-

Fannie Mae is revamping its affordable mortgage program to make it easier for low- and moderate-income families to qualify for low-down-payment loans.

August 25 -

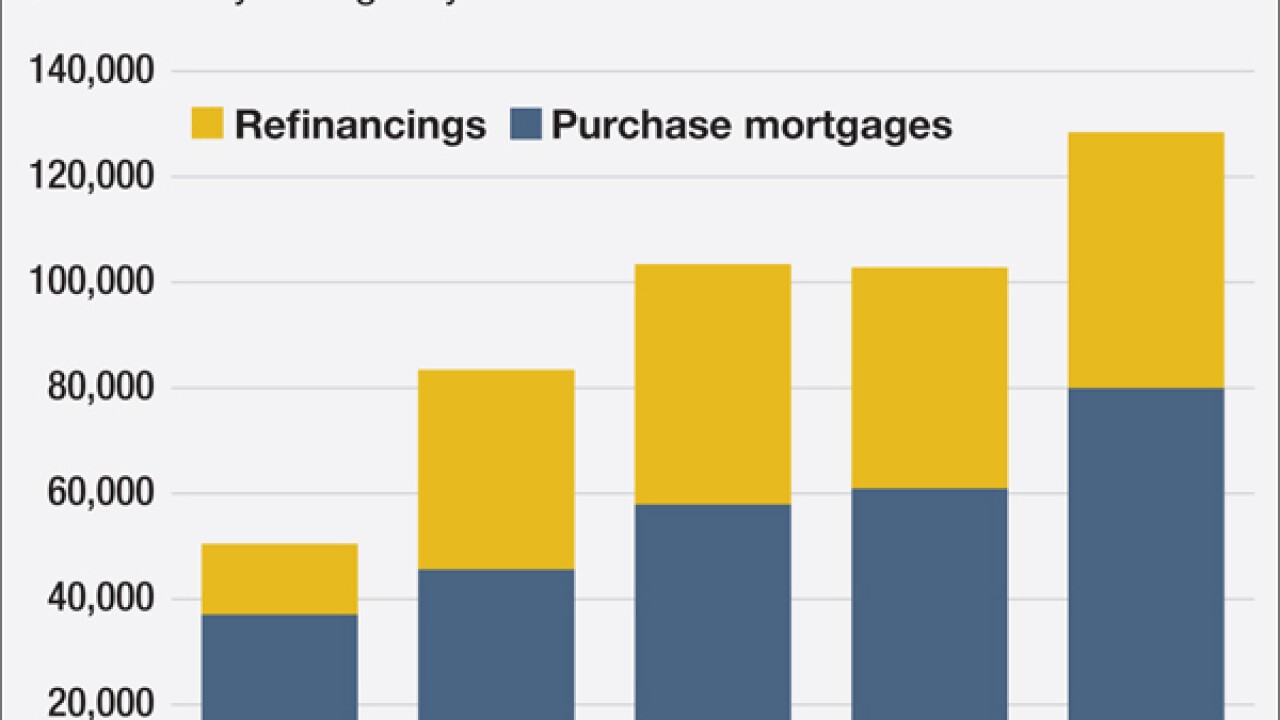

Loans to first-time homeowners and others with low credit scores are a big part of the Federal Housing Administration's growth in purchase mortgages since the agency cut premiums.

August 25 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 21 -

WASHINGTON The Federal Housing Finance Agency on Wednesday officially increased the target for loans purchased by Fannie Mae and Freddie Mac that benefit affordable housing, but the uptick is not satisfying housing advocates.

August 19 -

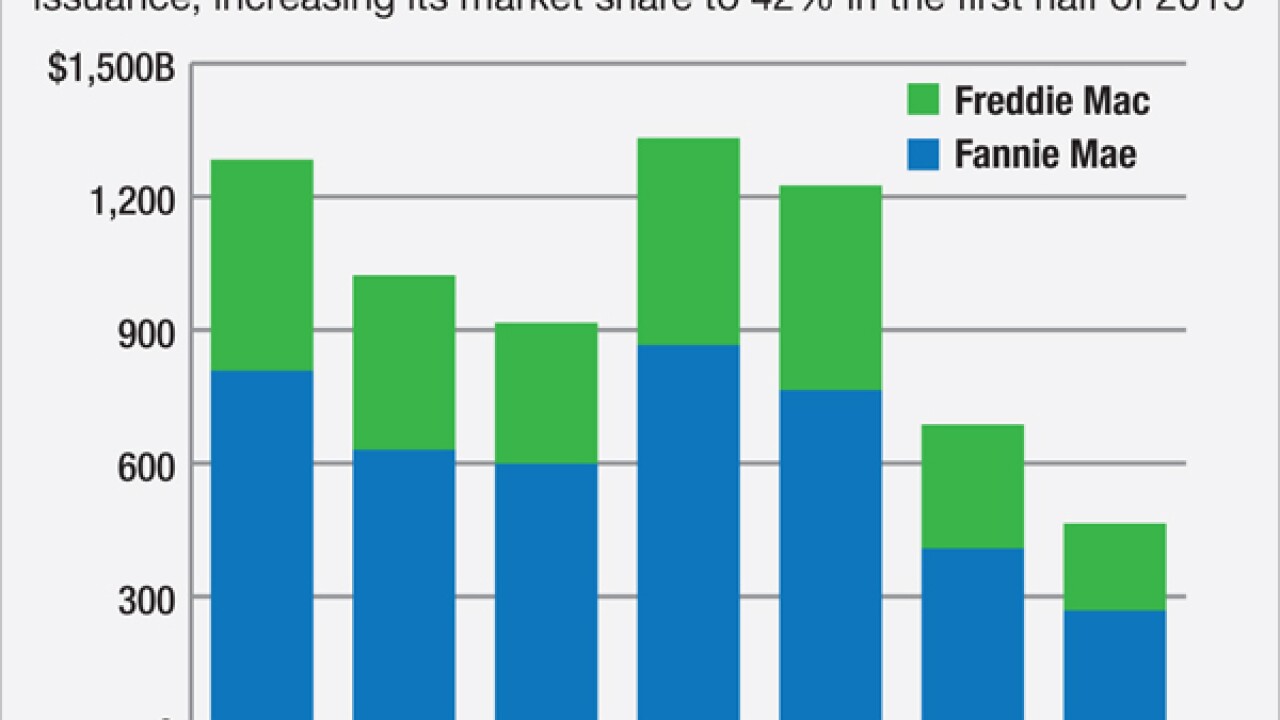

Fannie Mae and Freddie Mac have a regulatory mandate to shrink. But that's easier said than done, given the GSEs' outsized presence in the mortgage industry, as their latest quarterly results show.

August 17 -

WASHINGTON Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

Banks that sold faulty mortgage-backed securities right before the crisis have suffered a string of legal defeats over the timing of government lawsuits, but some experts believe the industry may still have a shot in the Supreme Court.

August 14 -

The Federal Housing Finance Agency is expected to issue a proposal soon that would require Fannie Mae and Freddie Mac to purchase manufactured housing loans from lenders.

August 13 -

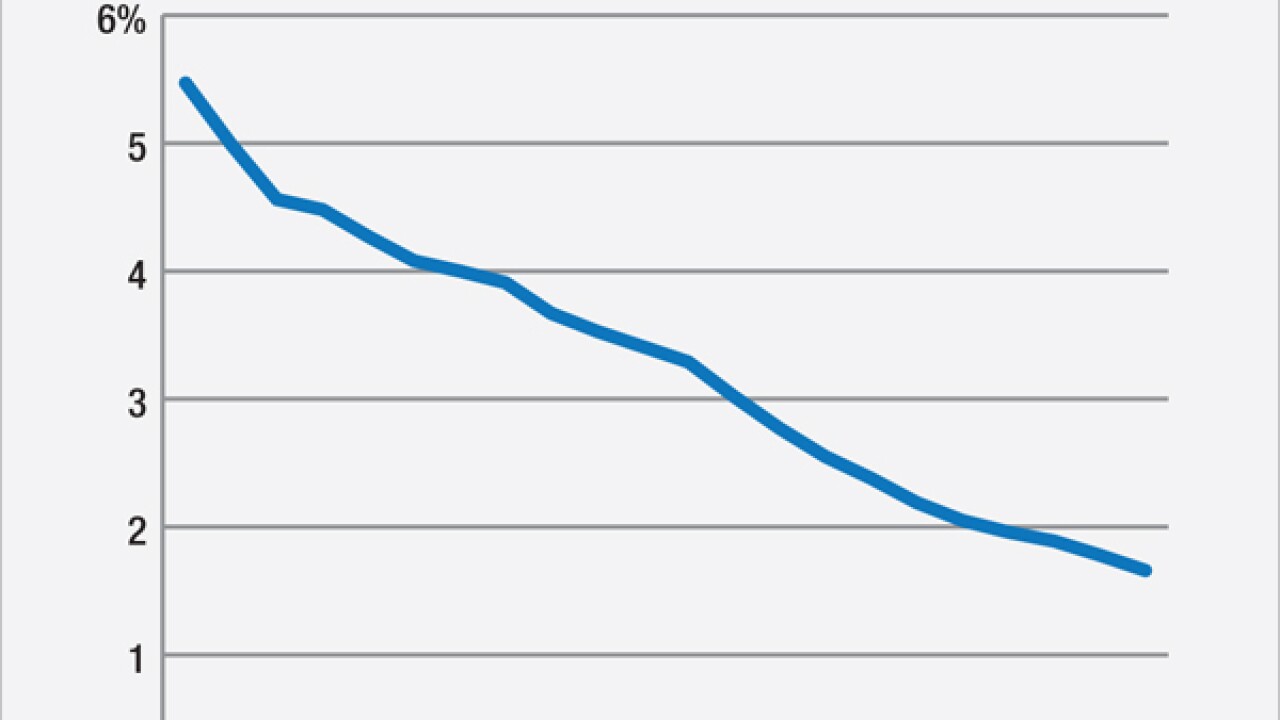

Homeownership is out of reach for too many Americans. The next president could change that with a few simple policies aimed at encouraging private capital to invest in residential mortgages.

August 13

-

Despite being introduced to the market with great fanfare, Fannie Mae's 3% down payment mortgage offering has yet to gain much traction with lenders and consumers.

August 6