-

Big banks' flirtation with the idea of suing the Federal Reserve Board over its stress testing regime carries significant political risk and even if successful could yield at best a pyrrhic victory over the megabanks' primary regulator.

September 16 -

House Democrats made an unusual move this week to avoid offering amendments or engaging in debate over a massive financial reform bill. Here's why.

September 15 -

Kentucky district court judge rules that the courts cannot interfere with the GSE regulator's wind down of Fannie Mae and Freddie Mac.

September 15 -

The Federal Reserve's annual stress testing regime violates federal administrative law, a coalition of banking groups said in a white paper released Thursday, likely previewing a court battle that could have far-reaching consequences for the program.

September 15 -

With the risk-taking culture at big banks including that which contributed to the Wells Fargo fiasco it's a good thing the House bill to weaken Dodd-Frank will never become law.

September 14 Marlin & Associates Securities

Marlin & Associates Securities -

New recommendations by the Federal Reserve Board are a crucial step in the direction of much-needed restructuring of the U.S. financial sector.

September 14 Cornell University

Cornell University -

Chairman Jeb Hensarling's financial reform bill was approved by the Financial Services Committee along mostly party lines as Democrats declined to offer amendments to legislation they said was too flawed to begin with.

September 13 -

While the retail lobby won in the political arena and successfully decreased its costs through price-fixing, the biggest loser in this situation was the American consumer.

September 13

-

Regulators, analysts and investors are likely to take a thorough look at other banks' cross-selling tactics following Wells' settlement with federal agencies for illegally enrolling customers in products and services.

September 12 -

In a speech in Washington on Monday, JPMorgan Chase Chairman and CEO Jamie Dimon said that political divisions between Republicans and Democrats are keeping the country from solving solvable common problems and reaching its economic potential.

September 12 -

Democratic lawmakers are calling for Wells Fargo Chief Executive John Stumpf to testify before a Senate panel as part of an investigation into nearly 2 million fraudulent bank and credit card accounts that Wells employees opened in an effort to meet sales incentives.

September 12 -

Its become an all-too-familiar story a big bank is caught doing something bad, it pays a fine, some lower-level employees are let go while higher-level executives appear to get off scot free and no criminal charges are assessed. Many see that happening again at Wells Fargo.

September 9 -

Marketplace lenders that have partnered with banks face more scrutiny after a federal judge in California handed a legal victory last week to the Consumer Financial Protection Bureau.

September 9 -

In an interview Friday morning, Federal Reserve Gov. Daniel Tarullo said that enforcement agencies and even the Department of Justice need to hold individuals accountable amid revelations that thousands of Wells Fargo employees opened illegal accounts for customers.

September 9 -

Nellie Liang, director of the Federal Reserve's Division of Financial Stability, has announced her retirement after 30 years with the central bank.

September 9 -

Wells Fargos reputation as a consumer-friendly bank suffered a significant blow Thursday after it agreed to pay $190 million to settle charges that thousands of employees created unauthorized bank and credit card accounts for customers in order to collect bonuses for themselves.

September 8 -

In response to industry comments, the Federal Reserve said it would follow notice-and-comment procedures when exercising its countercyclical capital buffer authorities a process whereby the biggest banks would hold an additional capital cushion to counteract overheated markets.

September 8 -

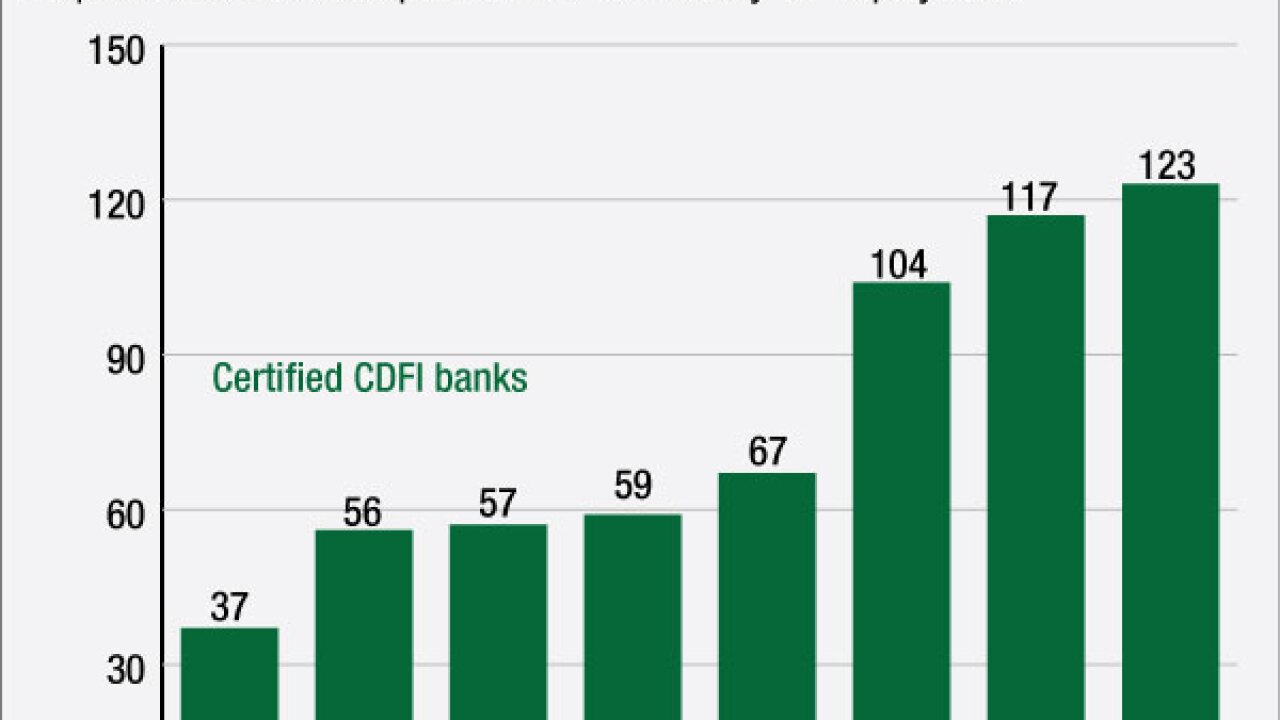

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

The Federal Reserves structure and makeup and even geographical locations drew criticism from members of Congress and the public as favoring the wealthy and ignoring the conditions of ordinary Americans

September 7