-

The rest of the credit card industry continues to be dogged by slow loan growth, but retail-branded cards are bouncing back, thanks largely to a big push by merchants.

September 14 -

Americans had 314 million credit card accounts during the first three months of the year, the highest number since the fourth quarter of 2008, according to a report released Wednesday.

September 9 -

Since the recession, card companies have profited largely from swipe fees and rock-bottom loss rates. But with interest rates expected to rise in 2015, loan portfolios are finally growing again, and the industry is starting to look more like it did before 2008.

December 29

It took seven years, but the U.S. credit-card business has finally bounced back from its post-crisis hangover.

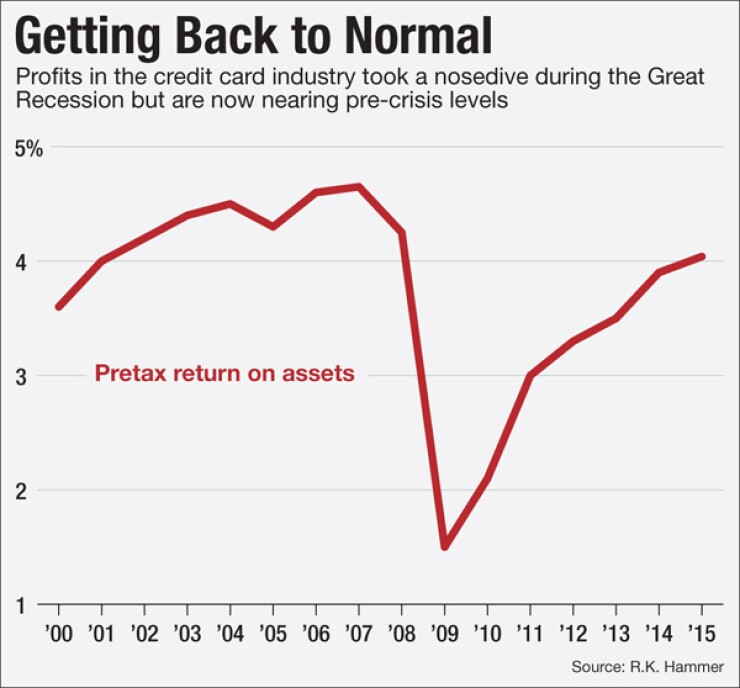

For the first time since 2008, the sector's pretax return on assets, an important measure of profitability, climbed above 4% last year, according to estimates made by the consultancy R.K. Hammer.

Prior to the Great Recession, the $900 billion industry routinely posted a pretax return on assets of between 4% and 5%. In 2009 that figure plunged to 1.5%, according to the data. It has risen each year since.

The revival of strong profits is the product of several factors: few loans are going bad; card issuers are regaining their appetite for risk; banks' borrowing costs are low; and new competition remains scarce. Also, a 2009 law that was expected to crimp profit margins has reshaped the industry in unexpected ways, opening up new money-making opportunities.

But there are also warning signs for an industry whose fortunes are closely tied to the economic cycle. Turmoil in China and the Middle East could spill over into the U.S. economy, setting off a chain reaction that leads to higher unemployment and more borrowers missing payments. And even in a sunnier economic climate, delinquency rates are expected to start climbing from historic lows.

"It would be hard to imagine profitability getting much better from where you are today," said Michael Taiano, director of the financial institutions group at Fitch Ratings.

The industry faced a much bleaker picture in 2009. As unemployment soared, a whopping $83 billion in card debt was charged off, according to CardHub.com. That was equal to about 8% of the total revolving credit that was outstanding at the time. Card issuers rapidly tightened the reins on the availability of credit.

"People were running scared, and they were right to," said Robert Hammer, the chief executive of R.K. Hammer.

In 2009, the card industry's pretax ROA plummeted to 1.5%, down from 4.25% the prior year, according to R.K. Hammer's estimates. The same year, Congress passed the Credit Card Accountability, Responsibility and Disclosure Act, better known as the CARD Act, which restricted issuers' ability to re-price existing credit-card debt. Industry officials initially feared that the new law would permanently reduce their profits.

"I think a logical reading of the CARD Act at the time would have said that that would put pressure on margins," Steve Crawford, the chief financial officer at Capital One Financial, said at an industry conference last month.

But the credit-card industry found new ways to earn money. One response was to lean more heavily on consumers who paid off their entire bill each month but still generated swipe-fee income for the issuers. Since banks had extremely low borrowing costs, it made better economic sense to pursue those more reliable customers than it had during the previous decade.

In addition, the industry's post-crisis reinvention, as steadier but less high-flying, may have dissuaded new competitors from entering the market.

Although Wells Fargo has begun to place more emphasis on its credit-card business than it did several years ago, the market is still led by the same six card issuers that dominated in 2009 — JPMorgan Chase, Bank of America, American Express, Citigroup, Capital One and Discover Financial Services.

In addition, the competition between the leading credit-card companies today largely focuses on enticing customers with spending-based rewards, rather than by offering the lowest interest rate. That may be an unintended consequence of the CARD Act's ban on the re-pricing of existing debt, and one that has been beneficial to card issuers.

"When you see the sort of huge returns that we are achieving in cards today, in the past a lot more of that would've gotten competed away," Discover Chief Executive David Nelms said at an industry conference in November. "But with the CARD Act and the consolidation, I think these returns are staying stronger than most people thought."

The card companies have also benefited from an extended run of high repayment rates. For the last seven quarters, the percentage of credit-card loans that are at least 90 days delinquent has been lower than at any time since at least 2003, according to the most recent available data from the Federal Reserve Bank of New York.

This trend, too, may be a partial consequence of the CARD Act, as card issuers have shied away from the riskiest borrowers, knowing they cannot raise interest rates retroactively on borrowers who miss a payment.

"There's certainly a permanent change in credit," Nelms said at the industry conference in November, citing the CARD Act and other factors. "We are close to 2% chargeoffs, which, in my career, [I] just would not have thought was possible."

In the third quarter of last year, banks that specialize in the credit-card business posted a pretax ROA of 4.50%, according to data from the Federal Deposit Insurance Corp. That compared to 1.49% for all FDIC-insured institutions.

Whether the card industry's strong profits will hold up in 2016 depends on factors that are hard to predict. Perhaps no part of the banking business is more closely tied to the U.S. economic cycle than credit cards. Historically, increases in card delinquency rates have tracked closely with spikes in jobless claims.

Analysts scanning the macroeconomic horizon see a number of potential dark clouds. Financial turmoil in China has already spilled into U.S. markets and could start to weigh on consumer confidence. Weak corporate earnings could lead to more layoffs and less spending by consumers. Continuing political instability in the Middle East is another source of worry.

"I'm mildly concerned," Hammer said. "Are consumers going to use cards less? They certainly did in the midst of the Great Recession."

There are also trends within the credit-card industry that give some observers pause.

It is counterintuitive, but card issuers have actually benefited in recent years from having a large pile of loans that went bad around 2008 and 2009. That is because they earn money from whatever scraps they can recover from the soured debt. But as that pile shrinks, so too does the issuers' ability to profit from charged-off loans.

"The unfortunate part of having low losses is that you're probably going to have lower recoveries as well," said Sanjay Sakhrani, an industry analyst at Keefe, Bruyette & Woods.

In addition, as several of the big card companies finally have begun to target new customers, they are expected to start recording higher losses, particularly in the short term. This is because new credit-card loans are historically most likely to sour in the first few years after they are made.

"Customers that have been around for a long period of time tend to have much lower losses than new originations do," Capital One CEO Richard Fairbank said at an industry conference in December. "So our losses are going higher."

Despite that negative short-term effect, some of the large credit-card issuers, including Discover and Capital One, are aggressively pursuing loan growth again. Capital One, for example, has been ramping up its lending to consumers with marred credit histories.

"The winners will be the ones who can generate lending volume," said Moshe Orenbuch, an analyst at Credit Suisse.

Others, like Bank of America, are remaining more cautious. CEO Brian Moynihan said a recent industry conference that B of A has chosen not to go after subprime borrowers, partly because the company believes that doing so would damage its brand, and partly because of the risks that would arise in a bad economy.

"I think that's what we learned in the credit-card business, is everybody thought you could price for every risk. Well, when it threatens your very existence, you can't do that," he said.