-

Tech investors love fast-growing marketplace lenders like Social Finance, but Wall Street has taken a dimmer view of them. A huge equity fundraising round should allow SoFi to keep fueling rapid growth while remaining privately owned.

August 20 -

The Chicago-based online consumer lender, which focuses on borrowers with less than pristine credit histories, is getting a boost from JPMorgan Chase, Credit Suisse and Jefferies.

August 20 -

Regulated by multiple agencies, marketplace lenders reduce the financial system's leverage, provide greater financial transparency and ultimately deliver a better product to consumers and investors.

August 19

-

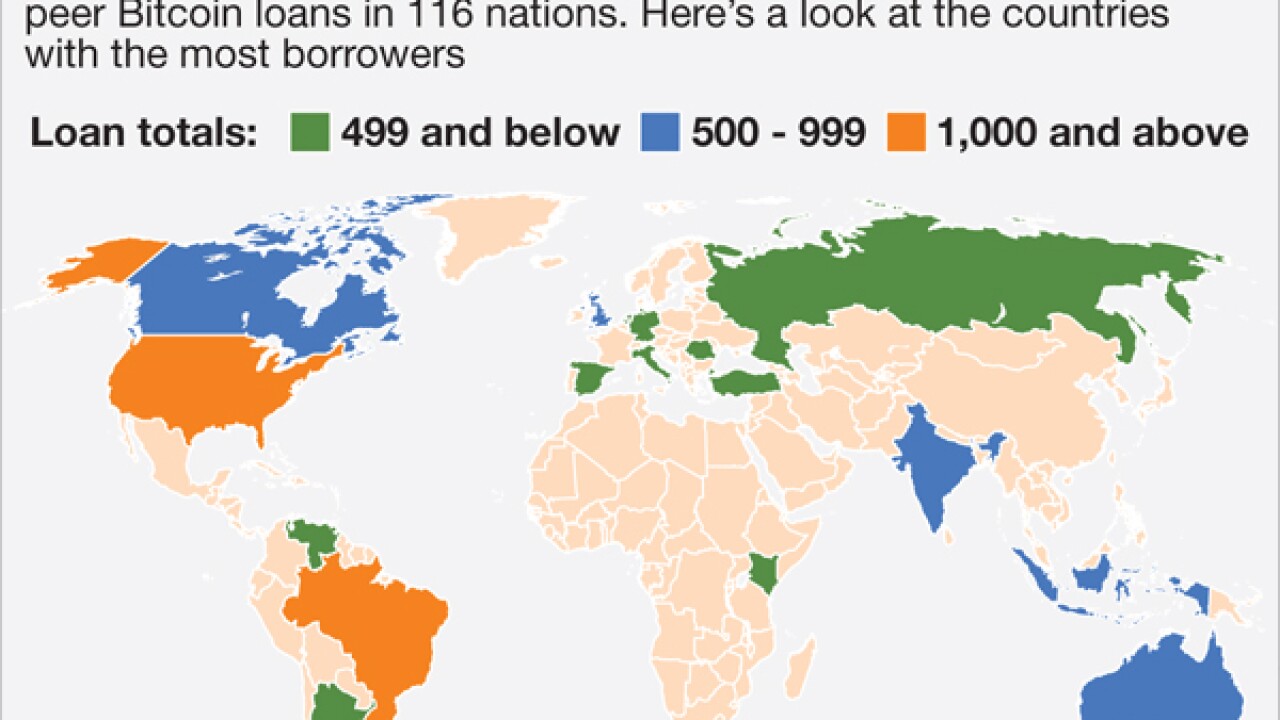

The global loan platforms present an extreme example of the ongoing clash between the fast-moving financial technology sphere and the staid world of financial regulation.

August 19 -

The Consumer Financial Protection Bureau said Springstone Financial, acquired last year by Lending Club, misled borrowers into thinking loans carried zero interest.

August 19 -

The Treasury Department announced Tuesday that members of the public will have an additional month to submit comments about the online marketplace lending industry.

August 18 -

Social Finance Inc. has hired Joanne Bradford, a veteran of the technology and media industries, as chief operating officer.

August 17 -

While marketplace lenders have introduced valuable innovation into financial services, they carry a fundamental flaw that threatens to undermine their business, destabilize financial markets and cause real economic hardship.

August 17

-

The Wall Street titan, having borne the costs of being a regulated bank for a number of years, is now looking to reap some of the benefits that come with a banking license.

August 14 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 14