-

Six financial institutions may be placed on West Virginia's restricted list if they are found "boycott" the fossil fuel industry, Riley Moore said.

February 29 -

MVB Financial plans to use Paladin Group to advise its bank and a number of its fintech clients.

April 20 -

First State Bank, which the FDIC sold to MVB Financial, had struggled with profitability and capital levels for several years.

April 3 -

MVB in West Virginia will gain a 47% stake in the partnership in exchange for contributing its mortgage unit's assets to the new company.

March 3 -

The move will allow MVB to devote more resources to Northern Virginia and its fintech business.

November 22 -

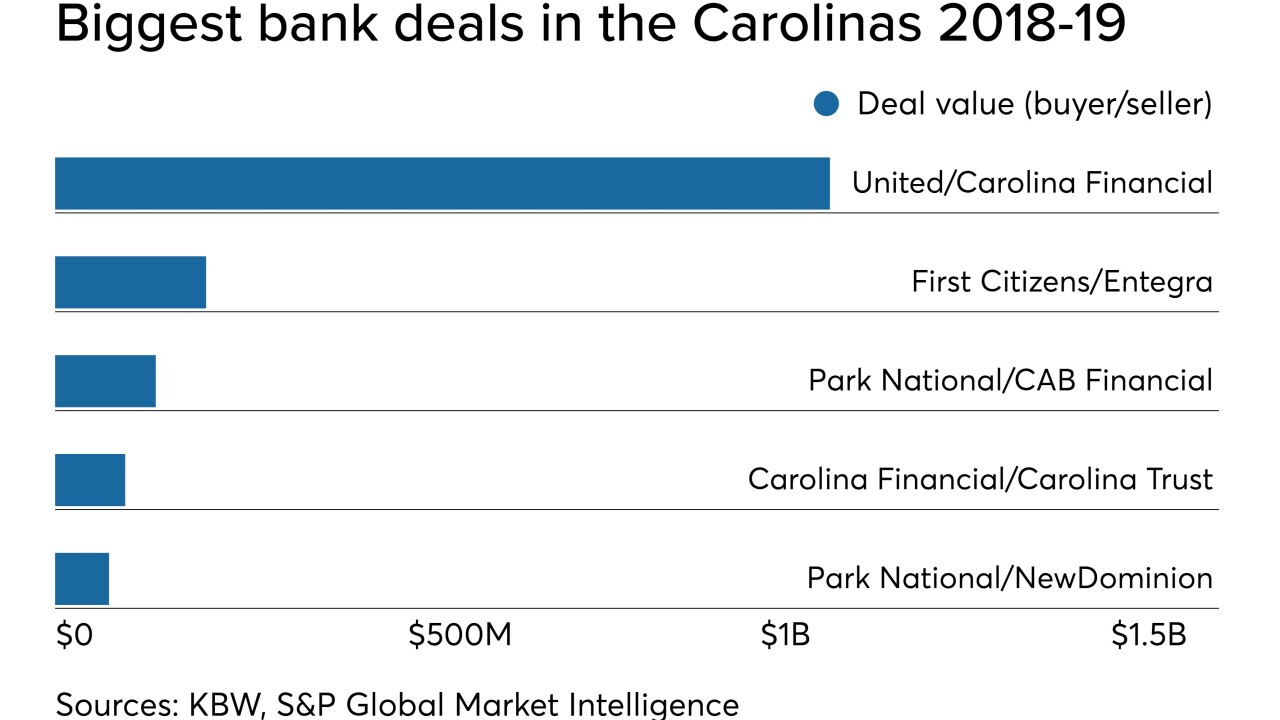

United Bankshares in West Virginia was willing to pay a healthy premium for Carolina Financial, one of a dwindling number of available banks with more than $4 billion in assets.

November 18 -

The company will pay $1.1 billion for Carolina Financial in Charleston, S.C., in a deal that will add nearly $5 billion in assets.

November 18 -

The company will pay $29 million for Cornerstone Financial Services.

September 18 -

The West Virginia company, which invests heavily in fintech firms, bought Chartwell Compliance in Maryland.

September 16 -

The $35 million-asset credit union was one of just five entities bidding to serve the Mountain State’s medical cannabis program.

August 29 -

A company that operates mostly in rural markets is finally making a push into the thriving mid-Atlantic markets of Washington and Baltimore with its deal for Old Line Bancshares.

July 24 -

WesBanco, which is based in West Virginia, will have more than $15 billion in assets when it completes the acquisition.

July 23 -

Only one CU in West Virginia wants to enter the pot banking space, but they're going against the grain not just of the state's credit union league but an industry where fewer than 1% of institutions are serving that market.

July 3 -

The company will record a $2.1 million pretax gain in the second quarter after selling Summit Insurance Services to the Hilb Group.

May 6 -

The company, which has invested $3 million in fintech in recent years, said the value of the portfolio is nearing $14 million.

April 30 -

New legislation in the Mountain State could clear the way for credit unions to accept funds legal pot shops' license fees.

March 20 -

Cindy Dickey has taken over as CEO at the West Virginia-based institution while several other changes were made to the management team.

March 11 -

Even as the movement grows through charter changes and field of membership expansions, some observers say many boards don’t yet reflect this dynamic.

February 19 -

Many credit unions already know they need to diversity their slate of directors. Here's how a handful of CUs have already started that process.

January 30 -

A meticulous approach to expansion, along with an ability to produce solid results while based in a slow-growth state, explains why Hageboeck is a Best in Banking honoree.

November 28