-

Freshly minted Capify combines subsidiaries in the U.S., U.K., Canada and Australia, aiming to strike multinational partnerships.

August 24 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 21 -

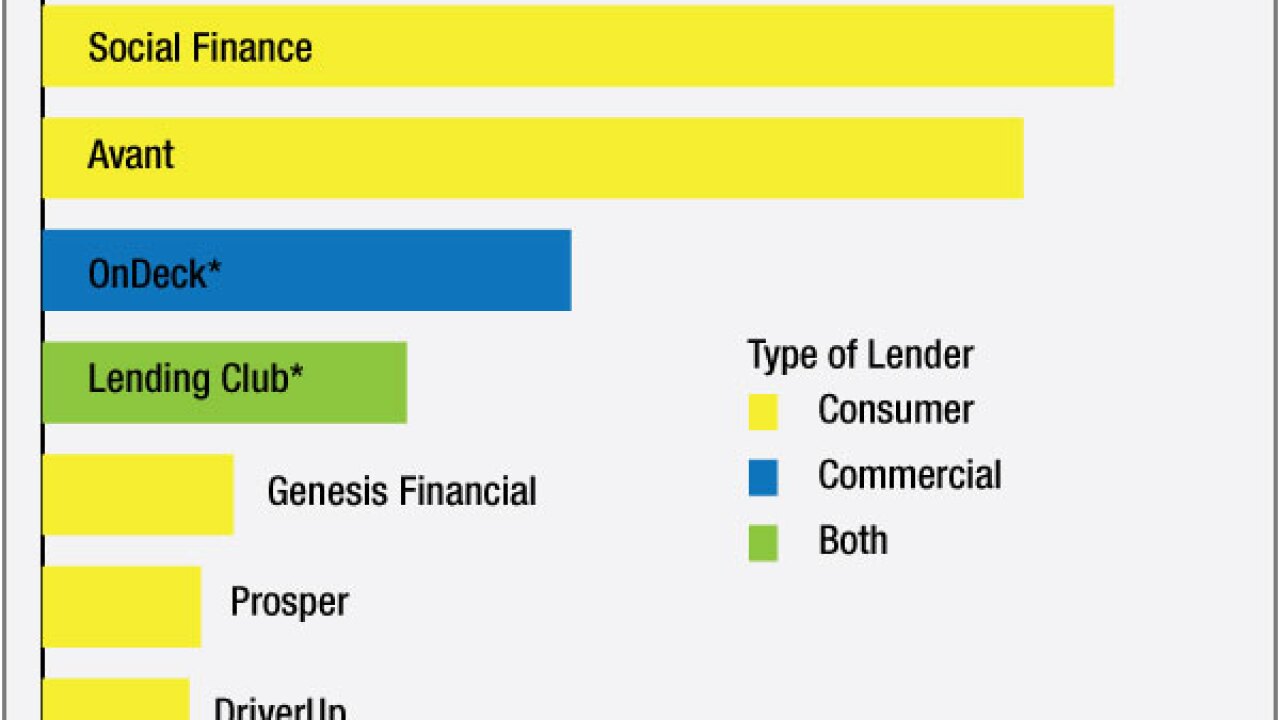

Tech investors love fast-growing marketplace lenders like Social Finance, but Wall Street has taken a dimmer view of them. A huge equity fundraising round should allow SoFi to keep fueling rapid growth while remaining privately owned.

August 20 -

The Chicago-based online consumer lender, which focuses on borrowers with less than pristine credit histories, is getting a boost from JPMorgan Chase, Credit Suisse and Jefferies.

August 20 -

Regulated by multiple agencies, marketplace lenders reduce the financial system's leverage, provide greater financial transparency and ultimately deliver a better product to consumers and investors.

August 19

-

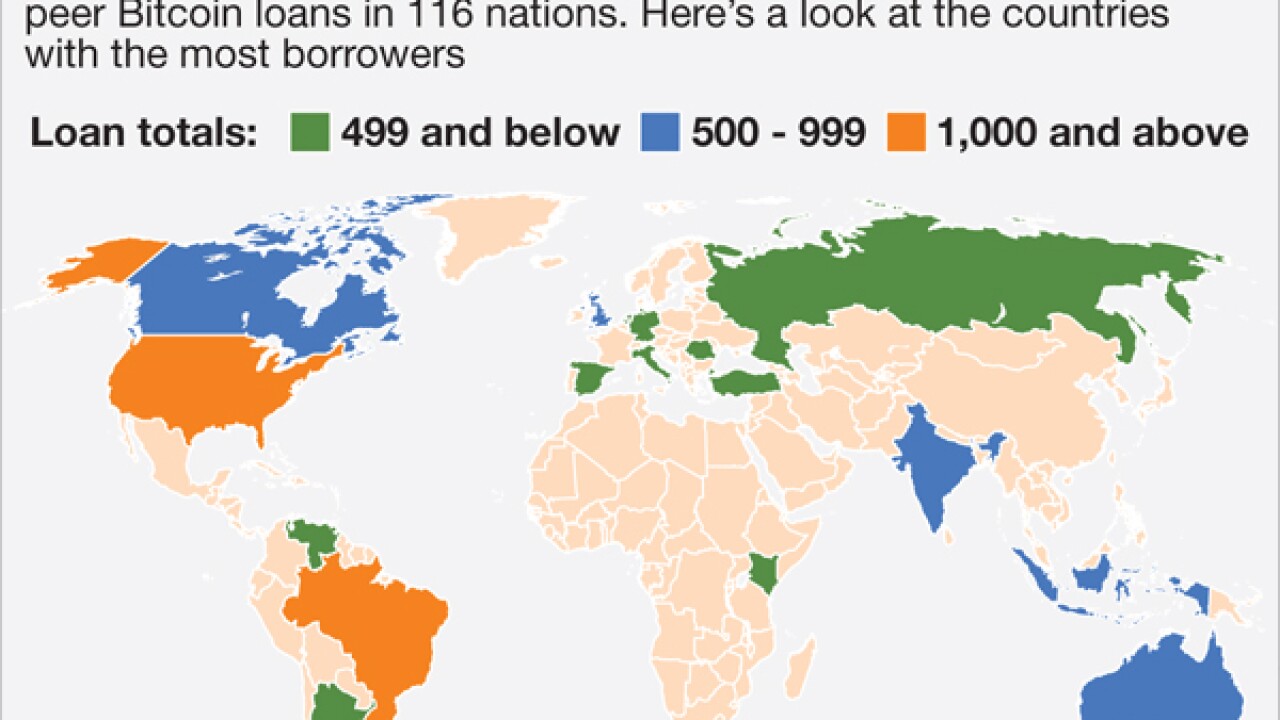

The global loan platforms present an extreme example of the ongoing clash between the fast-moving financial technology sphere and the staid world of financial regulation.

August 19 -

The Consumer Financial Protection Bureau said Springstone Financial, acquired last year by Lending Club, misled borrowers into thinking loans carried zero interest.

August 19 -

The Treasury Department announced Tuesday that members of the public will have an additional month to submit comments about the online marketplace lending industry.

August 18 -

Social Finance Inc. has hired Joanne Bradford, a veteran of the technology and media industries, as chief operating officer.

August 17 -

While marketplace lenders have introduced valuable innovation into financial services, they carry a fundamental flaw that threatens to undermine their business, destabilize financial markets and cause real economic hardship.

August 17

-

The Wall Street titan, having borne the costs of being a regulated bank for a number of years, is now looking to reap some of the benefits that come with a banking license.

August 14 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 14 -

Banks, marketplace lenders and other nonbank lenders were dealt a setback when a federal appeals court declined to reconsider a ruling that has set off alarm bells across the consumer finance industry.

August 13 -

C2FO, the operator of an online marketplace for small-business financing, announced a $40 million equity funding round led by a Singapore investment firm.

August 12 -

The Office of the Comptroller of the Currency is trying to "supercharge" its process for reviewing financial innovations in an effort to keep pace with a glut of new products inside and outside the banking system.

August 10 -

Rejiggering the credit-scoring system wont do much to expand credit access. Instead, banks and financial services companies should start thinking about new ways to evaluate the situational factors that influence borrowers reliability.

August 10

-

Lending Club and Funding Circle are among the firms pledging to adhere to a range of self-imposed standards in small-business lending.

August 6 -

The next financial crisis will probably originate from online lenders, hedge funds or other unregulated entities that are taking on some of the greatest credit risks, CIT Group Inc. Chief Executive Officer John Thain said.

August 6 -

In the worst-case scenario, they'll get state licenses and reprice a portion of their loans, but executives of the highflying industry say they doubt such steps will be necessary.

August 5 -

Lending Club reported a small quarterly loss on Tuesday as the marketplace lender stuck with its strategy of pursuing growth rather than near-term profitability.

August 4