-

The decision blocking the Financial Stability Oversight Council's designation of MetLife was presaged in factual and legal arguments made by trade associations and others for more than five years.

April 13

-

Regulators struck down the living wills of five of the eight megabanks under evaluation, including JPMorgan Chase, Bank of America and Wells Fargo, requiring them to submit fixes to their resolution plans by Oct. 1 or face more stringent regulatory requirements.

April 13 -

WASHINGTON The House passed a bill Tuesday that would create a new bankruptcy system for large financial institutions.

April 12 -

The Federal Reserve Board and Federal Deposit Insurance Corp. are set to give at least four megabanks a "harsh verdict" on their living wills, including JPMorgan Chase, according to an article by The Wall Street Journal, which cited "people familiar with the matter."

April 12 -

WASHINGTON The Federal Reserve Board and the Federal Deposit Insurance Corp. should rethink the review process for big banks' resolution plans, the Government Accountability Office said in a report released Tuesday.

April 12 -

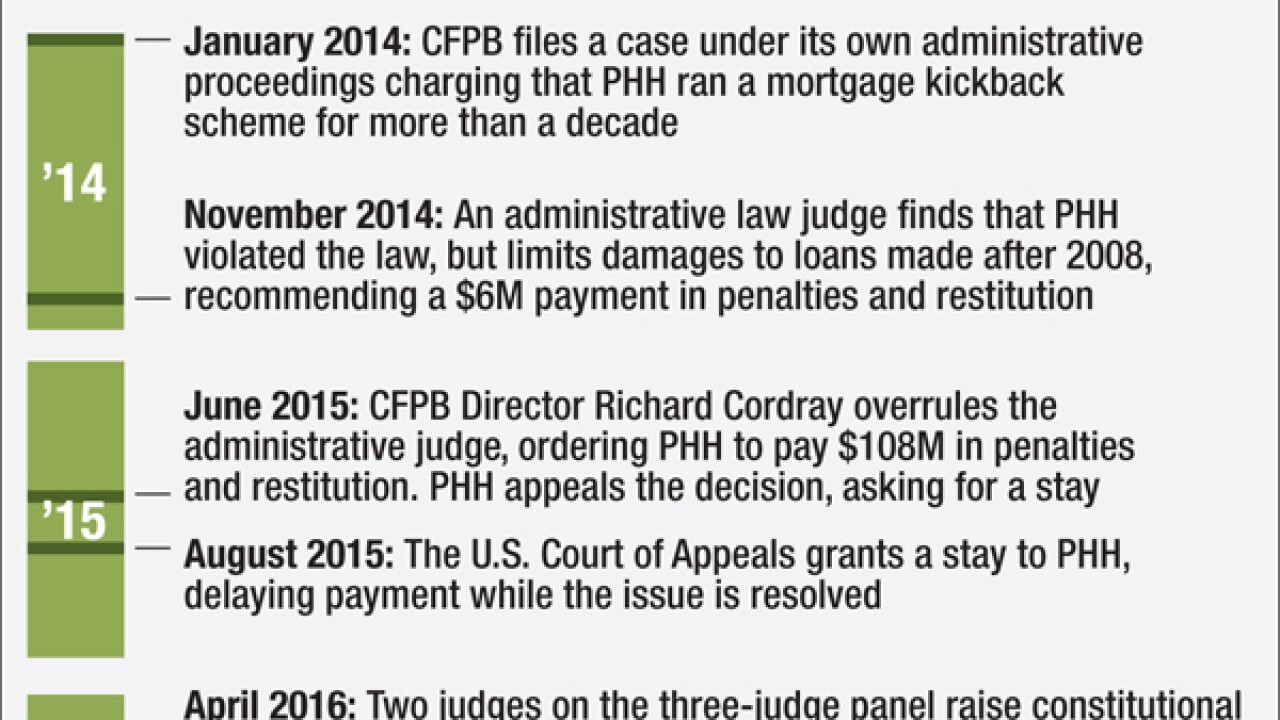

The Consumer Financial Protection Bureau faced hostile questions from two judges during oral arguments before a federal appeals court Tuesday as it sought to argue the constitutionality of its single-director structure in a lawsuit brought by the nonbank mortgage lender PHH Corp.

April 12 -

The impending Consumer Financial Protection Bureau proposal will limit access to payday lending but it will not enable small-dollar lending alternatives for consumers.

April 12 Financial Services Innovation Coalition

Financial Services Innovation Coalition -

Regulators have yet to provide feedback on last year's living-will resolution plans, but for foreign banks with significant operations in the U.S., those assessments are too late. Such institutions are required to put in place an entirely different business model by July of this year.

April 11 -

The U.S. Court of Appeals for the D.C. Circuit will hear oral arguments Tuesday about the Consumer Financial Protection Bureau's structure, in a case that has national implications. Even though a ruling isn't expected until the end of the year, legal experts say there are four major legal issues involved.

April 10 -

In a panel featuring the four living chairs of the Federal Reserve Board, Janet Yellen said that she does not share Minneapolis Fed President Neel Kashkari's view that the biggest banks need to be broken up but respects his opinion and the role of regional banks in the Fed system.

April 7 -

Speaking before the Senate Banking Committee, CFPB Director Richard Cordray said fintech companies should be held to the same standards as depository institutions. At the hearing, Cordray fielded questions on payday loans, indirect auto lending and regulation by enforcement rather than rulemaking.

April 7 -

In a ruling that was unsealed Thursday, D.C. District Court Judge Rosemary Collyer upbraided the Financial Stability Oversight Council for disregarding its own rules in its decision to designate the insurer MetLife as a systemically risky nonbank.

April 7 -

For the benefit of consumers who rely on nonprime credit and the lenders that provide it, Consumer Financial Protection Bureau rules offering clarity and consumer protections can't come soon enough.

April 6

-

GOP lawmakers and witnesses at a Senate Banking Committee hearing pointedly criticized the Consumer Financial Protection Bureau on Tuesday, setting the stage for a likely contentious hearing with the agency's director later in the week.

April 5 -

In an interview, FDIC Chairman Martin Gruenberg said the agency will work with banking groups, state commissioners and others to help foster the growth of new banking charters.

April 5 -

Two appeals court judges raised constitutional questions Monday about the structure of the Consumer Financial Protection Bureau in its case against PHH Corp.

April 4 -

In a forum at the Federal Reserve Bank of Minneapolis aimed at examining progress made in ending the era of Too Big to Fail banks, academics engaged widely differing views on the nature of bank risk and how far regulators have come in addressing them since the crisis.

April 4 -

GE Capital has formally asked the Financial Stability Oversight Council to review and rescind its designation as a systemically important financial institution, setting in motion a highly anticipated process that has not yet been tried by a designated firm.

March 31 -

The DC District Court on Wednesday ruled against the Financial Stability Oversight Council's designation of the insurance giant MetLife as a systemically risky nonbank, though the opinion behind the order was sealed and the reasoning behind the decision remains unclear.

March 30 -

WASHINGTON Congress should consider streamlining the financial regulatory structure and give the Financial Stability Oversight Council broader authority to respond to systemic risks, according to a Government Accountability Office report published this week.

March 29