-

The federal agency expressed skepticism about industry-developed standards Thursday, suggesting that there is currently no way to enforce the rules or punish bad actors.

June 9 -

With its very survival at stake, the San Francisco-based marketplace lender is balancing key priorities that are sometimes in conflict with each other.

June 8 -

Fintech firms and banks should collaborate on using alternative data sources to qualify more borrowers for small-dollar loans.

June 8

-

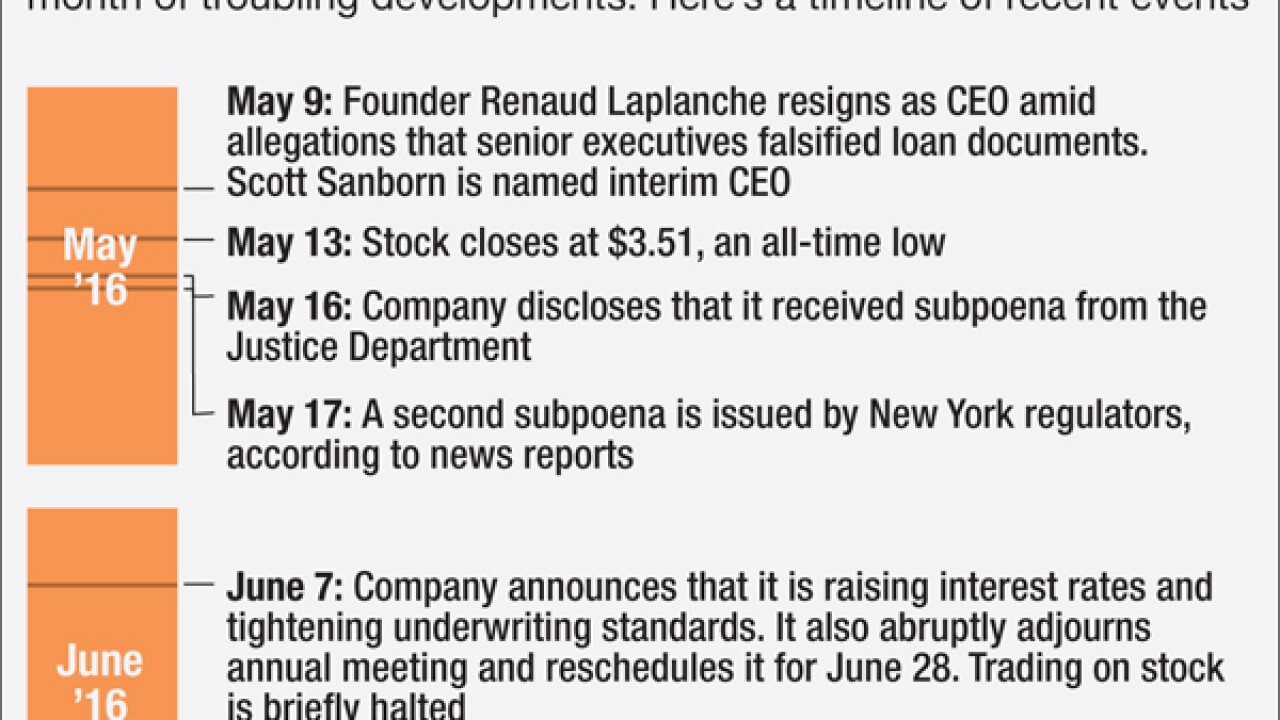

LendingClub abruptly adjourned its annual shareholder meeting Tuesday, saying it wasn't ready to address investors after a leadership shakeup last month. It also overhauled criteria for the consumer loans it arranges online.

June 7 -

LendingClub, under pressure to bolster investor confidence in the loans it arranges online, is boosting interest rates and tightening criteria for borrowers to qualify.

June 7 -

New York's financial regulator has ordered 28 online lenders to disclose whether they offer loans to state residents and to describe the types of financing they provide.

June 3 -

The regional bank has extensively studied the viability of such platforms, but has been unable to develop a plan to fits its risk appetite.

June 3 -

The Independent Community Bankers of America said that it agrees with the Office of the Comptroller of the Currencys support for responsible innovation in fintech but that it worries marketplace lenders have a regulatory advantage.

June 1 -

The Consumer Financial Protection Bureau will unveil sweeping federal regulations Thursday for payday lenders that could open the door for competition from banks, while forcing lenders to move toward longer-term installment loans. Here's what to track when the plan is released.

May 31 -

The pricing of student loans, and higher-ed degrees themselves, should have more to do with the proven earning power of a university's graduates in the eyes of some innovators. Big data could play a huge role.

May 31