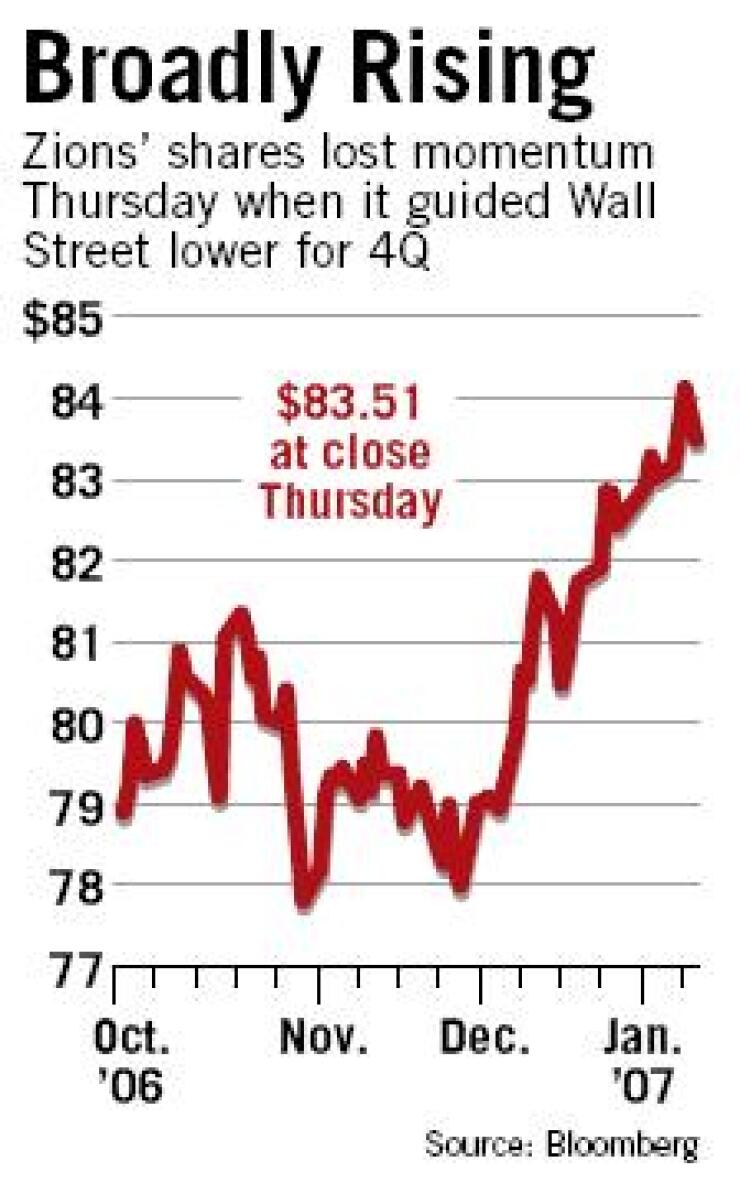

A three-pronged earnings warning and a divestiture deal did not weigh heavily on Zions Bancorp.'s shares Thursday.

The stock closed down 0.7%, even though Zions said several unusual expenses, including a fraud-related loss on an equipment lease, hurt fourth-quarter earnings to the tune of 14 cents a share.

The Salt Lake City company said it expects to report earnings per share of $1.31 to $1.33 on Jan. 23, compared with $1.32 a year earlier. Twenty analysts surveyed by Thomson Financial said they expected the $44.7 billion-asset Zions to report $1.43 cents a share.

Zions also said Thursday that Zions First National Bank has agreed to sell its insurance agency, Grant-Hatch & Associates Inc., and certain books of business of ZionsDirect and Zions Insurance Agency to Leavitt Group of Cedar City, Utah. It said Zions Bank and Leavitt reached a revenue-sharing agreement on the sale of retail and commercial insurance products to Zions Bank clients. The price of the deal, which is expected to close this quarter, was not disclosed.

Commenting on the equipment lease, Zions spokesman Clark Hinckley said, "We don't see any trends that suggest that the way this was underwritten was inappropriate or highlights any weaknesses in our underwriting." He said that the insurance divestiture would not be material to Zions; he described Grant-Hatch as "a relatively small local operation."

Analysts agreed with his description of the insurance agency but offered differing views of Zions' earnings warning, though they mostly remained bullish on the company.

Zions said in a filing with the Securities and Exchange Commission that its fourth-quarter results would include a $10.9 million loss from an equipment lease related to alleged accounting fraud at an unnamed water bottling company. It said the credit issue sliced 6 cents a share from fourth-quarter earnings. It also noted a 4-cent charge related to the redemption of trust-preferred stock and another 4-cent charge for a preferred-stock dividend declared in December. It said it will pay the dividend in March but had to set aside the dividend funds in the fourth quarter so it could begin a share repurchase announced in December.

Jacqueline Reeves, an analyst at BankAtlantic Bancorp Inc.'s Ryan Beck & Co. Inc., said, "The bottom line is the core, underlying franchise remains very strong."

Though they did not dismiss the credit-related charge, Ms. Reeves and others said the fact that the loss was fraud-related suggests that Zions' underwriting practices are not in question. "It makes it different, so you do have to look at it a little bit differently," Ms. Reeves said.

Heather Wolf, an analyst at Merrill Lynch & Co., wrote in a note issued Thursday that "none of these charges should be considered 'core.' "

But Todd Hagerman, an analyst at Fox-Pitt, Kelton, said in an interview, "While many investors want to give … [Zions] the benefit of the doubt, the bottom line is we're past the inflection point on credit, and credit trends are going to worsen for the industry."

That the loss was fraud-related "takes a little bit of the sting out of it," said Mr. Hagerman, who reiterated his "outperform" rating in a note issued Thursday, citing Zions' continued strong fundamentals. "We would be buyers on weakness," he wrote.