-

New FHFA Director Mark Calabria isn't just charting a future for Fannie Mae and Freddie Mac, but also fixing problems resulting from the "qualified mortgage" exemption for the GSEs and taking a "deep dive" into problems in the mortgage servicing market.

April 25 -

The company's credit card business has been outpacing industrywide loan growth. In the first quarter, results were also aided by higher loan yields.

April 25 -

The strong growth in commercial lending made up for more modest gains in credit card and auto lending, its two largest business lines.

April 25 -

The Wisconsin bank's pending acquisition of 32 Huntington branches would boost its ability to make more loans, but like other banks it said deposit costs are cutting into margins.

April 25 -

Stephen Steinour said it was pure conjecture that Huntington was a possible suitor for the Dallas bank if it decides to put itself up for sale at some point. He emphasized Huntington's core-growth strategy and upbeat economic signs from consumers and businesses.

April 25 -

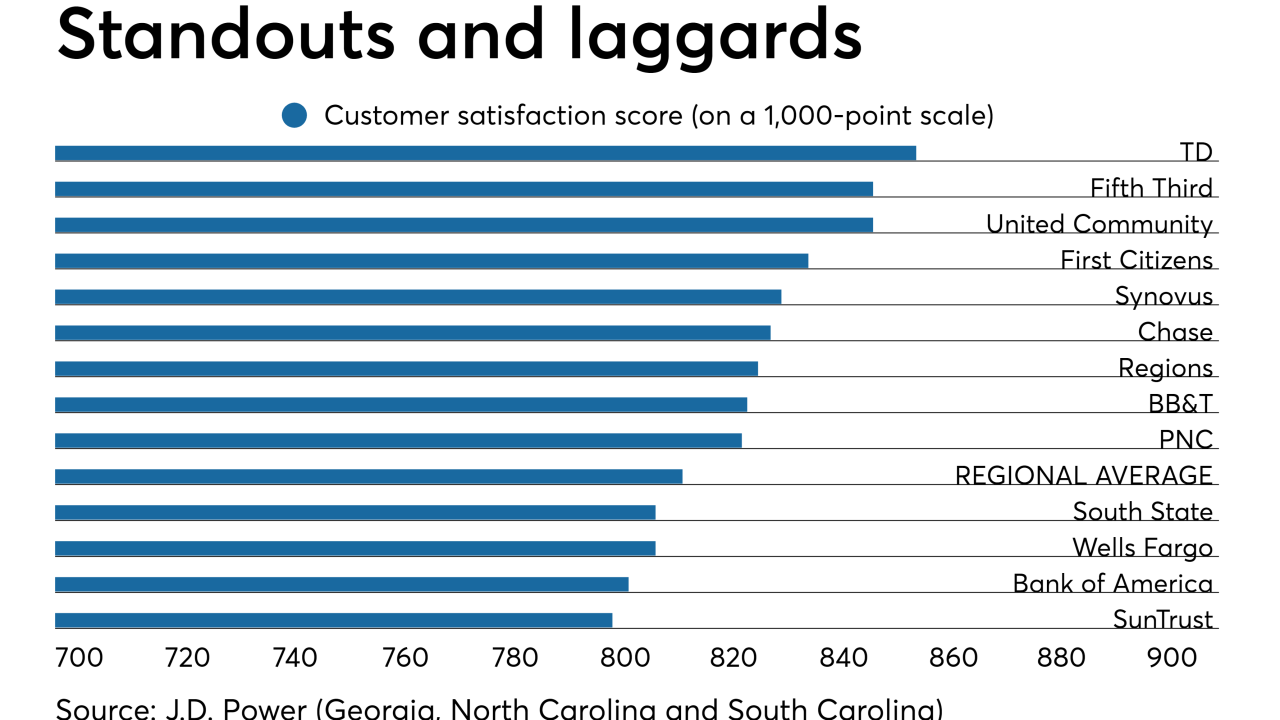

Larger institutions in particular have made banking so convenient that customers see little reason to move their accounts, according to a new report from J.D. Power.

April 25 -

The central bank issued an enforcement action against Sumitomo Mitsui Banking Corp. and its New York branch, citing deficiencies related to risk management and compliance with the Bank Secrecy Act.

April 25 -

A successor to Robert Allen, who has led the $7.3 billion-asset institution for more than three decades, should be named soon.

April 25 -

Earnest hopes offering a streamlined process can help it thrive in a risky niche.

April 25 -

The San Antonio bank reported 6.8% growth in loans, but Phil Green said he was unwilling to match overly generous prices and underwriting terms that he is seeing in the market.

April 25