-

A sharp disagreement between foreign and U.S. regulators is emerging on how far banking supervisors should go in asking financial institutions to stress test their loan and investment portfolios for any risks associated with climate change.

May 8 -

Lawmakers from both parties oppose a Small Business Administration proposal to raise guarantee fees. The clash could lead to a halt in operations this fall.

May 7 -

A proposal to give the Consumer Financial Protection Bureau jurisdiction over credit unions with $10 billion or more of assets has sparked a war of words between the longtime foes.

May 7 -

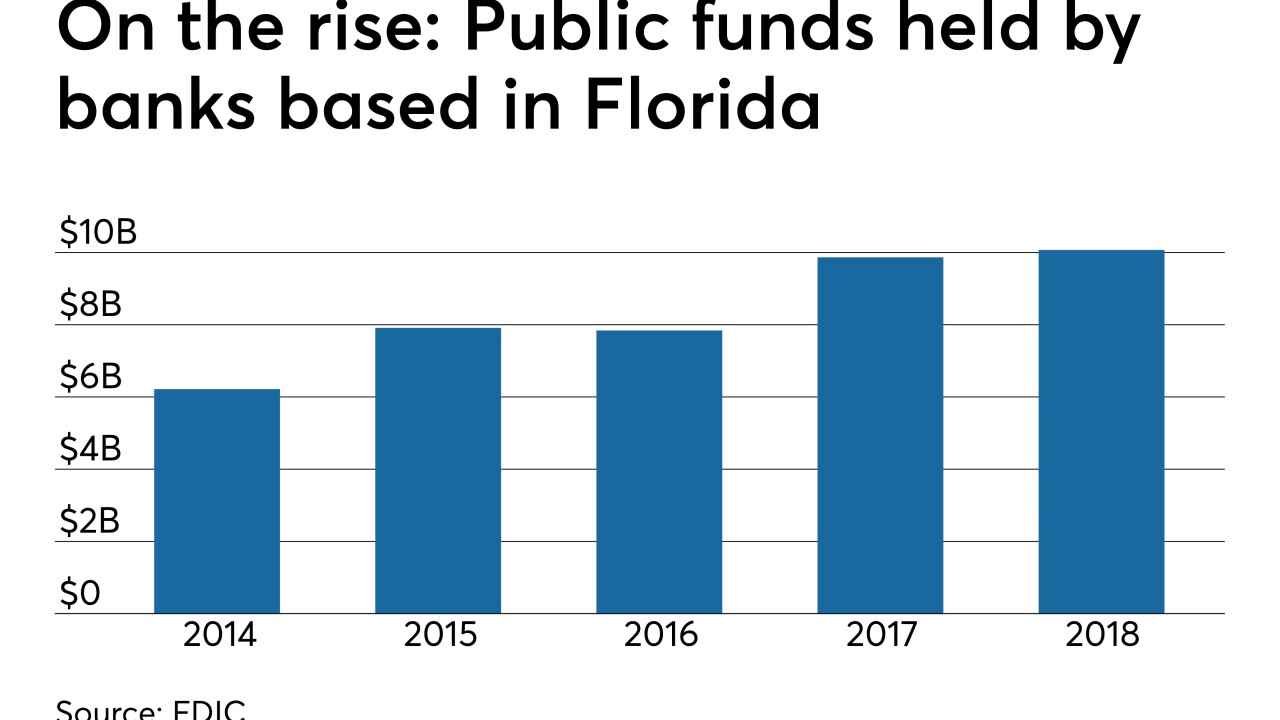

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

Sen. Sherrod Brown questioned Stephen Moore's ability to make decisions at the Fed to benefit all Americans after calling two Ohio cities the "armpit of America."

April 24 -

Sen. Sherrod Brown questioned Stephen Moore's ability to make decisions at the Fed to benefit all Americans after calling two Ohio cities the "armpit of America."

April 24 -

While NCUA lawyers fielded questions about the possibility of redlining, a three-judge appeals panel showed skepticism about other elements of the ABA's arguments against changes to credit union membership rules.

April 16 -

Credit unions in the Lone Star State have been working with lawmakers on a series of bills but the clock is ticking since the legislative session ends in May and won't restart until 2021.

April 16 -

A federal court this week will hear arguments in NCUA's appeal of a a judge's split decision on its 2016 field of membership rule while the new NCUA board meets later in the week.

April 15 -

From new legislation to mergers and more, here's a look at measures from across the country that could change how credit unions do business.

April 12 -

In a twist, bank lobbyists in the Sunflower State did not push back against nearly 70 proposed changes.

April 12 -

The former lawmaker joins the Swiss bank after years of pushing for bank deregulation as chairman of the House Financial Services Committee.

April 11 -

The Evergreen State is the latest to make a push to modernize the rules governing state-chartered credit unions.

April 10 -

The combined organization, representing nearly 500 member credit unions, is expected to launch early next year.

April 8 -

Hood was recently confirmed to the board after having previously served with the regulator from 2005 to 2010. He takes over for Mark McWatters, who often generated controversy.

April 8 -

A bill recently introduced in the California state assembly would create a framework for local governments to set up their own taxpayer-owned banks. It’s more specific than other public-bank proposals, which raised more questions than they answered, but still faces long odds.

April 3 -

In the second lawsuit of its kind, more than a dozen of the world's largest banks are accused of price fixing on roughly $486 billion of bonds issued by Fannie Mae and Freddie Mac.

March 22 -

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

A report from the Government Accountability Office found that while the Federal Home Loan banks have taken steps to improve diversity among boards of directors, members are still largely male and nonminorities.

March 20 -

With the National Credit Union Administration board at full strength for the first time in years, here are three areas where the panel can make a big difference for CUs early on.

March 20 NAFCU

NAFCU