Bankers are giving a group of Michigan credit unions high marks for creativity for

Still, industry trade groups will likely file an objection with the state’s Department of Insurance and Financial Services.

The application, submitted Monday by seven state-chartered credit unions, is "unprecedented," said Christopher Cole, senior regulatory counsel at Independent Community Bankers of America. He said he expects the Community Bankers of Michigan to fight the move.

“Credit unions are seeking to get into all facets of wealth management, to be both a fiduciary and to manage assets,” Cole said. “It’s another example of the credit union movement pushing the envelope and going well beyond their statutory mission of serving people of modest means.”

Rann Paynter, president and CEO of the Michigan Bankers Association, had a more measured response.

The application “is something we’ll be watching closely,” Paynter said. While a lot of credit unions "do an admirable job serving people of lesser means ... others have drifted away” from that purpose.

The proposed Credit Union Trust is scheduled to open early next year. Its initial goal is to focus on serving members of the trust company's seven founders, but organizers are already eyeing expansion.

“We don’t want to set limits,” said Scott McFarland, CEO of the $895 million-asset Honor Credit Union in Berrien Springs, Mich. “We’d like the opportunity to grow. If new opportunities emerge, we’ll evaluate them, but any growth will be financially sound.”

The credit unions plan to structure Credit Union Trust as a limited-purpose bank that will not originate loans or hold deposits. As a result, the only necessary approval would come from the Michigan's banking regulator, which can take up to 100 days to review the application.

While federally chartered credit unions are legally barred from acting in a fiduciary capacity, a number of state-chartered credit unions do offer trust services. The industry, as a whole, owns a credit union service organization, Members Trust, which works with hundreds of institutions to provide trust services to their members.

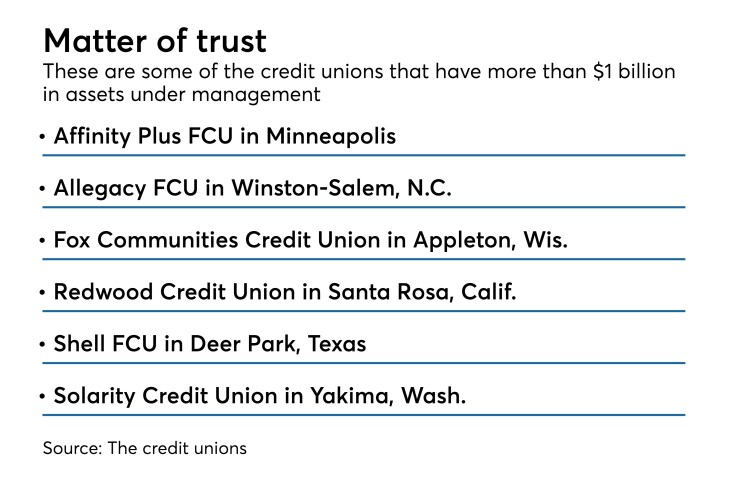

Still, credit unions’ overall trust presence has been relatively modest. Members Trust had $2.7 billion in assets under management at Dec. 31. That pales in comparison to the $2 trillion held by industry leaders JPMorgan Chase or the $1.2 trillion at Northern Trust.

Though aware of Members Trust, the organizers of behind Credit Union Trust believe a Michigan-based company would stand a better chance of bringing in business, McFarland said. The proposed trust bank would be based northwest of Detroit, in Farmington Hills.

“Right now, our members have to do their [trust business] somewhere else,” McFarland said. “Given all their needs, we’d at least like a seat at the table.”

Credit Union Trust's organizers have hired a veteran banker with Michigan ties to run the business.

Robert Sajdak worked at Comerica for 35 years, managing the $72 billion-asset company’s trust operations from 2007 until his retirement in 2012. After leaving Comerica, he joined Reliance Trust in Palm Beach Gardens, Fla.

Credit Union Trust plans to offer investment, trust and wealth management services, primarily to members of the seven founding credit unions, as well as members of other credit unions in the state. Michigan is home to about 5.2 million credit union members.

While high-net-worth individuals will be targeted, a particular area of focus will be entrepreneurs and small business owners, McFarland said.

That admission was enough to raise bankers' hackles.

"I find this development very disturbing," Art Johnson, chairman, president and CEO of the $630 million-asset United Bank Financial in Grand Rapids, Mich., wrote in an email to American Banker.

"Credit unions banding together to form a trust bank to offer products and services to high net worth individuals is just the latest in a very long stream of outrageous developments that fly in the face of the original intent of the credit union charter and its accompanying federal tax exemption," Johnson added.

"Over the last few years, we’ve seen an interest on the part of credit unions to get into wealth management,” said Patricia Herndon, senior vice president of government relations at the Michigan Bankers Association. “It’s a huge diversification away from their roots, and this should give policymakers and regulators reason to re-evaluate their business model.”

Bankers' concerns “haven’t been a point of discussion” for the trust company's organizers, McFarland said.

"A little healthy competition is never a bad thing,” McFarland added. "Our focus is on our members."