-

Two New England thrifts have beefed up their commercial-lending operations by hiring teams of bankers from recently acquired banks.

July 14

If you can't beat them, maybe some of them will join you.

In this adage, "them" represents commercial lenders. Faced with anemic demand for construction and real estate loans, smaller banks are discovering that the best way to grow in commercial lending involves pinching talent from bigger rivals.

Berkshire Hills Bancorp (BHLB), Rockville Financial (RCKB) and SP Bancorp (SPBC) are among the community banks actively hiring commercial lenders.

"Community banks need someone from a big bank training program" to grow their commercial book because, for the most part, smaller institutions lack the in-house know how, Tom Watkins, a co-founder of executive search firm Chartwell Partners.

Earlier this month, Palmetto Bancshares (PLMT) in Greenville, S.C., lures commercial lenders from Fifth Third Bancorp (FITB) and SunTrust Banks (STI). Palmetto wants to reduce its reliance on commercial real estate, says Sam Erwin, the $1.2 billion-asset company's president and chief executive.

Among banks based in South Carolina, Palmetto has the largest loan book around Greenville, according to BankDataworks.com. Almost half of the $742 million portfolio consists of commercial real estate. Erwin would not discuss targeted growth rates for commercial lending, but he says the new lenders will take advantage of the large number of automobile suppliers in the area.

"Greenville is a large C&I market," Erwin says. "Given its manufacturing economy, we think there is enough business there that it would be meaningful to us, even if we can take a small park of big banks' business."

Palmetto will focus on asset-based lending, equipment financing and cash management services, Erwin says.

Lenders are bolting large banks in other parts of the country to join smaller institutions.

Provident New York Bancorp (PBNY) on Tuesday hired a banker from Bank of America (BAC) for middle-market commercial lending in its Paramus, N.J., office. The $3.2 billion-asset Provident last year snagged a lender from M&T Bank (MTB) to oversee an expansion into New York with a focus on commercial lending.

The $4.3 billion-asset Berkshire Hills plucked a commercial lending team away from the $80 billion-asset Sovereign Bancorp last year. Berkshire has also recruited commercial lenders from Toronto-Dominion's TD Bank.

A pair of New England thrifts — Rockville Financial and Meridian Interstate Bancorp (EBSB) — last year

Even larger community banks can be sources of talent for smaller institutions. Earlier this week a commercial lender in Plano, Texas, left the $3.7 billion-asset ViewPoint Financial Group to join the $271 million-asset SP Bancorp.

Reassigning current staff might be a cheaper solution, but many bankers have expressed concerns about trying to convert someone trained in real estate into a commercial lender.

"We've seen some banks take CRE lenders and have them originate C&I loans," Ray Davis, the president and chief executive of Umpqua Holdings, said during a Monday panel discussion at the American Bankers Associations annual conference. That practice "is, at best, troubling."

"Community banks don't have the expertise to manage those types of loans," says Andy Moser, the president of Salus Capital Partners, an asset-based lender that partners with community banks. "They certainly don't have expertise to manage [the loans] if they become a troubled situation."

Palmetto was keen to that argument. "We were trying to stay away from taking the real estate lenders we already had and trying to turn them into C&I experts overnight," Erwin says.

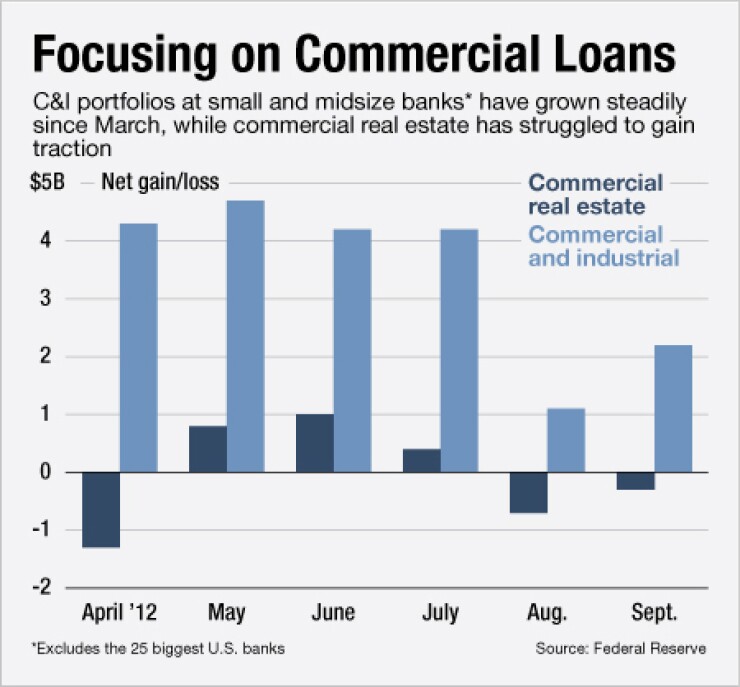

It is possible that small banks that are raiding big-bank talent are too late to the party, Watkins says. As they waited to see if real estate lending would rebound, commercial lending took off. Now, it appears that commercial lending may be cooling off and real estate lending could bounce back.

Still, it makes some sense for community banks to try to add commercial loans, says Damon DelMonte, an analyst at KBW's Keefe, Bruyette & Woods. Though competition for commercial loans is fierce, those loans could eventually become quite profitable.

"Community banks are desperate to get into C&I lending because when interest rates go up, the variable rates on those loans will go up," DelMonte says. "It's an optimistic bet that you will see an increase in borrowers' utilization rates."