Macroeconomic factors continued to squeeze community banks' bottom lines in 2024, but the top-performing companies eked out stronger performances through efficiency.

Banks that were better prepared for the interest rate cuts at the end of last year landed on American Banker's 2025 list of top-performing banks with between $2 billion and $10 billion of assets. The banks are ranked by consulting firm Capital Performance Group based on their three-year average return on average equity, or ROAE, according to data from year-end 2024.

Claude Hanley, a founder and partner of Capital Performance Group, said that last year wasn't about growth as much as it was about cost of funds management. The 20 top-performing banks in the asset group had a 1.97% median cost of funds, compared with 2.46% across all institutions in 2024.

But the Federal Reserve's interest rate cuts in the back half of last year, totaling 100 basis points, may have chipped away at some of the top-performers' advantage, as peer banks were able to decrease the amounts they paid on deposits.

"It's almost like a tale of two different operating environments, because the Fed started to reduce rates in September," Hanley said. "So the advantage that the top performers had in lower cost funding might have dissipated more towards the fourth quarter."

The top-20 banks had a median net interest margin of 4.08%, compared with 3.18% for all banks in the asset class last year. Although the banks at the top were more sensitive to interest rate cuts, they kept funding costs low by holding a higher proportion of demand and transaction deposits,

The return on average common equity among top banks in 2024 was nearly double that of all banks in the group, and the median efficiency ratio among the top-performing banks was about 13 percentage points lower than that of all peer banks.

Still, median net income fell more sharply from the previous year for the top-performing banks, by 3.76%, compared with the roughly flat change in bottom line among peers. Those profits were dragged down, in part, by expense growth. Expenses rose by 8.64% among top banks, compared with a 5.48% increase among all institutions in the size group.

"It's like a pure defensive environment," Hanley said. "It really wasn't about who could take advantage of growth opportunities so much as it was who could do better in this higher-rate environment."

Loans grew at a far slower pace than in 2023 across the board, but the top performers beefed up lending at a faster clip.

Some metrics were close across top performers and the rest of their asset group. The average asset size across all institutions in the asset category was $4.2 billion.

Capital Performance Group compiled its report using data provided by S&P Global Market Intelligence, based on filings with the Securities and Exchange Commission and other regulators.

Here are the 20 top-performing banks with between $2 billion and $10 billion of assets, using data from 2024. See the bottom of the page for the full list of rankings for banks in the asset class.

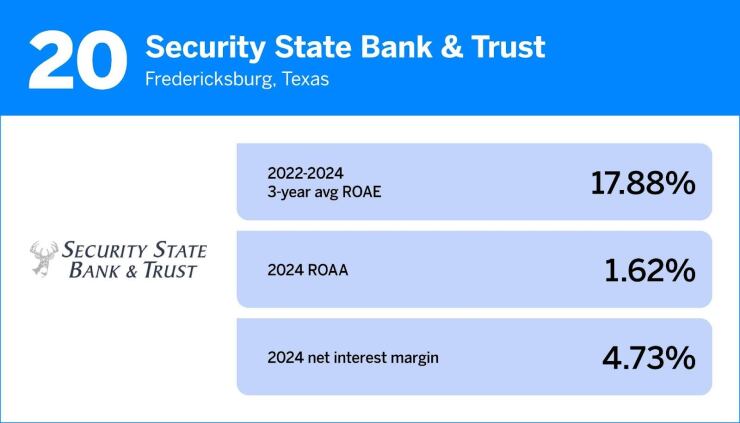

Security State is the smallest bank in top 20

This year is Security State Bank & Trust's first on the list, as it narrowly surpassed $2 billion of assets at the end of 2024. The Fredericksburg, Texas, company operates just over 20 branches in the Hill Country of Texas and has the fewest assets of any of the top-20 performers.

It also posted one of the highest net interest margins of the top performers in 2024, at 4.73%.

The company saw core deposits and loans grow by 4.71% and 2.34% in 2024, respectively. But net income fell by 3.45%, as noninterest expenses rose 11.59%.

Somerset passes $2 billion-asset mark

Somerset Trust Company in Pennsylvania, which operates in Southwestern Pennsylvania, northern Maryland and northern Virginia, made the list for the first time this year after just passing the $2 billion asset threshold.

While the bank's margin shrank in 2024 to 3.81%, from 4.16% in 2023, due to costly deposits, CEO Sean Cook said in Somerset's 2024 annual report that the company's loan growth helped offset the margin compression.

Somerset saw net income rise 5.42% in 2024. Credit seemed to worsen, as nonperforming loans made up 1.3% of gross loans, compared with a 0.74% ratio across peers. Cook said in the report that his bank's credit approach is to "always look for ways to work with our borrowers during difficult times."

"We knowingly accept this risk and account for it by carrying a higher loan loss reserve relative to other banks of similar size," Cook said.

He added that several recovery events in 2024 helped the bank decrease its credit loss provisions from $3.4 million in 2023 to $600,000.

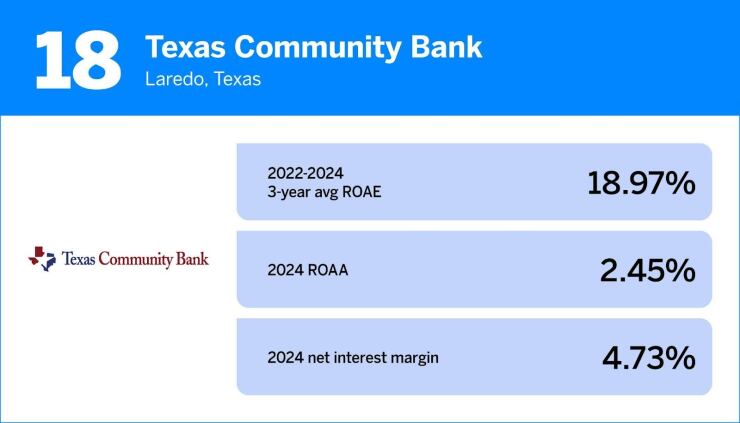

Texas Community Bank serves Texas-Mexico border

Texas Community Bank operates nearly a dozen locations across the South Texas-Mexico border and in San Antonio. It had near-pristine credit quality in 2024, though its net income dipped.

The Laredo, Texas-based bank offers products and services specific to the border, like international banking and wire transfers. Texas Community outpaced peers on both its yield on earning assets and its ratio of net interest income to average assets.

The $2 billion-asset bank also logged a low efficiency ratio, at 37.9%, and an above-average net interest margin, at 4.73%, in 2024.

Texas Community was founded 20 years ago when a shareholder group acquired a $15 million-asset bank, changed its name and began growing the franchise.

Nebraska bank posts pristine credit quality

Five Points, which barely sits above the $2 billion-asset threshold, operates 15 locations across Nebraska. The company is the only Nebraska bank in the top-20 list.

The bank didn't have any nonperforming assets or nonperforming loans in 2024, and it held a minimal level of demand deposits compared with peers.

The company saw net income fall 11.49% from the year prior, although its net loans and core deposits increased. Five Points kept a relatively low efficiency ratio and a relatively low ratio of expenses to total assets.

The bank offers wealth management and mortgage services, along with personal loans and business loans, including in the agriculture sector.

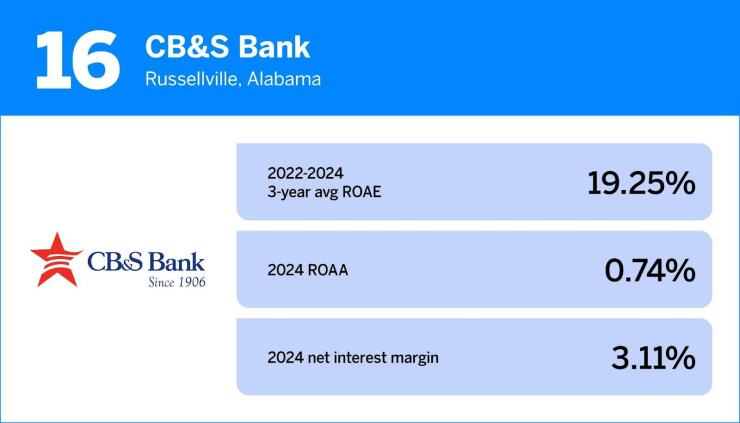

CB&S sees loan surge

The $2.7 billion-asset CB&S operates 56 branches in Alabama, Mississippi and Tennessee, employing more than 500 people.

The bank, headquartered in Russellville, Alabama, jumped up 10 spots from its 2023 ranking, amid 21.84% loan growth from the previous year, the highest increase of any top-20 performer. Revenue also rose by 4.51% in 2024, and the bank's return on average equity outpaced the average among all institutions over the last three years.

But net income fell from 2023 by 7.35%.

CalPrivate's deposits, loans grow

The La Jolla, California-based company saw its net income fall by 11.17% in 2024 compared to the year prior, but its core deposits, loans and revenue spiked by 16.52%, 12.99% and 12.31%, respectively.

Investors rewarded CalPrivate's results throughout the year, as its stock price rose by roughly 60% in 2024. The bank's assets also grew to $2.4 billion from $2.2 billion.

CalPrivate's return on average assets and net interest margin in 2024 placed the bank firmly above the average of all peer institutions at 1.65% and 4.52%, respectively.

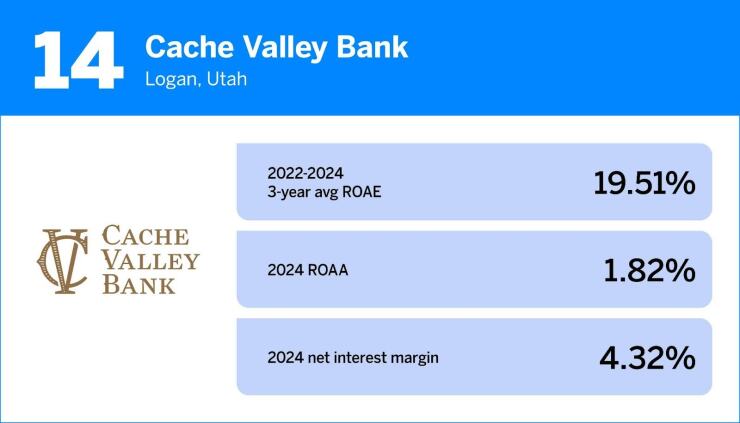

Cache Valley's acquisition showcased strength

Cache Valley Bank dropped from fifth to 14th in 2024's ranking. The Logan, Utah-based bank saw its return on average assets and net interest margin decrease from 2023, but both metrics still sat above the average among top-20 performers.

While the bank's core deposits and loans grew 10.17% and 4.41% in 2024, respectively, its net income dropped 5.21%, and its revenue fell 3.08%. Cache Valley was one of six banks in the top 20 to record a decrease in revenue.

Cache Valley bought the

Mother-son-led bank jumps four rankings

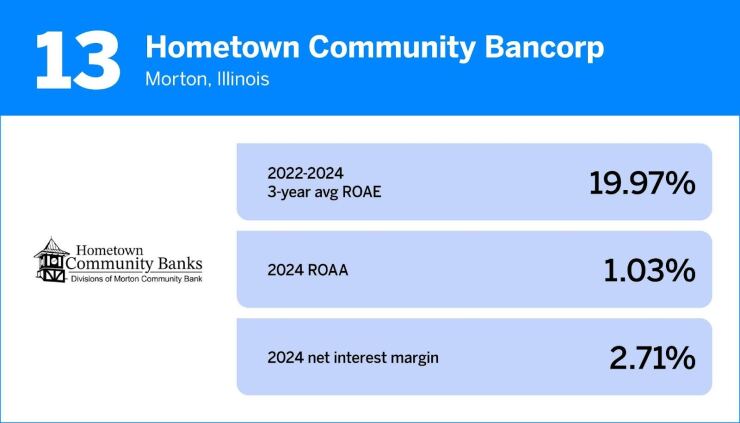

Hometown Community Bancorp, which primarily operates as Morton Community Bank, jumped from 17th in the ranking last year. The $5.5 billion-asset, family-owned company has locations across Central and Northwest Illinois, with about 600 employees.

The bank kept its cost of funds and its expenses below the averages among peers in 2024, even as net income and core deposits declined.

Hometown is led by mother-and-son co-CEOs Jean Ann and Andy Honegger, whose family also own the majority of the company. About 30% of the bank is owned by employees through an employee stock ownership plan. The bank has acquired 23 institutions since the late 1980s, per its website.

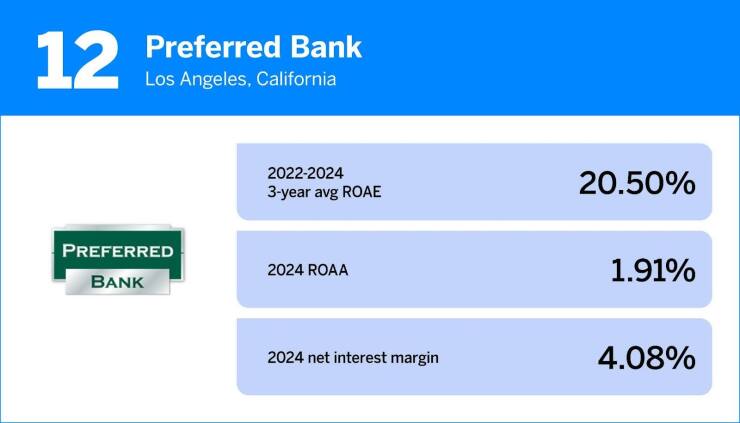

Preferred Bank's bottom line squeezed by interest rates

Although the $6.9 billion-asset Preferred Bank in Los Angeles saw net income fall in 2024, its 31% efficiency ratio bested the 64.3% average among its peers.

Preferred operates in Southern California, the San Francisco Bay Area, New York and Houston, with concentrations in commercial real estate loans, business loans and treasury management services.

The bank's bottom line declined 12.92% from the prior year, but Chairman and CEO Li Yu wrote in a prepared statement in April that "2024 results exceeded both our expectations and the market's expectations."

"A commercial bank's profitability is highly affected by the Federal Reserve's interest rate policy, Yu said. "Your management team has been sensitive and proactive to the changes in interest rates."

Woodforest National Bank reels in overdraft fees

Woodforest National Bank dipped from sixth place in 2023. Its loans declined, and its core deposits remained relatively flat in 2024.

The $9.2 billion-asset bank — the second-largest of the top-20 performers — operates nearly 740 branches across 17 states, per its website, most of which are located in stores like Walmart. Woodforest makes a hefty chunk of its profits from overdraft fees, which made up nearly $300 million of its income in 2024, according to public filings.

The company logged a high ratio of noninterest income to average assets, at 4.44%, compared with 0.77% among peers. Woodforest also has an above-average ratio of non-performing assets to loans, with below-average level of reserves compared with peers.

First Bancshares enjoys widespread growth

First Bancshares has the most assets of any company among the top-20 performers, at $9.7 billion. Headquartered in Merrillville, Indiana, the bank has more than 60 branches and 1,000 employees through its Centier Bank subsidiary, per its website.

First Bancshares produced positive numbers across the board in 2024, boasting growth in loans, core deposits and revenue, at 11.01%, 10.62% and 6.78%, respectively. The bank also saw its bottom line expand 4.6% from the prior year, as it reeled in net income of about $148 million. The bank opened or expanded six branches throughout Indiana as well.

The company's return on average assets of 1.62%, and its net interest margin of 3.48%, landed well above the averages for all institutions of its size, but slightly below the average across the top-20 performers.

Pedcor Financial contends with consent orders

Pedcor Financial fell from the number-two spot last year, as its return on average equity for 2023 and 2024 fell well below peers, but its 2022 return of 51.62% still buoyed its three-year average. The company, which operates United Fidelity Bank in Indiana, grew rapidly in the decade prior as it acquired eight banks, five of which were failed institutions.

The $6.6 billion-asset bank was hit with two consent orders in 2023 and 2024 by the Office of the Comptroller of the Currency and the Federal Reserve Board of Governors, respectively, for concerns regarding capital planning and risk management, among other issues.

Pedcor saw its bank's net income decline by more than 25% in the last year, as core deposits, loans and revenue decreased. The bank's parent company specializes in real estate and offers development, construction and property management through its affiliates.

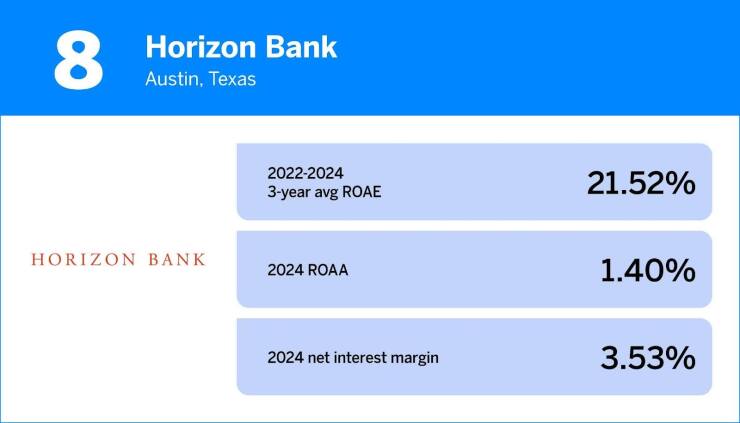

Horizon stays put at eighth

Horizon Bank landed at eighth in the ranking for the third consecutive year.

Headquartered in Austin, Texas, the bank posted a 2% increase in core deposits, a 4.15% rise in loans and a 2.06% climb in revenue from 2023, all just below the average among peers. But the company's return on average assets and net interest margin, at 1.4% and 3.53%, respectively, outpaced most other banks of its size last year.

Similar to most top-20 performers, Horizon saw a modest decline in net income, in part due to a 11.57% increase in noninterest expenses.

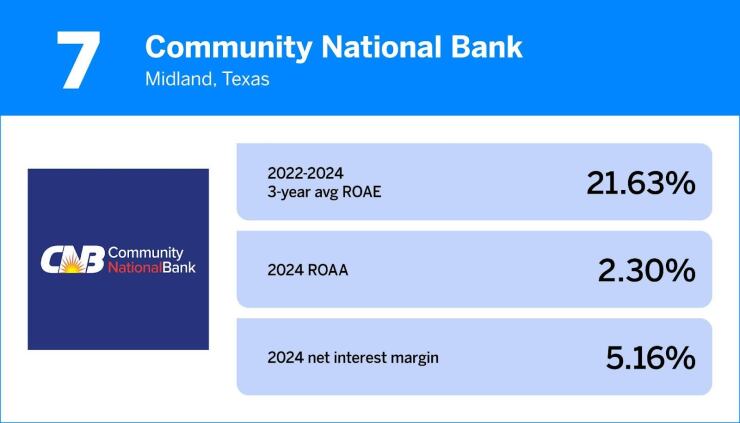

Community National moves up 12 spots

Texas-based Community National Bank recorded the third-best net interest margin among top-20 performers last year, at 5.16%, and the sixth-best return on average assets at 2.3%.

The bank also delivered the third-highest core deposit growth among the top-performing banks in its asset class, at 11.03%, and fifth-fastest loan growth, at 9.25%.

Despite its noninterest expenses increasing by nearly 20%, Community National's net income only decreased by 1.19% from the prior year.

Community National, which has $2.4 billion of assets, operates about a dozen locations throughout Texas.

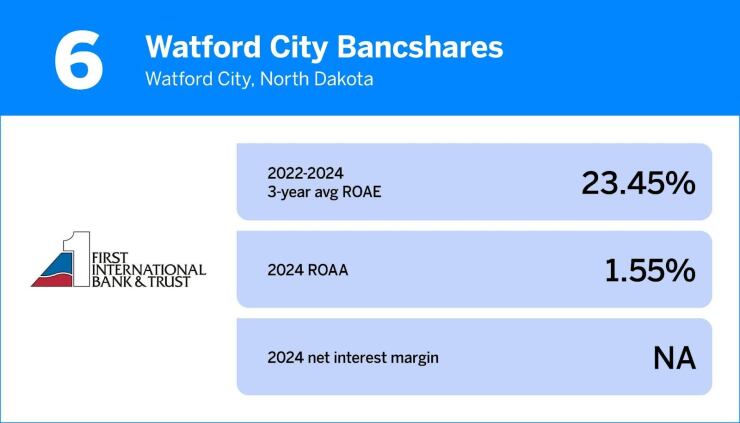

Watford City boasts profits far above peers

Watford City Bancshares, which has $5.5 billion of assets, enjoyed 32.09% growth in net income from 2023 to 2024— the largest jump of any top-20 performer by at least 25 percentage points. The company's pre-tax net income fell 2.86%, though.

Watford City reported above-average core deposit growth of 6.84% and loan growth of 2.19% last year. It also posted a solid 1.55% return on average assets.

The Watford City, North Dakota-based company has almost 30 branches spread across North and South Dakota, Minnesota and Arizona through its subsidiary, First International Bank and Trust. It jumped up four spots to sixth this year.

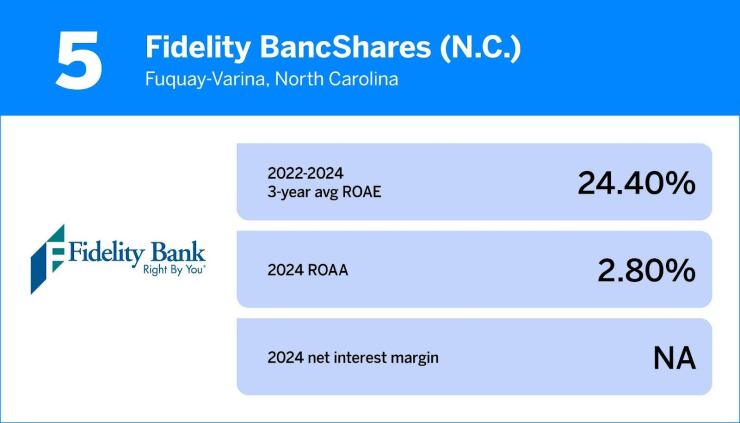

Fidelity BancShares takes fifth place after being unranked last year

Fidelity BancShares in Fuquay-Varina, North Carolina, made the list of top performers after going unranked in 2023, as the past two years of solid returns boosted its three-year average. While the bank saw growth in 2024 across net income, loans and core deposits similar to others in its asset group, it maintained a far lower cost of funds, at 0.97%, compared with a 2.46% average.

The $4.2 billion-asset bank offers banking, mortgage, investment and wealth management services, primarily serving small and medium-sized businesses in North Carolina and South Carolina. Fidelity entered the South Carolina market in 2022, and has been investing in branches and new services. The bank's expenses rose 12.03% last year, above the 7.53% average among peers.

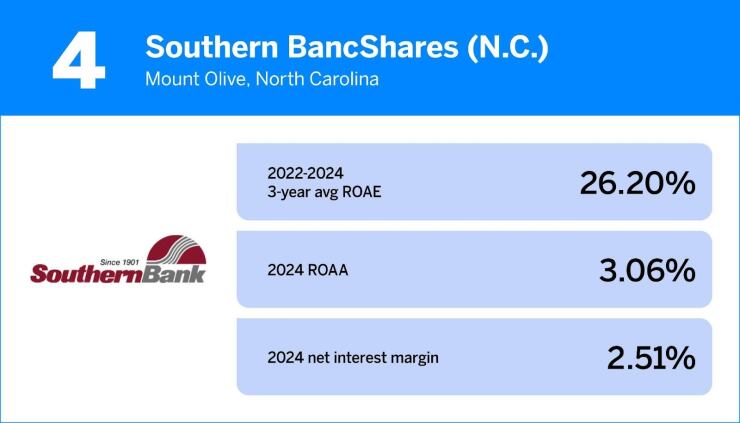

Southern BancShares delivers top ROAE

The $5.4 billion-asset company maintained its fourth-place spot with above-average growth in multiple categories.

Southern, headquartered in Mount Olive, North Carolina, performed particularly well in 2024, recording the highest single-year return on average equity, at 29.62%. The company also saw 6.36% growth in net income and a 2.97% increase in noninterest expenses. Loans and core deposits each sprouted by nearly 5% from 2023.

Southern Bank and Trust, a subsidiary of Southern Bancshares with 60 branches in North Carolina and Virginia, was named the best bank in the country by Forbes in February.

"This achievement speaks volumes about the caliber of our associates, the trust and loyalty of our customers, and the soundness of our community banking model," CEO Drew Covert said in an earnings release.

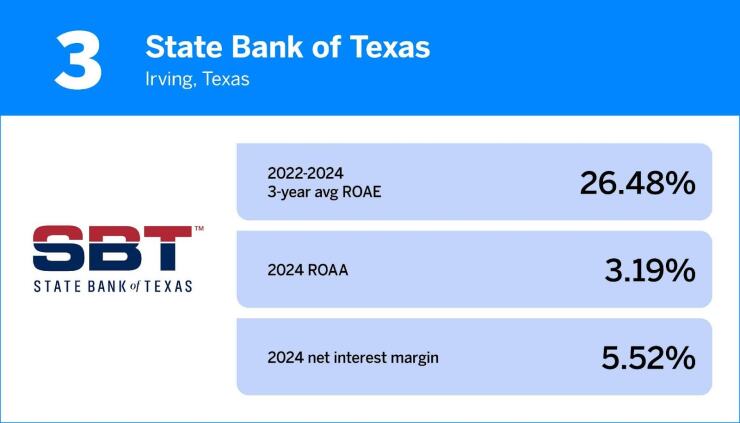

State Bank of Texas serves hotelier niche

State Bank of Texas has carved out a niche serving Indian and Indian-American hoteliers. Owned and run by Chairman and CEO Chan Patel, along with his sons President Sushil Patel and Chief Lending Officer Rajan Patel, the bank dropped from first place last year, but still turned out above-average profitability metrics.

The Irving, Texas-based company grew loans by 9.33% and core deposits by nearly 18% from the year prior. But State Bank of Texas' commercial real estate-heavy business leaves it with one of the lowest ratios of core deposits, a higher ratio of non-performing assets and a lower level of reserves than many peers.

Still, the $2.8 billion-asset bank has kept a lid on expenses and logged the lowest efficiency ratio of the top banks, meaning it uses its earnings more effectively.

First Community Bancshares boosts earnings with overdraft fees

First Community Bancshares, which primarily does business as First National Bank Texas and First Convenience Bank, has more than 350 locations in Texas, Arizona, Arkansas and New Mexico. The $4.1 billion-asset bank mostly operates at locations in stores like Kroger, H-E-B and Walmart.

The company maintained strong credit quality and kept a lid on expenses last year, posting the second-lowest cost of funds out of the top-performing banks.

The bulk of First Community's earnings in 2024 came from noninterest income, at $318 million — some one-fourth of which were made up of overdraft and non-sufficient fund fees. The bank's bottom line declined 9.55% in 2024, to $45.4 million, according to public filings. Still, the company charged nearly double that, $85.4 million, in overdraft and NSF fees last year.

The bank's ratio of noninterest income to average assets, at 7.11%, outpaced peers by multiple percentage points.

United Bank posts lowest costs of funds among top banks

United Bank topped the ranking for 2024, even though it's one of the smaller banks on the list, at $2.2 billion of assets. The Zebulon, Georgia-based bank delivered a net interest income to average assets ratio of 5.08% last year, compared with the 3.03% average of the group.

While United saw net income decline and expenses climb more than peers, its cost of funds was the lowest among the top-performing banks of the group. Core deposits made up nearly 90% of its total deposits, and its loan-to-deposit ratio, at 45.2%, was almost half of the 87.1% average among banks of its size in 2024.

The company, which operates across Middle Georgia with about 400 employees, also maintained its credit quality and reserves at stronger levels than most other banks in its asset class.