-

Fundation Group, a New York-based online small-business lender, announced Tuesday that it has secured a $100 million credit facility from Goldman Sachs.

August 23 -

Companies like Prosper have revolutionized the front end of the consumer lending experience, but they have not proven able to handle even minor financial bumps without running off the road.

August 23

-

With the Office of the Comptroller of the Currency evaluating the possibility of a nationwide charter for certain fintech firms, state regulators are voicing concerns that a charter could cut into their authority.

August 19 -

Heather Cox is moving to USAA; female regulators are gaining prominence in the online lending conversation; and asset managers are still fighting sexism at work (but then again, who isnt?).

August 18

-

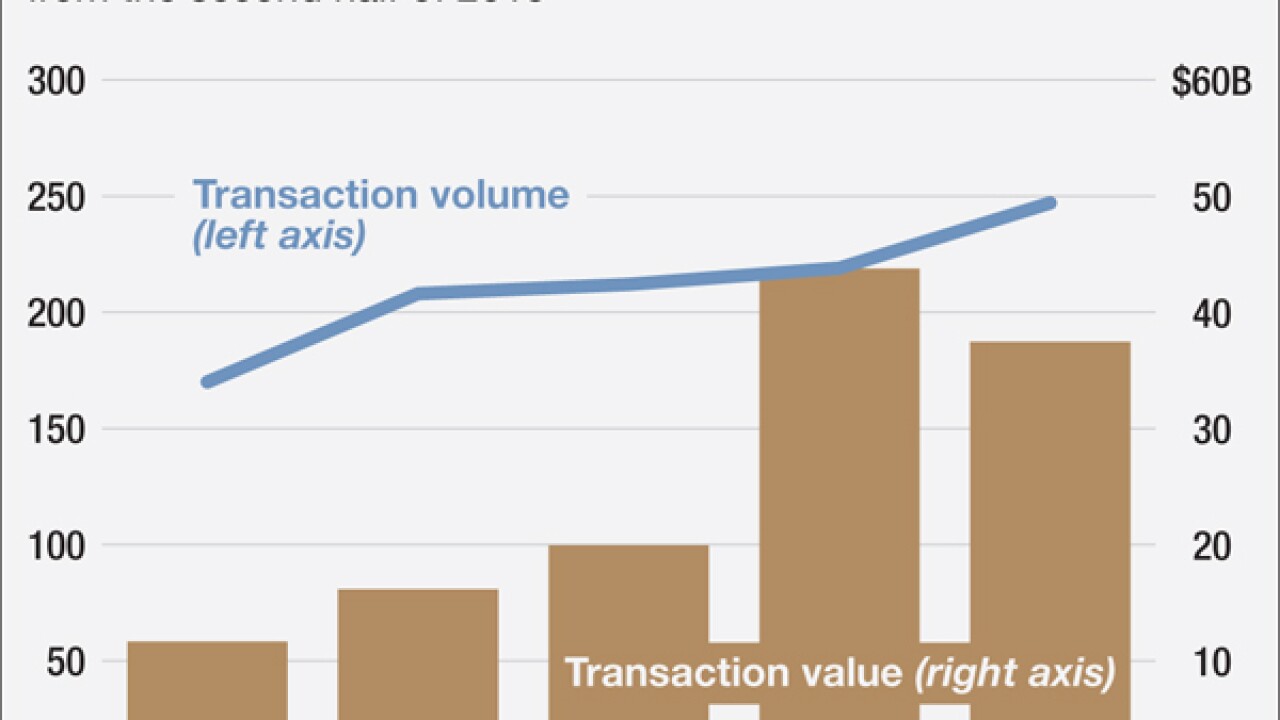

Banks have found a novel way to fend off fintechs plans to take them down: they are funding it. A new report shows corporate venture capital investors, such as those backed by banks, made up nearly a third of funding in the second quarter.

August 17 -

LoanDepot, a Foothill Ranch, Calif.-based company that offers mortgages, home equity loans and personal loans, has raised $150 million in term debt financing.

August 17 -

Avant, an online consumer lender based in Chicago, is shoring up its funding base with a pair of new transactions.

August 16 -

This year federal and state regulators have started to pay closer attention to the rapidly evolving online-lending sector particularly online small-business lending. What follows is a look at eight key players in the debate over how to regulate this emerging industry.

August 15 -

Online alternative financing can be an efficient source of capital for small businesses, but it can also be predatory, especially to unaware and inexperienced borrowers.

August 12 Invest in Women Entrepreneurs Initiative

Invest in Women Entrepreneurs Initiative -

A federal judge in California approved a $2.4 million settlement in a class- action lawsuit against Social Finance, a San Francisco-based online lender.

August 11 -

Small-business owners are struggling to understand the cost of loans sold by marketplace lenders. To remedy this, the industry must embrace a disclosure box that includes these five principles.

August 11 Fundera

Fundera -

Square Inc. is joining with restaurant technology startup Upserve to offer loans to eating establishments, extending credit for the first time to businesses that operate outside of its own payments processing system.

August 10 -

The emergence of lenders that have no real connection to a geographic area prompts questions over how the Community Reinvestment Act's "good neighbor" policy can continue.

August 10

-

The embattled firm is offering financial incentives in an effort to kick-start lending, but compliance-focused banks have been slow to respond.

August 9 -

The marketplace lender OnDeck Capital is sticking with its lend-and-hold strategy even though the practice contributed to a second consecutive quarterly loss.

August 8 -

Lending Club announced the resignation of its chief financial officer while reporting an $81.4 million quarterly loss due largely to fallout from the scandal that rocked the firm in May.

August 8 -

The scandal-plagued marketplace lender is set to report earnings Monday, and the results aren't likely to be pretty. The big question going forward is how quickly can it reverse the damage and win back the trust of investors.

August 5 -

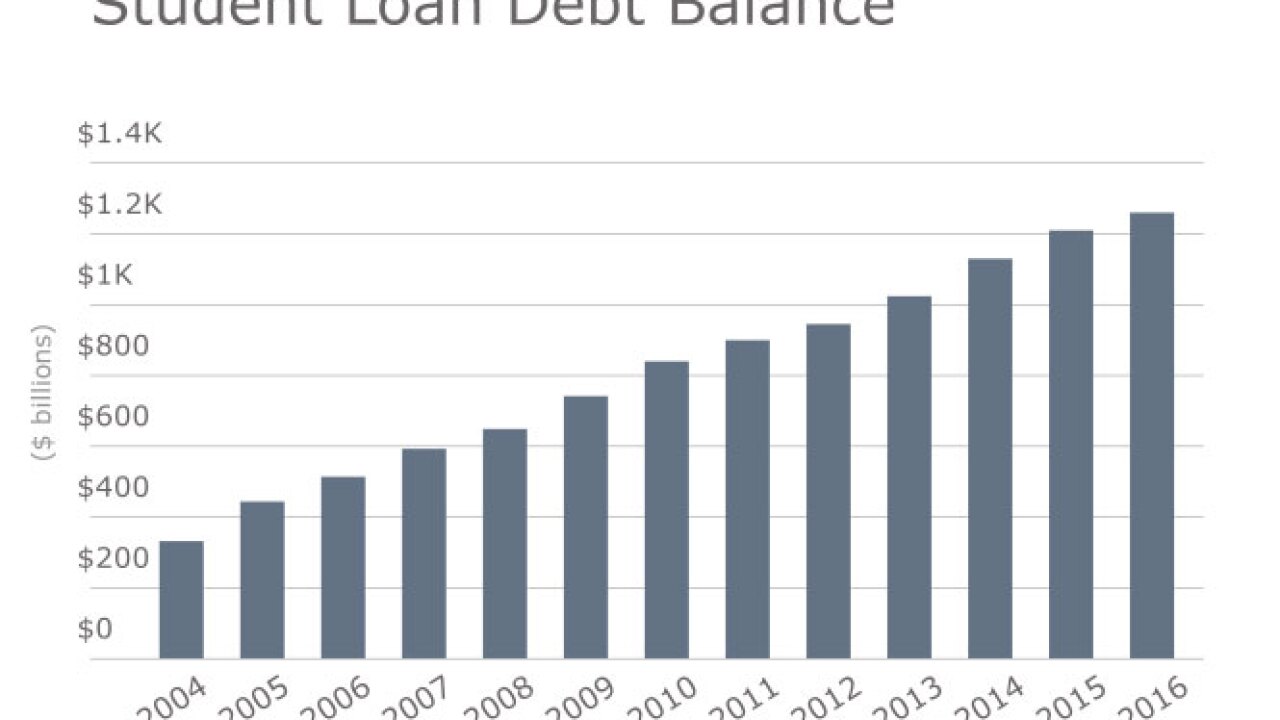

Fintech firms and millennial-focused advisers are providing advice on student loan refinancing, with the expectation that over time it will eventually lead to new business, in the form of brokerage and retirement accounts.

August 4 -

The private equity firm GTCR is interested in fintech companies looking to disrupt the status quo, so long as they have proved themselves and are paired with managers who have a long track record of success.

July 29 -

Hedgeable sees the peer-to-peer business and personal loans as an alternative to fixed-income investments that are traditionally offered through exchange-traded funds.

July 27