Why Scotiabank is building 'digital factories'

(Full story

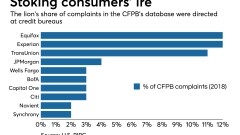

'Absolute scam': Complaints about credit monitoring plans flood CFPB

(Full story

Bank of America's Merrill Edge goes to zero-dollar trades amid price war

(Full story

A survival guide for small regionals

(Full story

OCC lacks legal power to create fintech charter, court rules

(Full story

Banking charter remains a long way off for fintechs after court ruling

(Full story

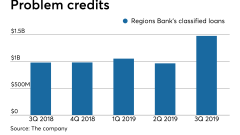

Regions set to replace core deposit system

(Full story

14 years after Walmart, banks face a new ILC bogeyman

(Full story

What Supreme Court case means for CFPB's future

(Full story

Don't mess with rules curbing derivatives risk

(Full story