-

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Long-time CEO grew M&T Bank into a $120 billion regional lender; Jim McCarthy, a high-profile manager, didn’t inform company about relationships.

December 18 -

The government-sponsored enterprises are at the heart of our housing finance problems, not the solutions.

December 15 American Action Forum

American Action Forum -

For decades, Fannie Mae and Freddie Mac helped working-class Americans get mortgages. That essential and powerful role in the national economy is fading.

December 15 National Community Reinvestment Coalition

National Community Reinvestment Coalition -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

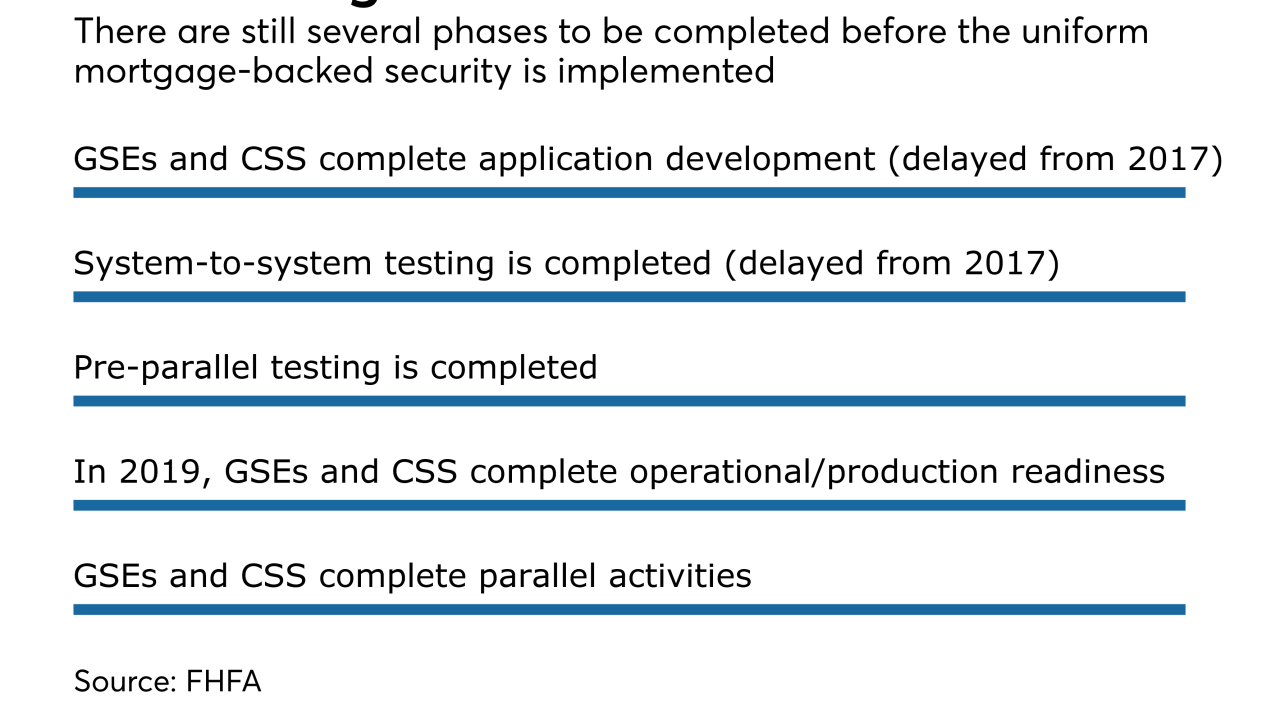

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1