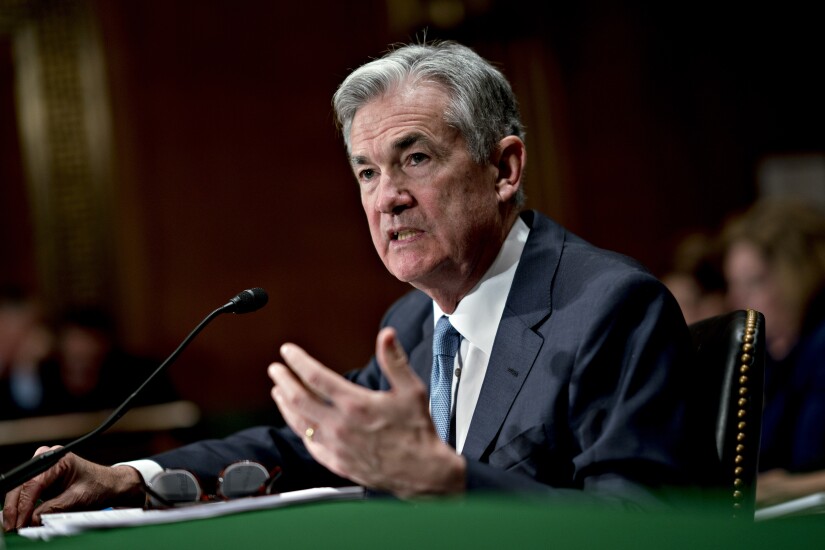

WASHINGTON — Federal Reserve Chair Jerome Powell told Congress the central bank remains firmly in wait-and-see mode for adjusting monetary policy.

In prepared testimony in front of the House Financial Services Committee on Tuesday, Powell said lingering uncertainty about the impacts of higher tariffs is keeping the Fed's monetary policy in a holding pattern, even as inflation readings continue to move toward 2%.

"The effects on inflation could be short lived — reflecting a one-time shift in the price level. It is also possible that the inflationary effects could instead be more persistent," Powell said. "Avoiding that outcome will depend on the size of the tariff effects, on how long it takes for them to pass through fully into prices, and, ultimately, on keeping longer-term inflation expectations well anchored."

Powell's comments come on the first of two days of Capitol Hill testimony this week, part of the Fed chair's biannual monetary policy report to Congress.

The full report,

Powell's appearance also comes as President Donald Trump and others in his political orbit have continued to criticize the Fed for keeping interest rates unchanged even as inflation continues to trend down. Advocates for easier policy say higher rates are depressing economic activity and increasing the government's debt financing costs unnecessarily.

In a 1:32 am

"What a difference this would make. If things later change to the negative, increase the Rate [sic]," Trump wrote. "I hope Congress really works this very dumb, hardheaded person, [sic] over. We will be paying for his incompetence for many years to come."

But, in his remarks, Powell said restrictive trade policies will, eventually, lead to higher prices and it is the Fed's duty to ensure that a jump in prices does not lead to persistent inflation.

"The FOMC's obligation is to keep longer-term inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem," Powell said. "As we act to meet that obligation, we will balance our maximum-employment and price-stability mandates, keeping in mind that, without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans."