-

Wells Fargo and JPMorgan Chase reclassified many second mortgages as delinquent, even though they are current, because the first mortgages to which they are subordinate have already gone delinquent.

April 13 -

Wells Fargo on Friday reiterated its plans to slash costs over the next year, but executives gave themselves flexibility to rethink those cuts later.

April 13 -

Click on individual bank names in the table below to access American Banker's coverage of each company's earnings report. Links to relevant coverage, filings, releases, and bank benchmark profile data can be found in the Related Links area of each article.

April 24

The bank earnings tea leaves are suddenly looking a little bit brighter.

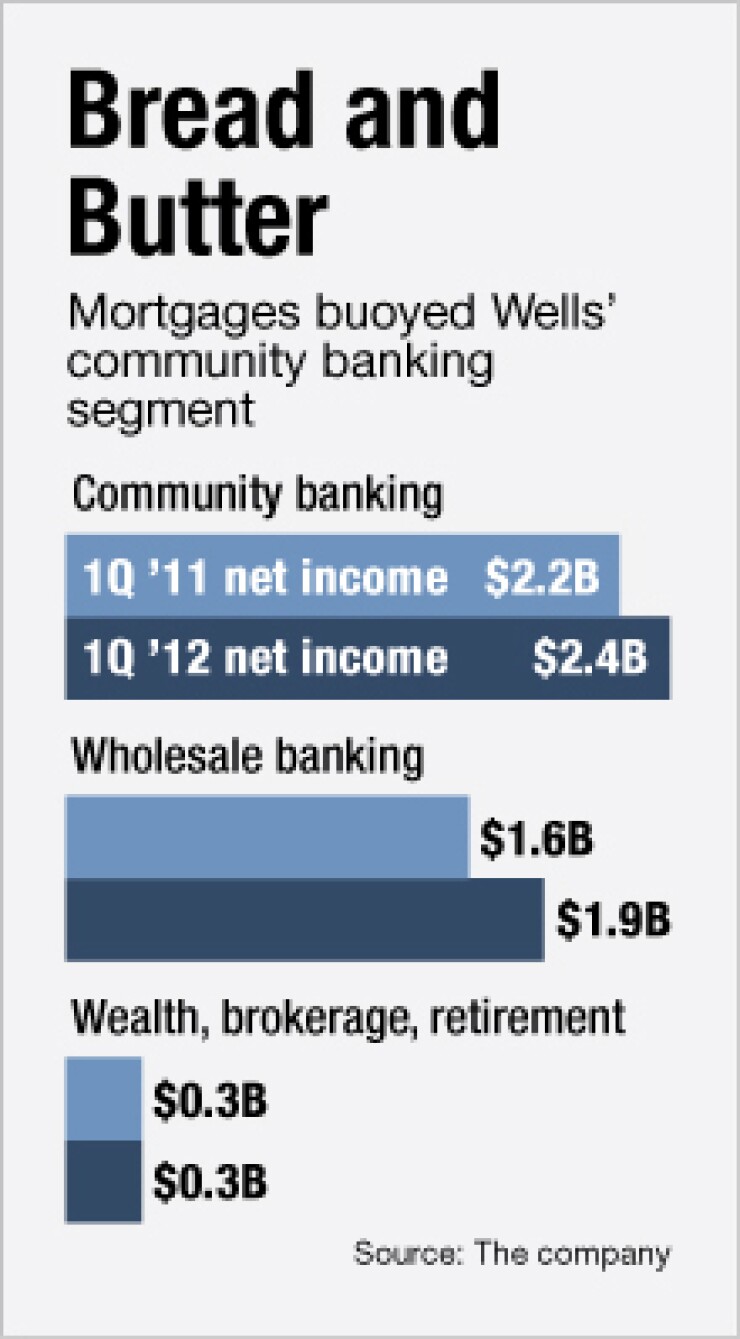

JPMorgan Chase (JPM) and Wells Fargo (WFC) reported surprisingly strong revenue growth on Friday, reversing the slumps of recent quarters, as the two banks kicked off the first-quarter earnings season A pickup in their mortgage banking returns helped both companies, which also saw their struggling investment banking businesses regain some ground.

"There are a lot of things to be optimistic about," Wells Fargo Chief Financial Officer Timothy Sloan told American Banker in an interview on Friday.

JPMorgan Chase and Wells Fargo, the largest and fourth-largest U.S. banks respectively, are generally regarded as two of the industry's strongest companies. But analysts said they hope to see similar revenue growth as other banks report results in the next few weeks.

"The thesis that we had coming into the quarter is continuing improvement, and I think we'll continue to roll through the rest of the group with that," says Marty Mosby, an analyst with Guggenheim Partners.

Not everything was rosy. Both JPMorgan Chase and Wells recorded higher costs, reflecting the ongoing pressures facing the industry from litigation, new regulations, lingering mortgage problems, and the increased competition banks face for customers during a still-sluggish economy.

"They're still in a situation where not everything is looking favorable for them. They're still fighting a lot of headwinds," says Jason L. Ware, an analyst with Salt Lake City-based Albion Financial Group.

JPMorgan Chase set aside an additional $2.5 billion for litigation reserves, primarily because of

The ongoing implementation of the Dodd-Frank Act and related regulations means that banks "don't exactly know what expenses are going to be [for the rest of the year], and I don't think the industry likes that," Ware adds.

But some government programs actually boosted first-quarter returns at JPMorgan Chase and Wells. Both banks reported a surge in mortgage fees, as the government's Home Affordable Refinance Program boosted originations and refinancings.

Quarterly revenue at JPMorgan Chase ($27.4 billion) and Wells ($21.6 billion) each rose 6% from a year earlier.

JPMorgan Chase's retail financial services unit saw revenue increase 20% to $7.6 billion from the prior quarter, as mortgage fees went higher. Revenue tied to mortgage production and servicing swung to a profit of $461 million, compared to a $1.1 billion loss a year earlier.

Wells Fargo did not break out revenue for its mortgage business, but noninterest income from the unit grew to $2.87 billion, up from $2 billion a year earlier, thanks to a big uptick in originations.

"The important point is that we go into the second quarter with a strong mortgage pipeline," Sloan told American Banker, adding that the bank also has a "good tailwind" in its loans business. It is in the process of closing its deal for BNP Paribas' North American

Mortgage application volumes were up 20% from the prior quarter and up 84% from the prior year, and Wells said that 15% of those first-quarter originations were associated with Harp.

That program "is an opportunity for very high loan-to-value — or 'underwater' from an equity perspective — current borrowers to refinance, and we are going to see more volume in that," CEO John Stumpf told analysts during a Friday morning conference call.

Executives said that it was too early to speak to gains from the revised

"Most of the volume that we saw from Harp was from Harp 1," Sloan said on the analyst call. "We are just beginning to see the results of Harp 2 start to kick in. How long that continues we don't know, but right now the mortgage business is very good for us."

Other units also helped revenue growth at both banks — as did their relative strength over competitors. Some of JPMorgan Chase's growth in the quarter was a result of taking business from smaller players, according to Morgan Stanley analyst Betsy Graseck.

"You need to be invested with a bank that can take share in a low rate environment," Graseck wrote in a research note on Friday.

In consumer banking, JPMorgan Chase has "had consistent growth in deposits and a [net interest margin] that's going down because of the rate environment," Chief Executive Jamie Dimon said during a Friday conference call with analysts. "But the underlying deposit flows and credit-card spending is good."

JPMorgan Chase saw growth in wholesale loans, small business loans, credit card sales, mortgage applications and deposits, Chief Financial Officer Doug Braunstein said during the conference call.

The bank's revenue from investment banking rose 68% from the prior quarter to $7.3 billion, which was "better than expected," Sandler O'Neill & Partners analyst Jeff Harte wrote in a research note. The improvement was due to strong trading revenue, particularly in core equity trading.

JPMorgan Chase recorded a $1.1 billion benefit in the quarter, as the defunct Washington Mutual