-

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

April 12 -

The maneuver could delay efforts by Senate Majority Leader Mitch McConnell, R-Ky., and Treasury Secretary Steven Mnuchin to add another $250 billion to the Paycheck Protection Program.

April 9 -

The decision sparked outrage from small-business owners who have checking accounts with the bank but not loans or business credit cards. Bank of America started taking applications Friday for a $349 billion program that's intended to offer aid to small businesses suffering from the shocks of the coronavirus pandemic.

April 3 -

Amid the coronavirus emergency, the central bank may have to decide at what point the imperatives of an economic crisis outweigh the requirements of its most severe enforcement action in recent memory.

April 1 -

The regulator formally announced the 60-day delay on Monday after tweeting about it over the weekend.

March 30 -

The credit union regulator will hold off in-person examinations until at least May and has already pushed back at least one comment deadline as the pandemic worsens.

March 30 -

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

March 29 -

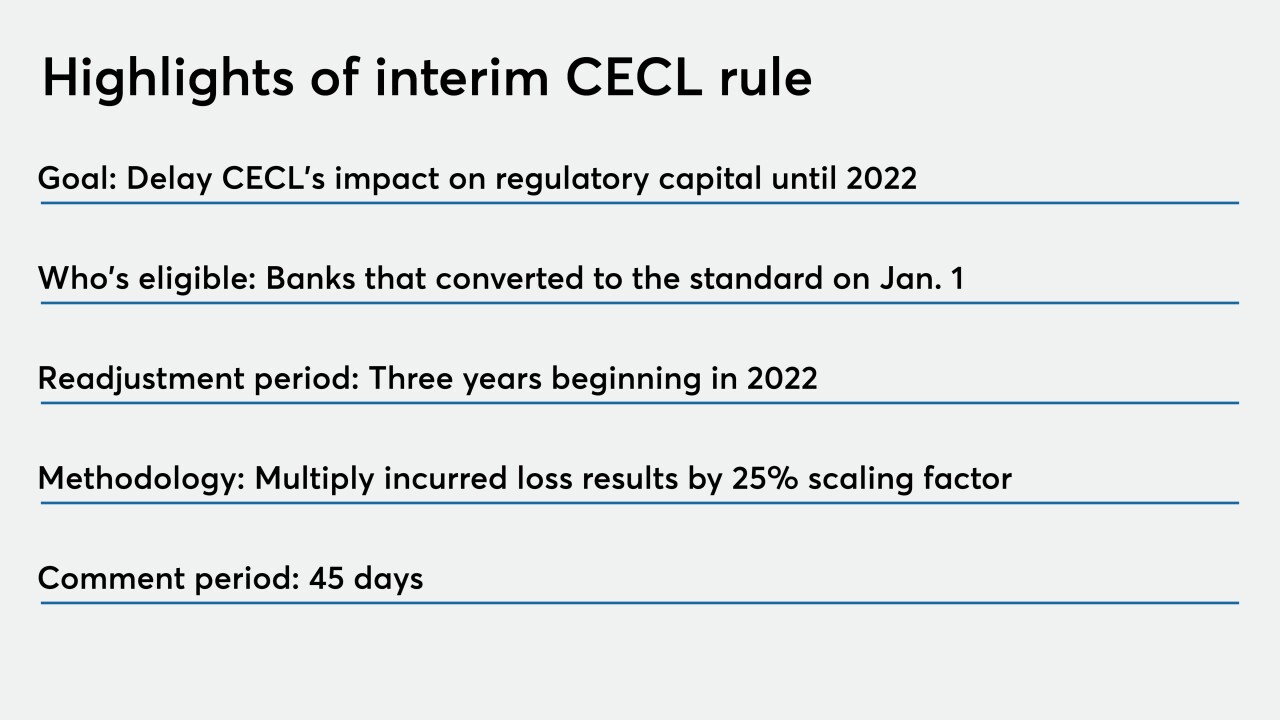

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

Many borrowers will suffer unless the program, the central bank's latest response to the coronavirus pandemic, includes consumer loans issued by fintechs.

March 26

-

Policymakers should abolish the new accounting standard because it could distract banks at exactly the moment they need to be focused on pulling their communities from the brink of recession.

March 25 Signature Bank of New York

Signature Bank of New York

!["Let’s take the opportunity to make some bipartisan fixes to allow [the Paycheck Protection Program] to work better for the very people it’s designed to help," said Sen. Chris Van Hollen, a Maryland Democrat.](https://arizent.brightspotcdn.com/dims4/default/473f544/2147483647/strip/true/crop/4777x2687+0+248/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F21%2Ffd%2F4cc30d254e5c8f8b2cf92eabb0d2%2Fvan-hollen.jpg)