-

More banks are looking to cut costs by selling off branches built during the real estate boom. Thankfully, there are still banks with capital and a desire to pick and choose assets and bargain prices, helping to fuel the market.

April 4 -

The agreements with rivals Community Bank System and Financial Institutions Inc. would complete First Niagara's planned divestitures in connection with its blockbuster deal for much of HSBC Bank's retail franchise.

January 20 -

The bank has little choice but to shrink itself through asset sales and layoffs, but the process is slow, demoralizing and no answer to future growth.

October 18

Bank of America (BAC)'s trash is a community bank's treasure.

As part of a

Of course, the community bankers who are doing the buying don't think the Bank of America locations are garbage. Northwest Financial in Arnolds Park, Iowa, had been lusting after Bank of America's locations in northern Iowa for years, even before B of A began its cost-cutting binge.

Neal Conover, Northwest's chief financial officer, "has been making quarterly calls to Bank of America for seven or eight years" to express an interest in buying some of its branches, according to Greg Post, the president and chief executive of Northwest Bank, one of three banks owned by the $1.5 billion-asset Northwest Financial.

"We always felt the big banks would want to exit these smaller communities," Post says. "As we made these phone calls, the tone of the conversation began to change recently."

Post declined to discuss how much Northwest Financial paid for the five Bank of America branches that it bought this fall.

"It met their expectations, and it met our expectations at the end of the day, as far as the financial aspects of it," Post says.

One would think branch buyers are getting bargains, given the economic pressures on bigger banks. After all, everyone knows Bank of America is trying to get smaller; plus,

However, prices vary widely, says Michael Bull, president of Atlanta-based commercial real estate brokerage Bull Realty.

"There is no trend suggesting that banks are getting these branches on the cheap," Bull says. "It's all dependent on the branch site itself, where it's located, what the local market is doing, traffic counts and visibility — all the typical valuations a buyer will look at."

Sale prices for branches of identical sizes can vary widely, Bull says. A branch that sells for $2.5 million in one market can sell for $250,000 in another market, even if the buildings themselves are nearly identical.

"That can happen if the market is dead and no one has an immediate need for" the branch, Bull says.

Northwest Bank wanted Bank of America's branches for three reasons — the customer relationships, the bank's employees and the real estate itself, Post says.

"The draw was a little bit of it all," he says.

The deals have fulfilled predictions that Bank of America would start unloading branches this year because many of them are located in markets too tiny to be worth its attention. As of Jan. 9, Bank of America branches located in metropolitan areas with populations of 300,000 or less, including Charlottesville, Va., and Santa Cruz, Calif., held deposits of about $36 billion.

"These small, seemingly irrelevant cities for [Bank of America] could be quite meaningful for another smaller bank," FIG Partners analyst Chris Marinac wrote nearly a year ago.

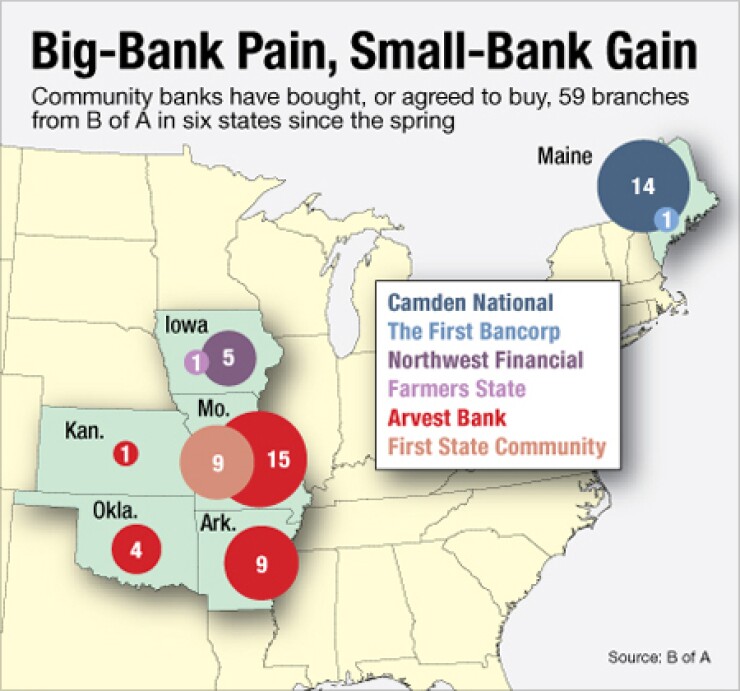

Indeed, for each of the markets in which Bank of America has sold branches this year, none has a population of more than 200,000 people. Most are located in small cities, like Bangor, Maine, Joplin, Mo., Muskogee, Okla., and Fort Dodge, Iowa.

In addition to Northwest Financial, the other companies buying Bank of America branches are the $13.8 billion-asset Arvest Bank of Fayetteville, Ark.; the $2.4 billion-asset Camden National (CAC) of Camden, Maine; Farmers State Bancshares, a $166 million-asset company in Mason City, Iowa; and the $1.3 billion-asset First State Community Bank in Farmington, Mo.

A Bank of America spokeswoman declined to elaborate on the branch sales.

Community banks should be careful to temper their enthusiasm for acquiring locations from Bank of America, says Frank Schiraldi, an analyst at Sandler O'Neill & Partners. If anything, many community banks need to be slimming down themselves, not bulking up on additional retail locations. Some smaller banks have cut costs in as many other areas as possible, and later shifted, somewhat unwillingly, to selling branches

"The low-hanging fruit in terms of cost saves has already largely been extracted," Schiraldi says. "Unless the revenue picture changes I think community banks are going to have to take a hard look at underperforming branches … to push earnings growth."