be a higher priority.

February 9 American Enterprise Institute

American Enterprise Institute -

The election of a Republican president could be the first prerequisite to repealing the financial reform law, but banks still need to argue their case for why repeal is necessary.

February 8

-

Democratic front-runner Hillary Clinton is increasingly on the defensive when asked why so many banks and hedge funds on Wall Street have given her money, insisting it doesn't influence her tough reformist views. But it raises the question what institutions hope to gain with all their money.

February 4 -

In a presidential race dominated by populists and even an aging socialist, the establishment candidates that bankers prefer Hillary Clinton and Marco Rubio had a good night in Iowa on Monday. But the race is far from over, and the Iowa results showed some ominous signs as well.

February 2 -

In an exclusive survey of bankers nationwide, American Banker found that regulatory relief and ensuring fintech companies faced banklike rules were the two top priorities for the industry this year while taxing credit unions and restructuring the CFPB took a back seat.

January 29 -

Former Florida Gov. Jeb Bushs polling numbers are running in the mid single digits in Iowa, making the prospects for his campaign bleak, yet he retains much of his support among bankers in the state.

January 27 -

American International Group announced $3.6 billion in new costs to fill a reserve shortfall and said it will hold an initial public offering for its mortgage insurer and sell an adviser network as Chief Executive Peter Hancock seeks to boost returns and protect his job after criticism from activist investor Carl Icahn.

January 26 -

Progressives' push for a more drastic overhaul of the industry ignores post-crisis changes that have had an undeniably positive effect.

January 22 IBM Global Business Services

IBM Global Business Services -

Sen. Bernie Sanders and former Gov. Martin OMalley pledged to reinstate the Glass-Steagall Act to separate commercial and investment banking, while former Secretary of State Hillary Clinton said her reform plan was the only one to go after the nonbanks like AIG that caused the crisis.

January 18 -

Financial services issues that helped define a presidency were largely absent from Tuesday's State of the Union address, including the crucial policy items that have not yet been resolved.

January 14

-

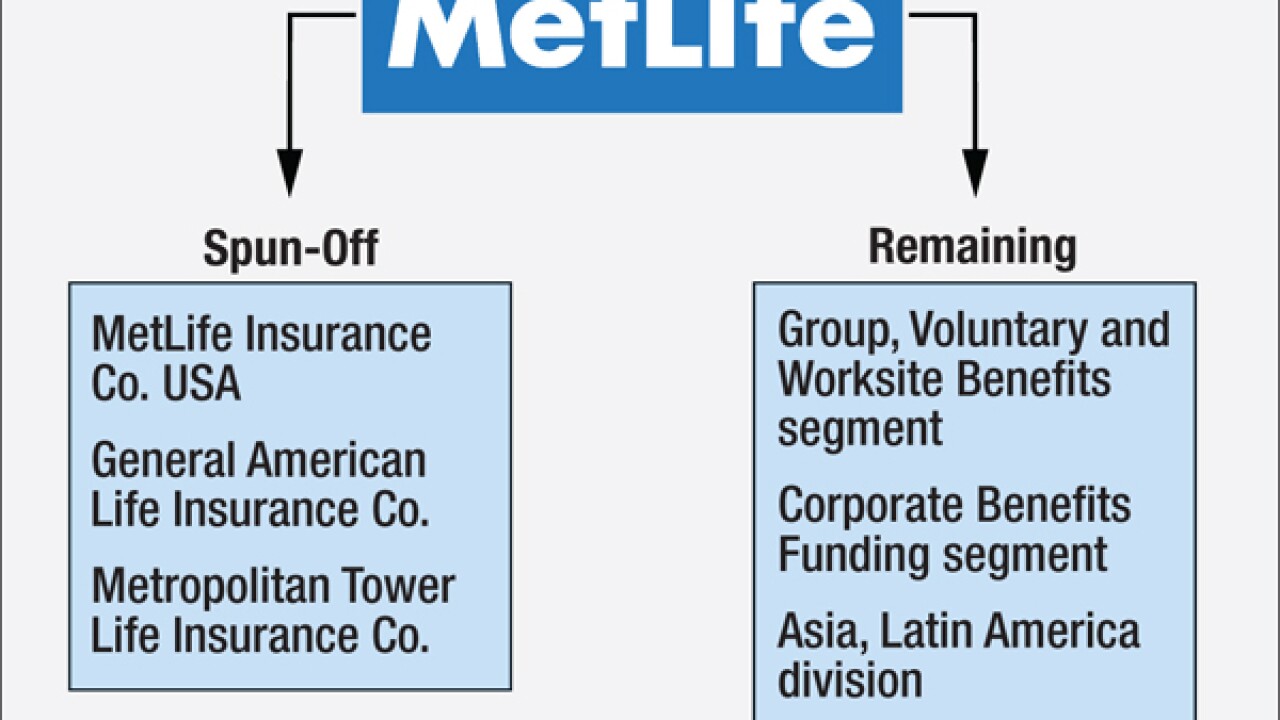

The conventional wisdom is that MetLife is breaking itself up partly as a response to its designation as a systemically important company. But there is significant evidence that's wrong here's why.

January 13 -

As fintech pitches itself as the future of consumer financial services to bankers, regulators, legislative staffers and journalists, it's not enough to claim that innovations are better. We nontechies want an explanation why, in layman's terms.

January 13

-

Raising capital has been tough for community banks ever since the financial crisis, especially the smallest ones. But a few firms have developed structured products that offer banks a chance to band together to raise needed Tier 1 capital at relatively low cost, while avoiding the regulatory ire that befell trust-preferred securities.

January 11 -

The financial industry is fractured over a Federal Deposit Insurance Corp. plan to require big banks to temporarily pay more in deposit insurance premiums, with small banks lobbying to force bigger payments over a shorter time frame and many large ones wanting to stretch it out.

January 8 -

In theory, Sen. Bernie Sanders' plan to use Section 121 of the Dodd-Frank Act to break up the big banks sounds plausible. In practice, it won't ever happen. Here's why.

January 7IntraFi Network -

Sen. Richard Shelby's bill changing how regulators gauge if a bank is "systemic" would refocus post-crisis policy on institutions that pose the greatest threat.

January 7