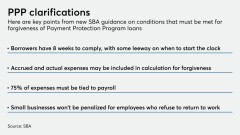

SBA, Treasury release more guidance on PPP loan forgiveness

(Full story

Santander Consumer reaches $550M settlement with state AGs

(Full story

How Wells Fargo's tech chief is managing coronavirus response

(Full story

OCC to overhaul CRA rule as Otting plans to leave agency

(Full story

FHFA plan would make GSEs hold banklike capital amounts

(Full story

An insider account of JPMorgan's PPP approach

(Full story

Pad reserves or buy out a rival? BlackRock haul gives PNC options

(Full story

Otting's legacy at OCC? It's complicated

(Full story

Bankers seek clearer guidance on forgiving PPP loans

(Full story

PPP lending helps brand-new bank get off to promising start

(Full story