-

Goldman Sachs makes leadership changes across its global credit business; JPMorganChase names Simon Dale global head of the credit portfolio group lending; Citi hires Anand Govind as a managing director on its technology investment banking team; and more in this week's banking news roundup.

January 23 -

The Raleigh, North Carolina-based bank recently made its first payment on a $35 billion note held by the Federal Deposit Insurance Corp. The note was arranged as part of First Citizens' purchase of the failed Silicon Valley Bank.

January 23 -

The House Financial Services Committee passed a community bank tailoring bill 33-21.

January 23 -

The buy now/pay later lender is seeking to create Affirm Bank, a Nevada-chartered industrial loan company.

January 23 -

The Federal Deposit Insurance Corp.'s approval of industrial loan company charter applications for General Motors and Ford Motor Company generated only moderate pushback from banks as crypto, debanking and credit card rate caps dominate the industry's attention.

January 23 -

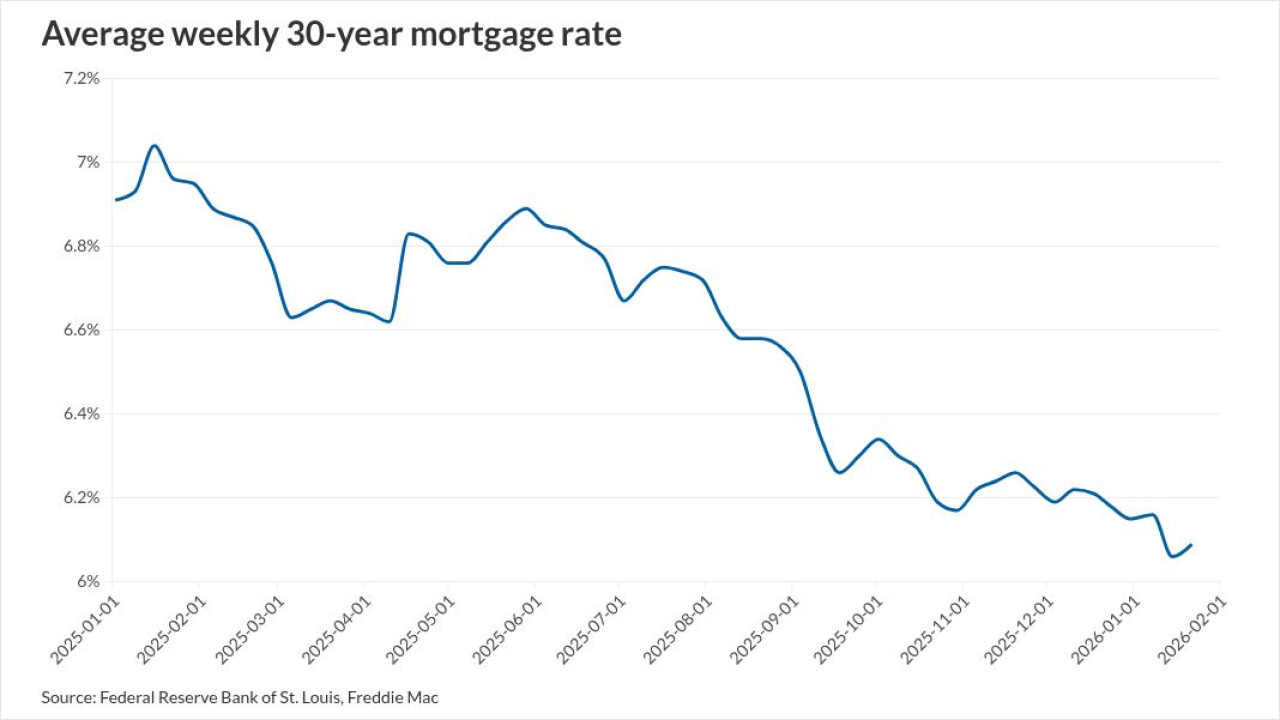

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

Once seen as a sleepy corner of the financial services industry, asset servicing has become increasingly important for banks as artificial intelligence, blockchains and a generational transfer of wealth alter the landscape.

January 23

-

The Brazilian digital bank Banco Inter now has a license from the Federal Reserve Board and the state of Florida to establish a virtual "branch" in Miami.

January 23 -

Shares of the California lender surged 25% on news of the leadership change and preliminary fourth-quarter earnings.

January 22 -

The McLean, Virginia-based bank plans to close the deal in mid-2026, about a year after it sealed its landmark purchase of Discover Financial Services.

January 22