-

Prosperity Bancshares in Houston rarely participates in auctions, but CEO David Zalman was confident enough of his offer for FVNB to the bank solicit another bid. Zalman won, and Prosperity's investors embraced the result.

July 2 -

Nine months ago FirstMerit executives were under fire for agreeing to buy Citizens Republic. Its shares plummeted. Now its stock is trading near a 52-week high. See how they did it.

June 28 -

John W. Allison of Home BancShares finally got Liberty Bancshares to blink after 10 years of trying to buy it. Allison's persistence and the high multiples on Home's stock helped seal the deal.

June 26

Investors are warming to bank acquisitions, and that could break the ice for dealmaking in the second half.

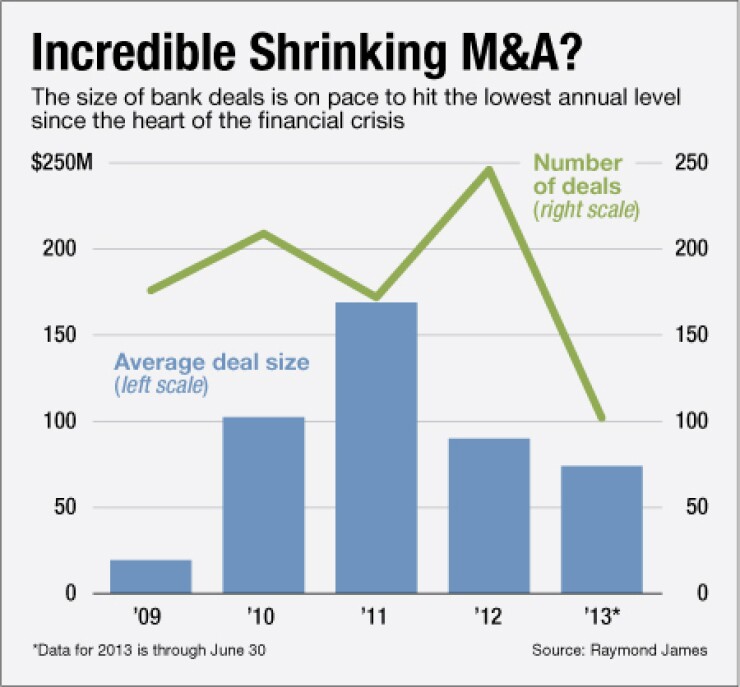

Granted, the midyear totals were weak. There were 102 deals through June 30, about 11% fewer than a year earlier. And deal values plummeted 22%, to $4.5 billion.

Yet conditions are ripe for a stronger second half because the markets have started to reward bank buyers.

"You can really see how the market is viewing transactions by looking at the stock of the acquirer," says Michael Rose, an analyst at Raymond James. "Well-positioned acquirers should continue to take advantage of the increasing opportunities in the marketplace. In turn we continue to see their stocks benefiting as bank M&A reaccelerates."

Examples include Prosperity Bancshares (PB) in Houston, which has seen its stock rise 11% since the last close before announcing July 1 that it would

A Raymond James report Wednesday named several other banks that have announced acquisitions this year or last and have seen significant increases in their stock price this year, including Glacier Bancorp (GBCI) and BNC Bancorp (BNCN). The report recommends that investors buy acquirers because of the potential lift that is coming with deals.

Joseph Fenech, an analyst at Sandler O'Neill, made a similar case last month after the Home-Liberty deal was announced. Essentially, certain buyers are already trading at significant premium to tangible book value, analysts say. They are using that currency to buy other banks, and the positive market reaction is providing them fuel for more deals.

"There is a group of community banks that are emerging from this cycle as the clear winners, and each transaction seems to further widen the gap between the 'haves' and the 'have-nots,'" Fenech said in the note. "We're finding ourselves increasingly more willing to look past valuation as an obstacle to recommending these stocks. We just think this is a theme that investors should be paying close attention to as we move forward."

For the last few years, advocates of bank M&A have had an experience akin to rooting for the Chicago Cubs: early optimism, followed by disappointment. Economic uncertainty, market volatility and stubborn sellers have created obstacles.

But the market's embrace of buyer stocks could be a catalyst for more deals.

"For the last few years, a couple of little inklings of activity have given us hope, only to have it fizzle out," says R. Scott Siefers, another Sandler O'Neill analyst. "The one favorable change this year has been that the buyers and the sellers' stocks are reacting positively. In that regard, the hope is that good deals beget good deals."

The positive market reaction helps investment bankers trying to persuade potential sellers of the immediate benefits of stock deals.

"This has been the investment banker pitch to the sellers: 'Things aren't getting better for you, you might need more capital, but look what has happened to these buyer stocks after they've announced these deals,' " Rose says. "And more data points bring more confidence that these trades could work."

Investment bankers say the sellers are taking note of the new trend.

"There is a realization of the smaller banks that their currency is lagging behind the bigger banks," says David Olson, chairman and chief executive of River Branch Holdings, a financial services merchant bank in Chicago. "The buyers are saying, 'We aren't paying you more, but you are catching a rising star.'"

There are other forces fostering deals, such as better credit quality and a bigger pool of possible buyers. Still, dealmakers remain a bit skittish about how the rest of the year will shape up.

"We've had high expectations for some time now," Olson says. "There are forces that are good, but for every fatigued seller, there is a seller steadfastly waiting for better pricing."