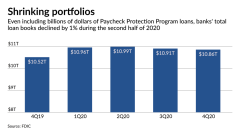

Will PPP runoff expose revenue weakness at banks?

(Full story

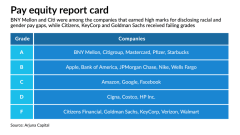

Citi, BNY Mellon earn top grades for pay gap disclosures

(Full story

Three new candidates emerge to head OCC

(Full story

CFPB complaints skyrocket as credit reporting issues again top the list

(Full story

U.S. Bancorp tool helps protect overambitious savers

(Full story

Banc of California will buy Pacific Mercantile, ending M&A drought

Banc of California, which last bought a bank in 2013, has agreed to pay $235 million in stock for Pacific Mercantile, which is based in Costa Mesa, Calif.

(Full story

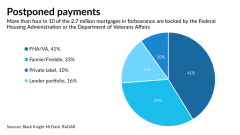

The mounting costs of protracted mortgage forbearance

(Full story

The fintech partnership helping Sterling Bancorp reach kids

(Full story

Illinois caps consumer rates at 36%, adopts state-level CRA

(Full story

Here's the pep talk branch workers need

(Full story