It’s easy to believe that the youngest FI consumers would be the primary demographic wanting more from

We discovered this when we conducted primary research among 795 U.S. consumers and 150 regional and community financial institutions in June of 2021 to better understand

To qualify for the double-blind study, consumers ages 18-75 admitted to online or

Boomers and Gen Z want the same things

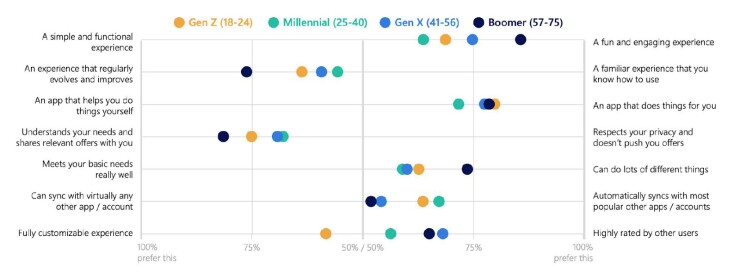

Alkami asked digital banking consumers from each generational cohort (Gen Z, Millennial, Gen X, and Baby Boomer) to select their digital banking preferences on a sliding scale across multiple polarities, including the following:

As our research shows, imposing one’s own deliberate or unconscious generational bias risks missing the bigger picture that brilliant digital user experiences are, in fact, universally lauded by all. The data reveals that Baby Boomers are more likely to prefer an engaging, ever-evolving, relevant, and multifunctional digital banking experience than all other generations and are just as likely to want it to be autonomous as Gen Zers.

Digital banking solution preferences among generations

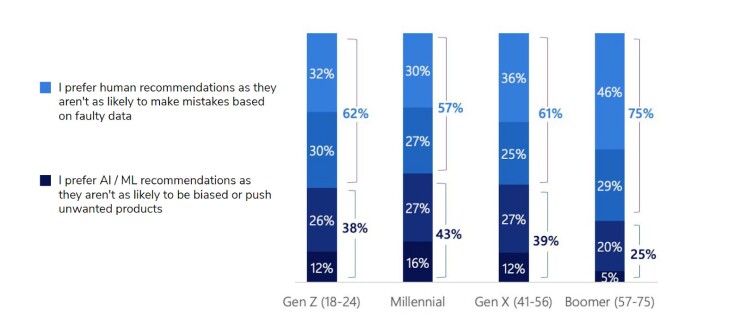

Preference for AI decisioning plays differently across demographics, with younger generations being more trusting than Gen X and Boomers. Still, more than half of all generations are wary of machines solely running the show.

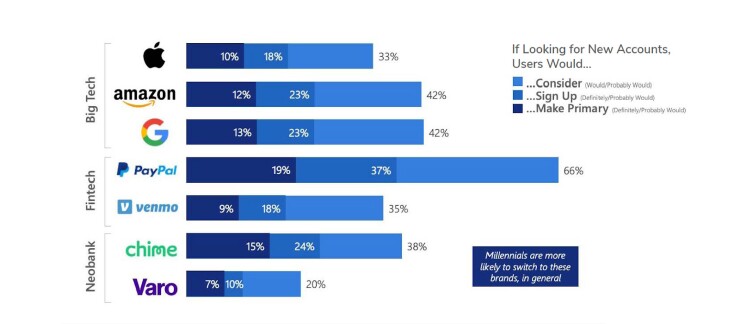

Mobile-first, data-informed fintech and neobank experiences emulating those of Big Tech companies have swayed 79% of digital banking consumers across all generations to consider opening a new checking or savings account with a technology-driven organization. While half of respondents reporting they would

The takeaway: interrogate generational biases

Everyone cares about digital banking, and their concerns are becoming more informed and specific. To cater to one demographic online and another in the branch is to misunderstand today’s challenges. Not only are FIs racing to stay at the forefront of technology for their own day-to-day, they’re also straining to meet user expectations. It would be simpler to only have to meet the demands of one demographic, but all users want a better digital experience, and their needs are not so different among Boomers and Gen Zers.