It never hurts to have a backup plan.

Federal lawmakers and regulators are threatening severe limits on how much banks may charge in overdraft fees, which heavily subsidize free checking.

Bankers have already started developing makeover plans for the highly popular product in case overdraft revenues are reduced. Among the options are imposing new limits on free checking that reduce costs or raise revenue or charging monthly fees on accounts that include more bells and whistles.

The marketing challenges promise to be dicey.

"Americans love 'free' or the perception thereof, and so banks will try to keep the free checking product if it helps them," or seek palatable alternatives, said Hank Israel, a director at Novantas LLC.

The Federal Reserve Board is considering whether to require banking companies to get customers' permission before charging overdraft fees. Under a proposal issued late last year, the Fed said it was considering whether overdraft protection should be an opt-in or opt-out feature.

Separately, lawmakers such as Senate Banking Committee Chairman Chris Dodd are calling for the creation of a new Consumer Financial Protection Agency whose duties would include reining in overdraft fees. Congress may also enact legislation to crack down on how much, and when, banks may charge for overdrafts.

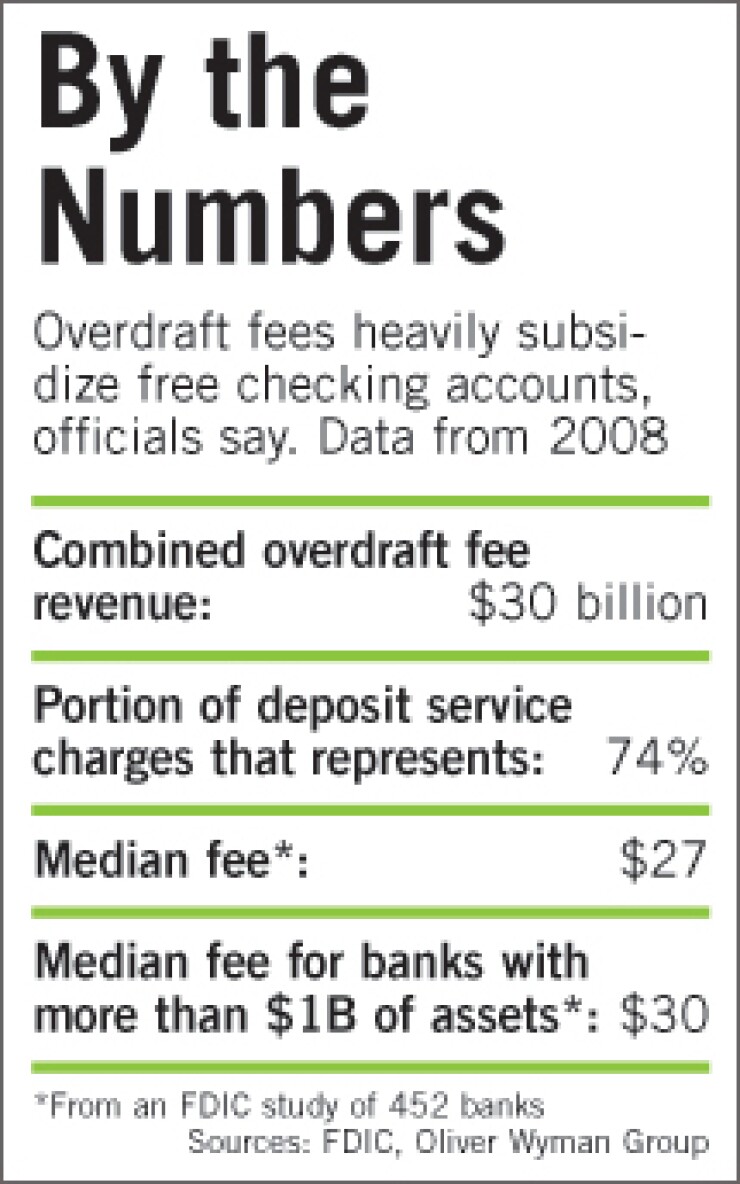

If any of this were to occur, banks' revenues from overdraft fees would be severely reduced, substantially hurting many industry players, consultants said. A November 2008 study of 462 banks by the Federal Deposit Insurance Corp. said that 74% of their total deposit service charges came from overdraft fees. Applying that proportion to the entire industry's $39 billion in deposit service charges indicates that overdraft fees total about $30 billion a year.

To keep checking free, bankers would have to find other ways to garner income or cut expenses, Israel said.

One way would be to require that customers who have such accounts do a certain amount of point of sale transactions a month using their bank-issued debit cards so that the bank would get interchange income, Israel said. JPMorgan Chase & Co. already offers customers this option to get free checking.

Cost-saving moves could include requiring customers to sign up for direct deposit. JPMorgan Chase, as many other banking companies do, offers this among its free checking options.

Banks could also trim expenses by requiring customers with free checking accounts to do all their banking online, at automated teller machines or at kiosks in the branches.

As part of this strategy, banks may offset reduced overdraft revenues by cutting branch hours and number of tellers or at least differentiating service levels available to customers with free checking accounts and those holding premium accounts, said Aaron Fine, a partner in the retail and business banking practice at Oliver Wyman Group, a New York management consulting unit of Marsh & McLennan Cos.

"Banks might offer better service levels for high-balanced customers, sort of like a 'first-class' line similar to what the airlines offer," Fine said.

Citigroup Inc. has dedicated tellers in some branches for Citigold checking account customers. The account is free to customers who deposit or invest a total of more than $100,000 at Citi; otherwise, customers pay a $25 monthly fee. The account features special services like an exclusive telephone customer service line.

Banks could also reinstate monthly fees. Fifth Third Bancorp in Cincinnati recently introduced several checking account products with either a $7.50 or $15 monthly fee, in addition to its free checking product.

For $7.50 a month, customers get free identity theft alerts, a 50% discount on safety deposit box rentals and a choice of one of two savings accounts that charge no monthly fee.

Most banks are not eager to discuss changes in free checking publicly. A Citigroup spokeswoman answered questions about the Citigold account but not on broader issues, and representatives of JPMorgan Chase and Fifth Third declined to comment.

But Fine said that many banks are taking a hard look at how they could tweak their free checking products or introduce new ones.

Many banks are looking at checking account products that come with more "value-added" offerings, he said. Banks in other countries have offered products that include features such as traveler's insurance or car rental supplemental insurance.

"Banks can think about how they can actually provide more value for the customer and, as a result, justify the monthly fee," Fine said.

In fact, one such "value-added" offering could be "overdraft insurance," said Andrew Frisbie, a vice president at First Manhattan Consulting Group.

For example, a monthly up-front fee could be charged that lets customers make a certain number of overdrafts that would be covered by the bank, Frisbie said.

Israel said that limits on overdraft revenues may also "energize" banks to consider other deposit product offerings to generate fee income, such as offering back-office capabilities to landlords to let them accept payments from renters on the landlords' Web sites (competing with existing sites like renttopay.com).

Banks may also create "hybrid" debit cards, which would let customers pay off all the charges debited to their accounts monthly, Israel said.

Banks could also make fixed installment loans for holders of such hybrid cards that let them pay off the amounts they debit over a longer period.