-

Germany has emerged as the main roadblock to broaden European Union sanctions against Russia by targeting the country’s biggest bank and its energy sector.

March 9 -

Sberbank said it’s looking at the possibility of issuing cards using the Russian payments system Mir and China’s UnionPay after Visa and Mastercard suspended operations following the invasion of Ukraine.

March 7 -

A portion of Goldman Sachs Group’s Russia staff is relocating out of the country as firms react to a global effort to shut off the Russian economy after the invasion of Ukraine.

March 7 -

Citigroup said it’s helping some of its workers in Ukraine seek refuge in Poland and sending advances on pay to help them contend with the Russian invasion.

March 3 -

Mastercard said it got about 4% of its net revenues last year from business linked to Russia, as Western nations level sanctions against the country for its invasion of Ukraine.

March 2 -

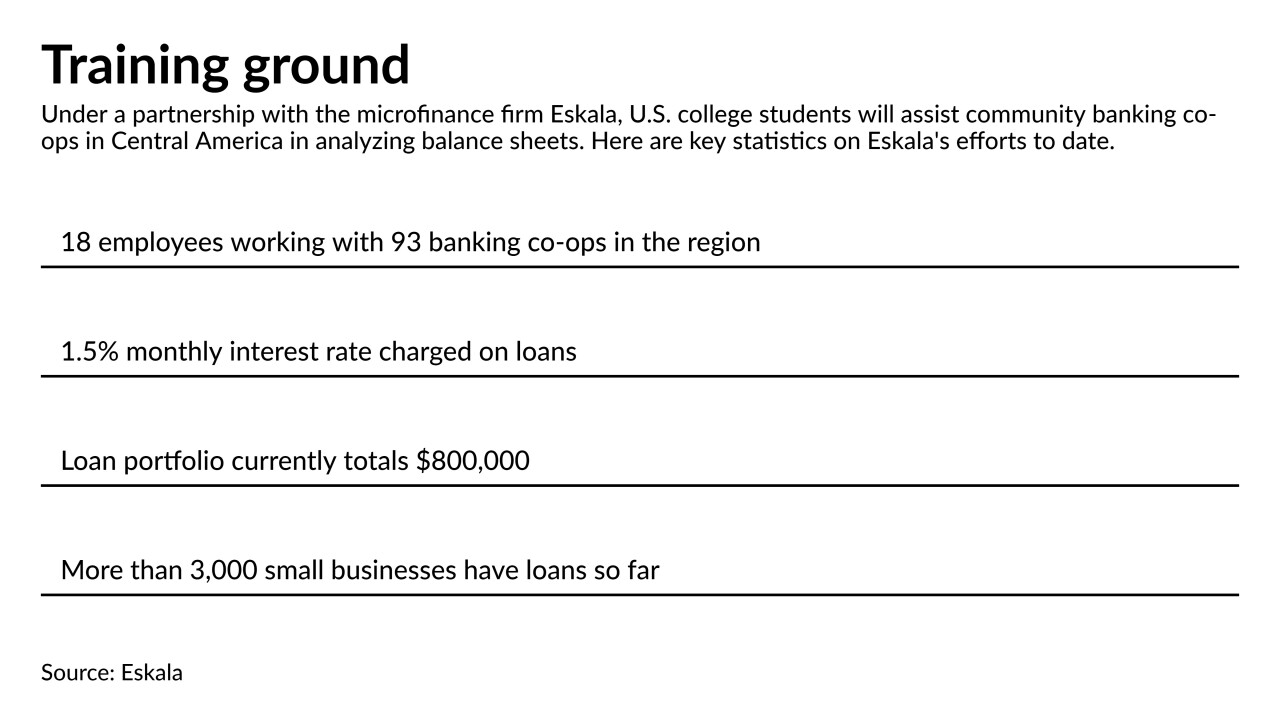

Marquette University has formed a partnership that will give undergraduate business students experience working with grassroots lenders in Panama, Honduras and Nicaragua. The goal is not only to teach the basics of commercial lending, but also to instill some idealism in the next generation of bankers.

September 8 -

JPMorgan Chase settled a longstanding French criminal investigation over allegations it helped clients commit tax fraud for 25 million euros ($29.6 million).

September 2 -

Citigroup’s chief financial officer said China’s recent moves to crack down on companies isn’t likely to harm the bank’s business across the Asia-Pacific region.

July 30 -

President Biden nominated Judith D. Pryor as first vice president of the Export-Import Bank of the U.S., the nation’s official export-credit agency.

July 19 -

Citigroup plans to exit Venezuela by selling its remaining business there, ending more than a century of operating in the South American country.

July 12 -

U.S. Treasury Secretary Janet Yellen signaled she’ll prod multilateral development banks to rein in their lending for fossil fuels, part of a global effort to make the financial system greener.

July 12 -

Financial services companies are set to be exempt from a global plan to make multinational firms pay more tax to the countries where they operate, in a win for U.K. Chancellor of the Exchequer Rishi Sunak.

June 30 -

JPMorgan Chase is shutting its private banking business in Mexico, according to people with knowledge of the matter, as wealthy clients in some of Latin America’s largest economies move their money to international financial capitals.

February 25 -

The company is mulling the sale of certain retail operations the Asia-Pacific region as part of incoming CEO Jane Fraser's plan to streamline operations, according to people familiar with the matter.

February 19 -

His family got its start in banking by financing camel-caravan traders in the Ottoman Empire and eventually expanded its reach into the U.S., Europe and Latin America.

December 11 -

Better dialogue between banks and authorities coupled with stronger anti-money-laundering measures could help address the suspicious activity report flaws revealed by investigative journalists.

October 14 Institute of International Finance

Institute of International Finance -

Better dialogue between banks and authorities coupled with stronger anti-money-laundering measures could help address the suspicious activity report flaws revealed by investigative journalists.

September 28 Institute of International Finance

Institute of International Finance -

Randal Quarles, who is also chairman of the Financial Stability Board, said FSB members must do more to prepare for bank failures.

July 7 -

The Financial Stability Board said it stood ready to coordinate additional help on capital requirements, upcoming regulatory deadlines and other standards.

April 15 -

Bank for International Settlements report says central banks don't have tools to handle climate change; banks could face different CRA rules.

January 23